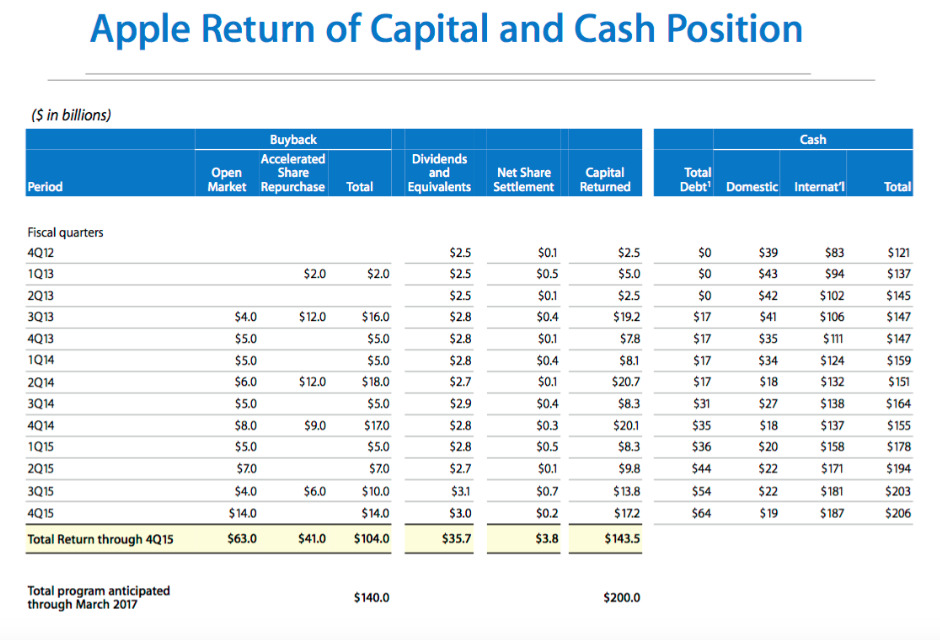

Apple reported a spike in its capital return program, spending $17 billion in Q4, including $14 billion in open market stock buybacks in addition to $3 billion in dividend payments to shareholders.

This is the largest open market stock buyback the company has ever made, a notable figure given that Apple has regularly been setting records in the arena of massive stock buybacks ever since it began its capital return program three years ago.

As anticipated by AppleInsider last month, the company has taken full advantage of the depressed price of its stock.

Apple's share price had collapsed by nearly a third following its earnings report for fiscal Q3 on July 21. That gave the company a rare opportunity to shovel capital, most of which was borrowed in the form of incredibly low interest bonds, into share repurchases.

The company outlined during its earnings conference call that it had settled 10 million shares remaining from its $6 billion Accelerated Stock Repurchase initiated in July. That represent a faster that usual completion of an ASR, essentially a buyback sale delegated to an outside bank.

Additionally, Apple itself completed its largest open market buyback ever to the tune of $14 billion within the quarter, buying up nearly 122 million shares, representing an average price of around $114.75.

This all happened before

The last time Apple's stock nose-dived after an earnings release, in January 2014, the stock panic shaved less than (a split adjusted) $10 off of Apple's share price. The company responded by scrambling to spend an incredible $18 billion to take advantage of faithless investors' extreme gullibility on behalf of its loyal shareholders, although the bulk of those buybacks ($12 billion) were performed under an ASR rather than in open market orders.

Those actions paid off tremendously. Apple bought up over 30 million shares at prices below (a split adjusted) $75, right before the stock again returned to more rational prices.

Over the last quarter, Apple's stock price plummeted by as much as $25 at one point, effectively erasing any appreciation contributed by the blockbuster sales of iPhone 6 over the past year (albeit never closing below $100, well ahead of the last buyback-inducing stock panic trough).

Despite continued massive cashflow from operations, Apple continues to borrow money by the billions internationally, with one primary intent: to again buy back as many shares as possible before the market comes to its senses.

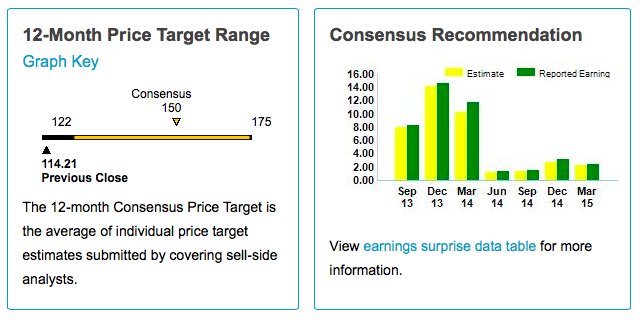

Borrowing capital at interest rates below 2 percent to buy shares that are currently languishing at a price that analyst consensus targets expect to rise by around 30 percent over the next year (to $150, according to public market data) is a no-brainer, particularly for Apple's executives who fully grasp the potential of the company in the global markets it is operating across.

