Shares of Apple stock closed at 346.28, down 1.10 percent, on Monday. The company's stock saw a spike in volume on Monday morning, with nearly 13 million shares trading hands in just 30 minutes. As of the close of market on Monday, the company's stock is up 6.99 percent year to date.

Last Friday, the last day of trading before the rebalance, Apple's stock price ballooned up $7 at one point during the day before settling at 350.15 just before the close of market. According to one report, an investor sold off more than 6 million shares of Apple stock, worth over $2.1 billion, in after hours trading on Friday.

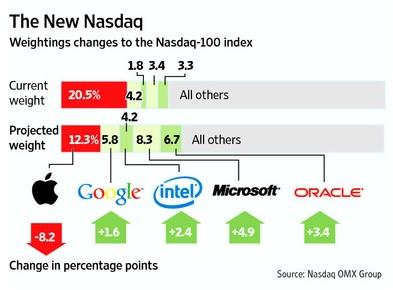

Nasdaq formally announced the rebalancing of the Nasdaq-100 index last month. The changes removed Apple's boosted share of the index, bringing its portion in line with a standard ratio based on the number of shares.

Though all 100 of the companies tracked by the index were affected, Apple saw the biggest change. In addition to Apple, 80 of the companies saw their weighting reduced, while Microsoft, Intel, Oracle and Google gained from the rebalancing.

Following the announcement, Apple stock declined for two weeks before recovering at the end of April. Early reports had suggested that Apple stock might drop as funds directly tracking the index sold off some of their shares, but Wall Street analysts reassured investors that any negative impact would be short-term and would represent a buying opportunity.

Brian White with Ticonderoga Securities told investors last month that the rebalancing would add "more noise" to an already loud past few months. According to White, after initial concerns regarding the Nasdaq rebalancing, possible supply issues arising from the Japan earthquake and tsunami and Apple CEO Steve Jobs' health have quieted down, Apple stock will reach new all-time highs as investors return to a focus on the company's fundamentals.

J.P. Morgan analyst Mark Moskowitz said in a note to clients that the re-weighting was unlikely to have a lasting effect. Moskowitz estimated that index funds and "passive managers" adjusting their holdings would result in sales of just 8 million shares of Apple stock, roughly half of the company's daily trading volume. The firm maintains a Dec. 2011 price target of $450 and Overweight rating of Apple.

Josh Ong

Josh Ong

-m.jpg)

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

18 Comments

The market reaction over the past few weeks to the rebalance looks like it will offer an excellent entry or position add opportunity to investors in AAPL. Target of 450 by Dec 2011 by analysts even seems conservative given the fundamentals behind Apple. And even that will give a cool 30% return over the next 8 months. Not too shabby!

It is ludicrous that the stock of a company that has achieved more than 50% annual compound earnings growth in each of the past five years is trading at a P/E multiple of just 16.7, placing it in the middle of the pack with every Tom, Dick, and Harry mediocre company of the S&P 500.

This is especially ludicrous when you consider that AAPL is supremely well positioned as a dominant player in two markets that are experiencing explosive growth (smart phones, tablet computers), absolutely owns the mature market for MP3 players, and is grabbing ever larger shares of the market for traditional PCs and notebooks.

Fortunately, for those of us who own AAPL stock, the price of the stock must go up at least in line with earnings because the P/E ratio can't sensibly go any lower, which means that the value of our stock is virtually assured of rising at a rate of about 50% a year for the next several years.

It's like printing money! Thank you AAPL!

PS: Point of reference: AMZN P/E Ratio 84.7???

Shocking - a change that was known weeks in advance didn't cause a large reaction the moment it occurred? That's so weird! Maybe this will be helpful for those who don't understand how the stock market works. It's not about what happens, it's about how events compare to expectations. That's why Apple's stock seems to move random directions after earnings. Some people are surprised, some are disappointed, no matter what the "expectations" quoted on wall street are.

I agree ... todays low is a drive to have others sell their shares due to this downward momentum only to buy in again. Well, the recent events and news are also major factors in the price of the stock. Notice that the movement is similar to the DOW, except on earnings and new product openings.

But in reality, this is just a temporary dip for the big merchants to buy back in and get them to drive the price up again and then when it peaks they make $3-$7 a share out of their millions of shares traded. Its an unethical but rather a very good strategy/technique (if you may call it) the big boys from big institutions plays. Sadly, that's just a way to drive profits. And then when it peaks up they'll short it. I really hope the market realizes that tomorrows open is a big opportunity to get in the action as quick as they can before they get left behind when the stock price heads in the upward continuous direction.

Apple is just a valued company that doesn't drive their earnings from fees (unlike RIMM) as Cramer puts it. The gross of their profit comes from actual sales of a real product unlike other tech companies out there. Not advertising. A genuine piece of technology that changes the world everyday. The price target of Wall Street analysts is $450, however, they too estimated recent fiscal Q2 2011 earnings which Apple obviously continued its trend of positively crushing Wall Street expectations year after year when last week they released a $24.67 billion. in sales - a smashing 83% jump in revenue from $13.5 billion of sales from Q2 of last year. This is a great company to invest in right now when most, if not all, analysts are very positive with this company.

Apple is cheap right now and undervalued ... but not for long. Tomorrow will be an upward drive. I'm Long in Apple

New posters touting Apple. What can that mean?