Apple should borrow money at low costs against its significant overseas cash position to avoid a tax hit when repatriating that cash, one analyst believes.

Ben A. Reitzes with Barclays believe it's time Apple strongly consider "tapping the debt markets," which would allow it to borrow against the $94 billion in cash the company has overseas, $40.4 billion of which is untaxed.

"This way, Apple could maintain flexibility to make acquisitions and not incur a tax hit for repatriation — all for very low current borrowing costs," Reitzes said in a note to investors on Tuesday. "As a result, we calculate that Apple could easily double the size of its current three-year capital return plan, among the many options it has."

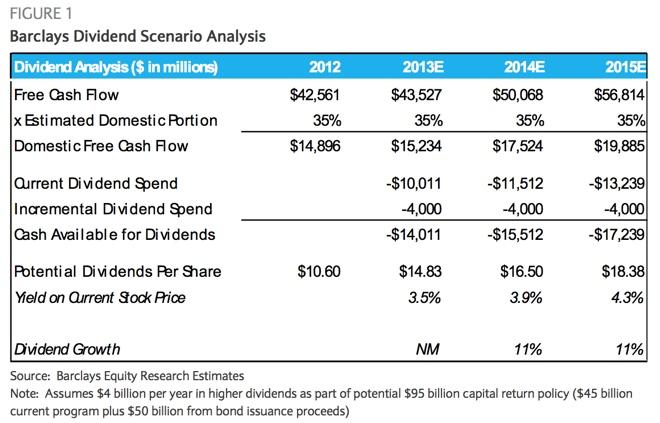

If Apple were to borrow, Barclays estimates that the company could double its level of capital returns. Doing so could allow Apple to boost its dividend to more than $14.75, giving it a 3.75 percent yield that would be comparable to other blue chip companies.Borrowing at low rates against its overseas cash could allow Apple to "maintain flexibility to make acquisitions and not incur a tax hit for repatriation," Ben A. Reitzes believes.

Reitzes believes AAPL stock could reach the $575 level if its dividend yield were in line with "bellwethers" such as Cisco. He also said the company has the capacity to increase its share buyback program by $30 billion over three years, up from its current $10 billion share repurchase program.

The analysis assumes that Apple would want to maintain at least $10 billion per year in domestic cash. That money could be reserved for mergers and acquisitions, as well as general corporate purposes.

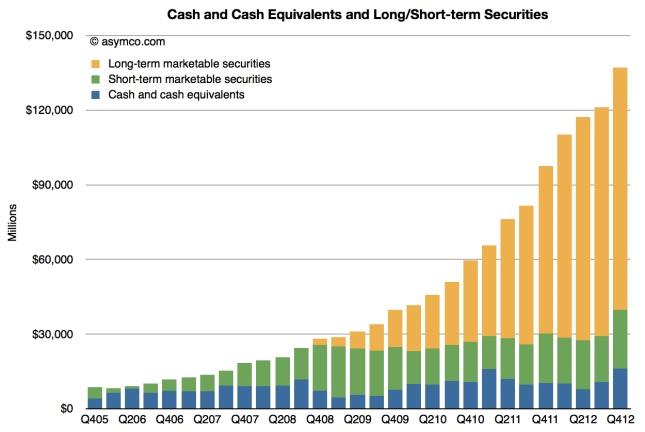

At the end of last quarter, Apple's growing cash hoard had reached $137 billion. Particular attention has been given to the company's $40.4 billion in untaxed overseas cash, with calls from the U.S. for the American company to repatriate that money and pay taxes on it.Apple had $137 billion in cash as of last quarter, with most of it held overseas and more than $40 billion untaxed.

Last week, The Wall Street Journal did an analysis of 60 large U.S. corporations, and found that they collectively held $166 billion in untaxed offshore earnings as of 2012. Apple's $40.4 billion represented nearly a quarter of that from just one company.

Market watchers expect that Apple will soon announce what it plans to do with its growing cash and reserves.

It was about a year ago that Apple announced it would begin a quarterly dividend along with a stock buyback plan. With the company's annual shareholder meeting and a lawsuit from hedge fund manager David Einhorn now behind Apple, analyst Brian White of Topeka Capital Markets said this week he believes the timing would be right for the company to announce its next move.

Neil Hughes

Neil Hughes

-m.jpg)

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

51 Comments

When will AI stop publishing this kind of b*sh*t...

Borrowing sucks.

Planet Banking is so desesperate that Apple has no need for its services ....

Or they could just, you know, pay their f*cking taxes. On top of it being the right thing to do, think of the PR/image boost of a huge global corporation actually acting like a patriotic American citizen should? My guess is that they'd see quite a sales spike that would counteract a chunk of the extra taxes that they'd be paying.

Why are all these people pushing Apple to get into debt? Even my kid would say that it is stupid! I hate this American mentality of living on borrowed monies! This country got here because of this!