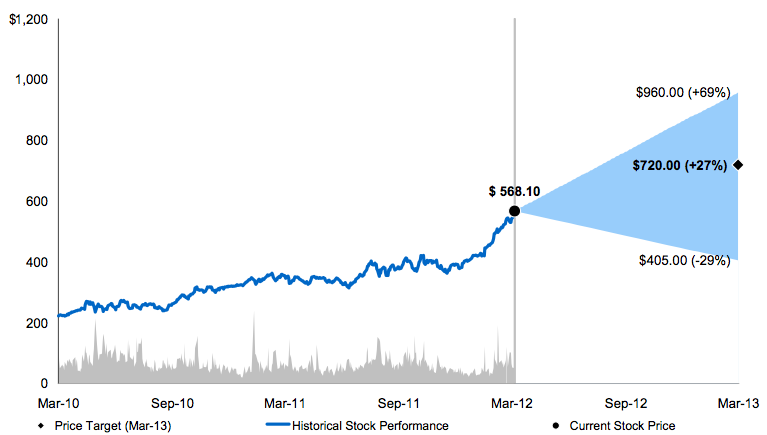

Apple's stock reached new heights on Tuesday, up 2.92 percent at market close. Shares of the company have been on a rally since the beginning of the year and have climbed 40 percent to $568.10.

Analyst Katy Huberty sent a note to investors Tuesday informing them that Apple had been added to the firm's Best Ideas list. The analyst continues to believe that investors "underestimate" Apple's strong position, raising her price target from $515 to $720. She also said the stock could climb as high as $960 by next March in a bull case scenario.

Morgan Stanley's new target is one of the highest seen to date. The Street reported last week that FBN Securities had set a new Wall Street record with its AAPL price target of $730. The previous high was Barclay's Capital's $710 price target.

Enterprise tablet adoption combined with demand upside from a lower-priced iPad; a strong upgrade cycle for LTE-capable iPhone later this year and emerging market iPhone (plus iPad, Mac) growth driven by new carriers are all potential upside drivers in her mind. In addition, Huberty added that the world's largest carrier, China Mobile, "could add more incremental iPhone shipments" next calendar year than the Street currently expects.

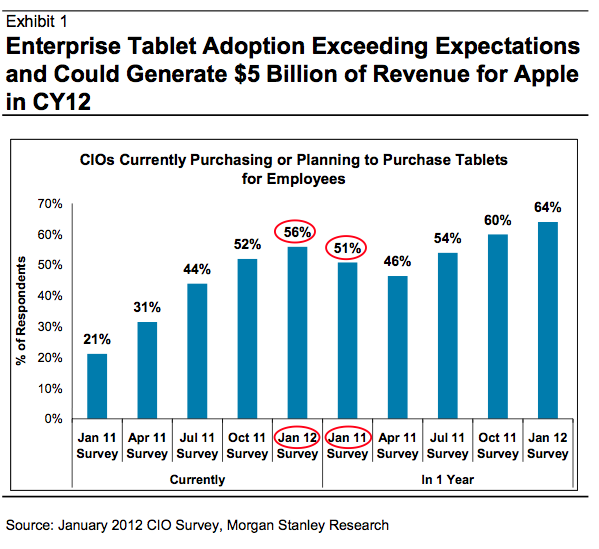

According to a January 2012 CIO survey by Morgan Stanley, 56 percent of U.S. companies already purchase tablets for corporate use. Assuming Apple manages to maintain an 80 percent share of the enterprise tablet market, Huberty believes enterprise iPad purchases could reach 9 million units and $5 billion in revenue for Apple next calendar year.

Meanwhile, consumer demand is also expected to remain robust. A survey from late last year showed that 13 percent of U.S. consumers expect to buy an iPad in the next 12 months. Huberty pointed out that the data indicates as many as 80 million unit sales globally next year. The analyst also suggested that the $100 price cut on the iPad 2 could bring about more than 15 million U.S. iPad sales and over 35 million global sales.