If Apple were actually facing a upcoming barrier of slowing growth and a collapse of demand in China, rather than buying back its own stock it would be scrambling to acquire other companies with an actual, apparent strategy the way Google has been almost blindly gobbling up its Alphabet soup over the past several years as Android has done nothing and every one of its hardware efforts have all imploded into embarrassing ruin.

Apple is also making acquisitions (albeit with a discernible strategy), but Apple's biggest ongoing acquisition over the past several years has been Apple itself, to the mind-blowing tune of $104 billion. That pace isn't expected to slow down. Instead, Apple says it expects to spend at least another $36 billion over the next six quarters.

While U.S. tax law is currently making it unattractive for Apple to spend its foreign earnings on buybacks, that pile of overseas capital (now above $200 billion) is effectively guaranteeing bonds that raise cheap capital Apple can use to buyback its shares at an extreme discount.

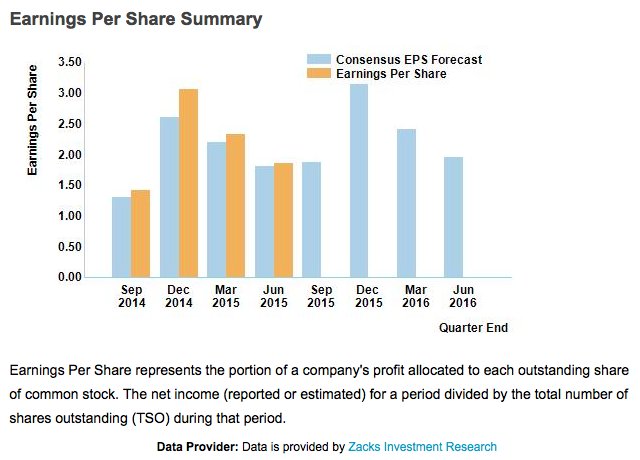

One indication that the market (and the consensus of analysts) haven't really grasped what's happening with Apple's buybacks is the fact that Apple's Earnings Per Share have consistently exceeded their expectations every quarter this year.

China Concerns

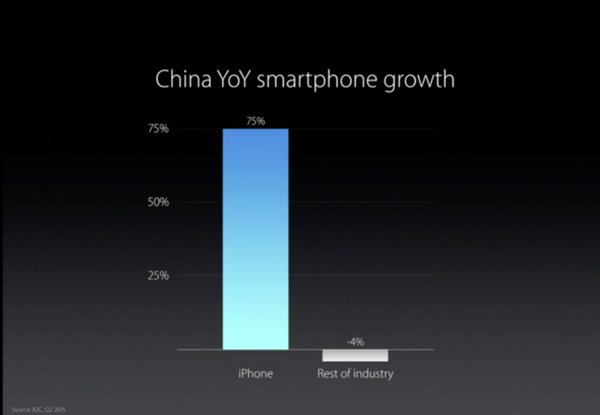

Unrest in China's stock market appears to have been weighing on Apple's stock. Given that Apple is really the only tech company to have any real success in selling products in China, and given that success has been absolutely blockbuster, concerns regarding the vast Chinese market sensibly affect Apple more than, say, Amazon or Google, neither of which even have a foot in the door of the huge Chinese smartphone opportunity.

Of course, those two companies have also earned virtually nothing on their entire, global smartphone efforts outside of China either. Both inside and outside of China, Apple is the only company making any real money on the scale of Apple. And Apple is growing while everyone else is increasingly struggling to turn a profit at all. Apple is selling China's vast emerging middle class technology products that, while perhaps luxurious, are broadly affordable. Apple is selling China's vast emerging middle class technology products that, while perhaps luxurious, are broadly affordable.

On today's conference call, Apple's chief executive Tim Cook said that if he weren't otherwise aware of the macroeconomic issues affecting China's economy, he wouldn't know about it looking just at consumer demand for iPhones and Macs.

Apple's revenues from China soared 99 percent year-over-year in its fiscal Q4, growing from just under $6.3 billion to about $12.5 billion.

Even China's minority with exposure to stock market losses is unlikely to decide that the most pressing economic concern in their lives is whether they're spending the equivalent of about $30 per month financing a new iPhone or not, given that Apple's brand in China is a status symbol unmatched by anyone, let alone a third rate knockoff smartphone.

China's 4G mobile service continues to be built out from virtually nothing just a year or two ago. Incredible numbers of people are buying new iPhones to take advantage of it. Apple's market share in China could drop and the company would still be growing dramatically.

