Apple, Inc. market cap up $6.9 billion on news of ITC import ban veto

Last updated

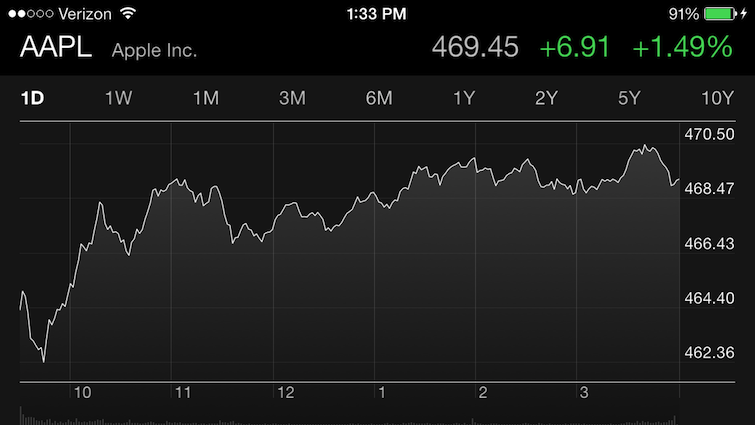

As markets opened this morning, the Wall Street Journal noted Samsung lost over $1 billion in market value on news of U.S. veto of its import ban. Apple closed the day up $6.9 billion.

Source: Google Finance

The Wall Street Journal called attention to Samsung's drop early in the day, as Asian investors reacted to the news while much of California was still asleep.

Investors were relieved by the news, sending Apple's stock up $6.91 or 1.49 percent, enough to raise Apple's market capitalization by just over $6.9 billion, a figure as large as Apple's most recently reported quarterly net income.

The rally continued the month's upward trend; Apple is up $52, or 12.46 percent from the beginning of July. However, Apple is still down nearly 12 percent for the year, 23.7 percent over the last year, and nearly 35 percent from its all time high reached last September, when the company's shares briefly reached above $700.

The market was also apparently encouraged by reports that interpreted the ban as positive for innovation and likely to interrupt the flood of patent holders attempting to use the ITC to gain what the Obama administration had described as "undue leverage."

Samsung's ban was based on a controversial patent that Judge Lucy Koh had already ruled Apple had not infringed last summer in a summary judgement.

Philip Elmer-DeWitt of Fortune had additionally noted that dissent among the six commissioners helped set the ban up for a virtually inevitable veto, citing a report by patent expert Florian Mueller of FOSSPatents

The Obama administration had announced its plans to veto the ban on Saturday. It was scheduled to otherwise go into effect today, and would block the imports of older, GSM-only models of Apple's iPhone 4 and iPad 2.

iPhone 4 still an important entry level model for first time buyers

While it wouldn't have affected Apple's mainstream products and only affected consumers in the United States, the ban would have been a significant inconvenience and disruption for Apple, particularly since sales of older iPhone 4 models have been selling briskly.

In Apple's most recent conference call, its chief financial officer Peter Oppenheimer stated that "iPhone 5 remains by far the most popular iPhone, but we were also very happy with sales of iPhone 4 and 4S," later adding that "iPhone 4 sales accelerated as we offered more affordable pricing in emerging and in other markets.""The number of first time smartphone buyers that the iPhone 4 is attracting is very, very impressive" - Tim Cook

Apple's chief executive Tim Cook referenced lower iPhone 4 pricing a significant factor in the "unusual" growth in iPhone sales in the June quarter, noting that "with the moves that we made on [iPhone] 4 and with iPhone 5 continuing to be the most popular model, we saw very strong sales in several of the emerging markets, sort of pre-pay markets."

Cook later added that "what we've seen is that the number of first time smartphone buyers that the iPhone 4 is attracting is very, very impressive. We want to attract as many of these buyers as we can and we saw that beginning to happen toward the end of the Q2 timeframe, as I'd referenced on last quarter's call, and we did that on a wider spread basis, offered more affordable pricing on a wider scale basis this quarter, and continue to be very happy with what we saw.

"Where iPhone 5 continues to be the most popular iPhone by far, we're really happy to provide an incredible high quality product with iPhone 4 running iOS 6 to as many first-time smartphone buyers as we can, and I think it's proven to be exactly a great product for that buyer."

Daniel Eran Dilger

Daniel Eran Dilger

Amber Neely

Amber Neely

Thomas Sibilly

Thomas Sibilly

AppleInsider Staff

AppleInsider Staff

William Gallagher

William Gallagher

Malcolm Owen

Malcolm Owen

Christine McKee

Christine McKee

18 Comments

Let us hope this momentum continues.

Hahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahah .............(deep breath)........ Hahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahah

They say up 4.9 % which would be amazing but it is really up 1.49 %. Hopefully they fix that mistake. C

"Apple, Inc. market cap up $6.9 billion on news of ITC import ban veto " please provide some basis for you claim of a correlation between the rise in stock price and the veto of the ban. the stock has been steadily climbing for over a month. oh, wait, this is a rumour blog. no facts needed.

This article is just stupid.