Xiaomi— a Chinese startup that aimed to push out high volumes of low cost smartphones and then make money on ecosystem-related services— has missed its volume goal for 2015 while substantial revenues from services remain a "figment," casting doubts upon its $46 billion valuation.

In a report for the Wall Street Journal, Eva Dou stated that having "raised vast sums on China's mobile-Internet boom," Xiaomi is now "facing growing pressure to live up to expectations."

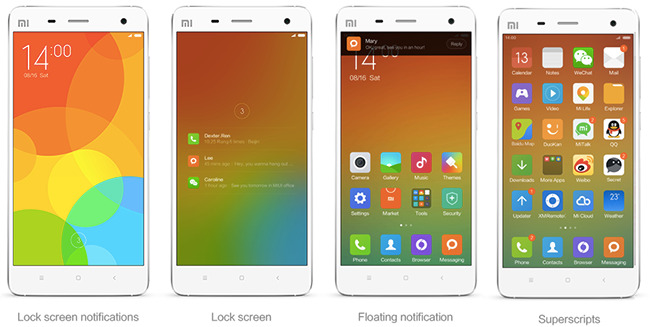

The smartphone maker, famous for making Android-based devices that look nearly indistinguishable from iPhones, has a $46 billion valuation based on "yet unrealized plans to generate substantial revenue from Internet services" the paper stated.

It added that Xiaomi also failed to reach its target of selling 80 to 100 million smartphones in 2015. The previous year it had sold 61 million units, representing 300 percent growth over 2013. However, improving sales volumes by another 30 percent proved to be impossible.

No room for hardware profits

While Apple has also come under scrutiny over the "difficult compare" of improving upon its massive sales volumes (in fiscal 2015 it sold 231 million iPhones), Apple sells its phones at a profit. iPhones have comfortable room for hardware margins, thanks to an Average Selling Price that increased over the past year by $67 to reach $670.

Over that same period of time, Xiaomi's smartphone ASP fell from $160 to $122, the Journal reported, based on figures from IDC. Huawei's ASP sits at $209 (up $8 over the last year). However, China's overall smartphone average price rose from $202 to $240 over the past year, suggesting that most of that price appreciation came from Apple's sales.

Similarly, while IDC depicted Xiaomi and Apple being virtually tied in global wearables unit sales and market share in August, it was comparing the roughly $450 Apple Watch to Xiaomi Mi Bands, which cost at most $25.

Services remain an illusory "figment"