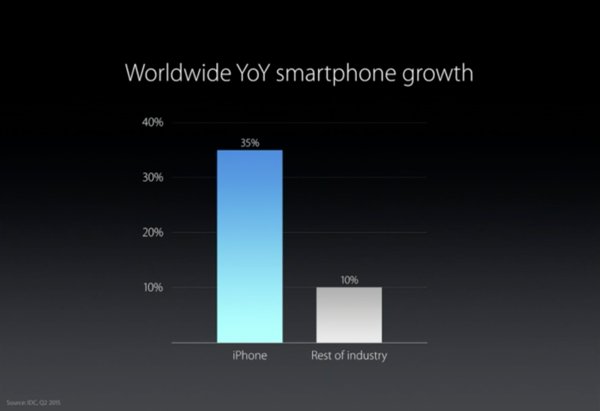

Instead, Apple's growth is still outpacing the industry by a huge margin. In fact, Cook noted that without counting iPhones, the smartphone market in China actually contracted during the quarter. He noted that Apple "has been able to grow without the market growing."

And outside of China, Apple's massively successful iPhone 6 launch over the last year, which has reclaimed market share in nearly every market, has helped to establish Apple's brand as shorthand for "customer satisfaction."

The scale at which Apple is introducing new buyers to its brand suggest incredible potential. Cook noted that 68 percent of iPad buyers in China were buying their first tablet, and that 40 percent of those never bought any Apple device before. Cook noted that 68 percent of iPad buyers in China were buying their first tablet, and that 40 percent of those never bought any Apple device before

Apple's primary rivals in smartphones are not only led by a disastrously poor series of rollouts by Samsung, but are also plagued by the malcontent associated with Android and its increasingly appalling reputation for security flaws that never get fixed by a company that doesn't seem to even care about it.

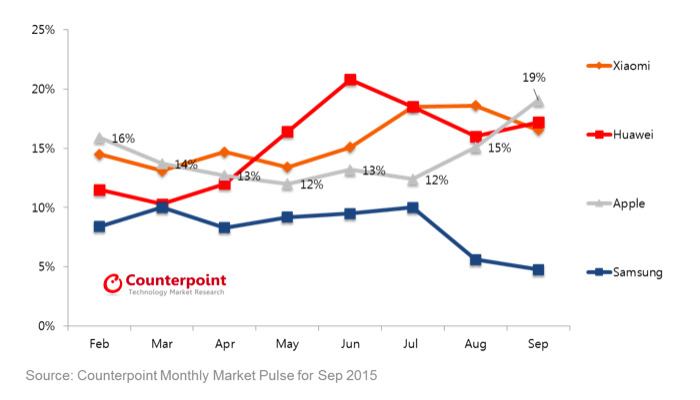

Apple's two largest contenders in China, Huawei and Xiaomi, were both close to Apple in total unit sales of smartphones within China in September. However, as with Android vendors in other markets, those firms are selling a lower end mix of devices and earning much less. They're also facing serious barriers outside of China. That leaves Apple the only company to be leading sales in both the U.S. and China, the world's two largest phone markets.

Currency Headwinds

There are legitimate concerns in front of Apple, one notable issue being foreign currency headwinds. The U.S. dollar has been appreciating against a wide variety of other currencies, making Apple's exports more expensive. If this hadn't happened over the last two quarters, Apple earnings results would have been even better.

However, Apple has weathered unfavorable currency fluctuations better than many of its peers simply because it is so profitable, and it has the capital and credit to enter long term hedging contracts to mitigate risk. Additionally, it's unlikely that the situation will continue to worsen at the same rate going forward, given the impact the surging dollar already has on every other American company.

At the same time, energy costs are also continuing to fall, making Apple's international shipments and other transportation costs cheaper. The price of oil is expected to fall faster than the dollar can rise, offering some offset. And as oil falls, producer countries including Saudi Arabia are selling off their dollar reserves, blunting the dollar's rise.

Additionally, today's stronger dollars should also make it cheaper for Apple to invest in large infrastructure, production and lavish retail projects internationally, such as the surge in expensive retail stores Apple is working to build across China over the next few years.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Christine McKee

Christine McKee

Malcolm Owen

Malcolm Owen

Marko Zivkovic

Marko Zivkovic

Andrew Orr

Andrew Orr

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

-m.jpg)

81 Comments

All well and good, but it's doing exactly zilch for their stock. Apple may want to consider ending this well-meaning program.

"Apple is selling China's vast emerging middle class technology products that, while perhaps luxurious, are broadly affordable." but all that 'journalism' would tell you that in china they cannot afford the phone, only assemble it.

All well and good, but it's doing exactly zilch for their stock. Apple may want to consider ending this well-meaning program.

They should rather have spent that $100B to buy Tesla and DropBox or some other top of the line Cloud company.

Amazon, Microsoft and Google all three went up on their sky high growth expectation of Cloud based services.

So Apple lost 6 billion dollar this quarter. Wow.

[quote name="shahhet2" url="/t/189795/apple-inc-snatches-up-14-billion-of-its-own-shares-in-massive-q4-buyback-surge#post_2797312"] They should rather have spent that $100B to buy Tesla and DropBox or some other top of the line Cloud company. Amazon, Microsoft and Google all three went up on their sky high growth expectation of Cloud based services. [/quote] Utter nonsense.