The analyst said Apple's next-generation iPhone is likely to include a "higher-resolution and potentially thinner screen, new casing material, faster processor, and quad-mode baseband chip that works on multiple flavors of 3G and LTE." Based on a recent survey indicating 62 percent of iPhone owners planned to upgrade to the iPhone 4S, the release of an LTE iPhone later this year would imply a base case of 148 million and bull case of 160 million upgrade purchases, supplemented by 38 million and 86 million shipments to new users.

Huberty named China and other emerging markets, like Brazil, as "huge untapped markets" for Apple that present a long-term upside for the company. Emerging markets have 14 times as many members of the smartphone-friendly 25- to 34-year-old age group than Western Europe and North America. Apple only directly address 20 percent of China's high-end subscriber market, Huberty said, adding that a China Mobile-compatible iPhone would reach the other 80 percent.

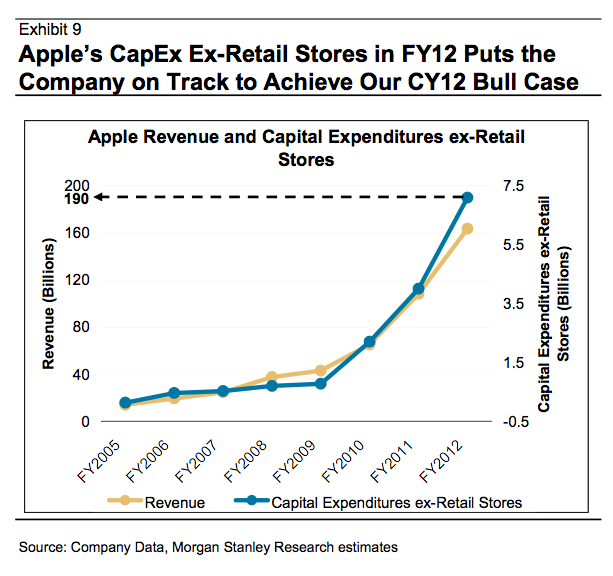

Morgan Stanley presented its $80 earnings per share and $960 valuation bull case as "reasonable" because of several factors: Apple's capital expenditure forecast predicts a "similar revenue trajectory;" the estimate doesn't include new product categories such as an HDTV or a low-price iPhone; the forecast of 129 million iPad units is in-line with current survey data; predictions for iPhone growth, with the exception of China, assume an average upgrade rate and a new subscriber increase similar to calendar 2011 and the firm assumes "no multiple expansion despite a possible dividend."

Apple expects to spend $7 billion on capital expenditures in fiscal 2012, possibly implying fiscal year revenue of as much as $190 billion. Morgan Stanley believes the "vast majority" of that will go to equipment purchases for its suppliers that will help the company get a leg up on its competitors.

The analyst did go on to outline potential risks factored into the bank's $405 Bear Case valuation. Lower carrier subsidies, increased competition in low-price smartphone and tablet markets, competition from Microsoft's Windows 8 in developed markets, lack of product roadmap visibility beyond 2013 after last year's management change and multiple compression as growth slows were all named as risks for Apple.

Josh Ong

Josh Ong

-m.jpg)

Charles Martin

Charles Martin

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Sponsored Content

Sponsored Content

51 Comments

Holy crap

Yeah - and here I thought the mid-$500 range was getting a little silly... Glad I bought some down at $128...

AI never seems to point this out (MacRumors is now pointing out Gene Munster's unreliability), but Katy Huberty is one of the worst AAPL analysts and certainly isn't a star-rated analyst per StarMine.

AI readers should categorically toss all AI articles with references to Munster, Shaw Wu, Huberty, and a a few others into the circular bin.

Without the caveat emptor, they are worthless. As a matter of fact, it might be better to take an opposite position from what those "anal-ists" are predicting since they have garnered a track record in piss-poor accuracy.

Katy Huberty is one of the worst AAPL analysts and certainly isn't a star-rated analyst per StarMine.

As soon as I saw the AI headline, my first thought was "Uh, oh. Maybe I'd better sell my Apple stock".

Almost doubling the stock is a little bit ridiculous.