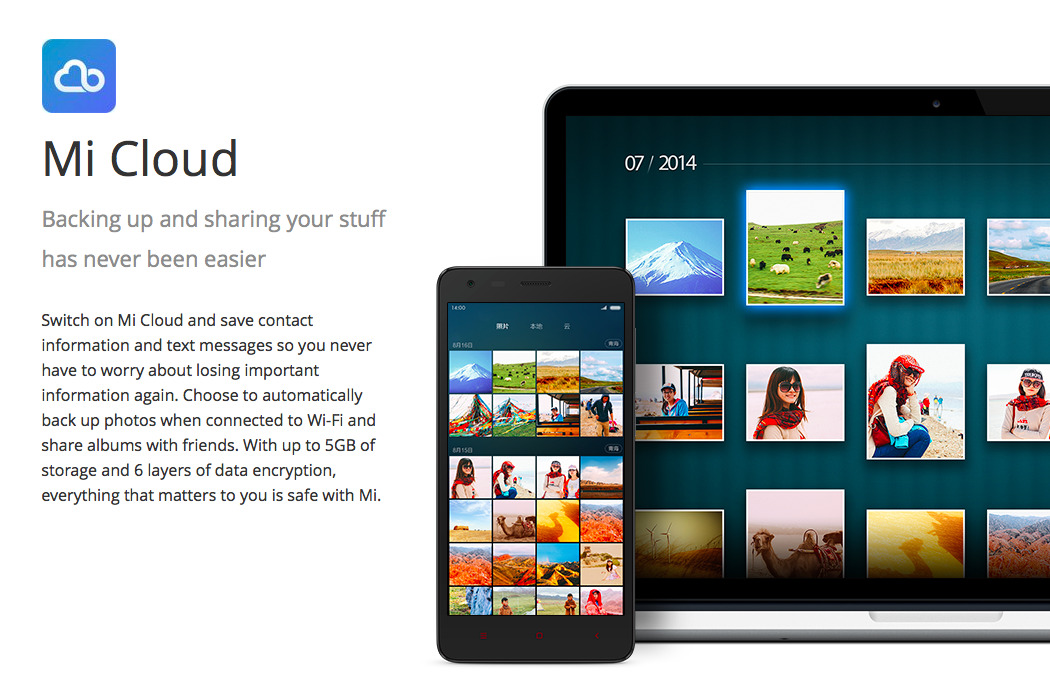

Despite slowing sales growth and plummeting ASPs, Xiaomi has centered its business strategy around services-based ecosystem and branded products, including a series of acquisitions related to smart-home products.

However, according to Steven Hu, a former partner in Xiaomi investor Qiming Venture Partners cited by the Journal, while "Xiaomi's promise lies in its ecosystem," he noted that "mobile services, e-commerce, branded consumer products— these still are largely just a figment rather than a huge and growing source of profits that could validate last year's sky-high valuation."

Failing to reach its forecast of 80-100 million units— a growth goal given by chairman Lei Jun last March, then dialed back in December as "not the number one priority for us" indicates a crisis of confidence.

"For Xiaomi, we currently need to return to our original aspiration, to be like a startup," Lei said last month. "We need to be more persistent in building a good user experience and product."

Apple's 64 Beats

One of the problems Xiaomi ran into in 2015 was the problematic Snapdragon 810 chip rushed to market by Qualcomm in order to have something to position against the 64-bit A7 Apple had introduced in 2013.

While Apple sailed into the lead with iPhone 5s' A7, and then enhanced its design with the 2014 A8 used in iPhone 6 models, Qualcomm struggled to achieve even a generic 64-bit processor by early 2015. That left Xiaomi's most expensive phone, the $350 Mi Note, plagued with overheating issues that tarnished its image.

Further, when it attempted to expand its sales into India, that country's Delhi High Court issued an injunction blocking sales of Xiaomi's phones not using Qualcomm chips, due to an ongoing patent infringement lawsuit filed by Ericsson affecting alternative MediaTek processors.

Other handset makers were able to work around Qualcomm's flawed chip by rolling out their own processor, as Huawei and Samsung did. Samsung's use of its own Exynos processor also made it a major customer of Cirrus Logic, one of the "iPhone suppliers" now suffering an earnings shortfall that coincidentally occured as Samsung's premium flagships failed to sell in competition with iPhone 6, but which is being widely interpreted as a harbinger of doom for Apple because, it too, is a Cirrus customer.

In addition to lacking vertical integration in chips and the ability to defend against patent infringement suits, Xiaomi is also "locked in a Chinese demographic ghetto of mainly males 18 to 30" according to Peter Fuhrman, the chairman of investment bank China First Capital.

Rather than increasing its appeal, Xiaomi's focus on low prices has further tarnished the company's brand he added.

Media darling gets Journal jilting

Just over a year ago, the Wall Street Journal reported that, based on a "a confidential document" that it had "viewed," Xiaomi had earned 3.46 billion yuan ($566 million) on revenues of 27 billion yuan.

Journal reporters said this "shows that Xiaomi's net profit nearly doubled last year, making it a lucrative business in an industry where most players selling cheap handsets struggle to break even."

While noting that "a Xiaomi spokeswoman declined to comment" on the reported earnings, the paper marveled at how Xiaomi could be making so much money on smartphones that start around $114, with the company's Mi4 flagship priced at just $327.

"A possible explanation for Xiaomi's ability to squeeze out so much profit while selling affordable phones is its inexpensive but efficient marketing tactics," the Wall Street Journal reporters Prudence Ho, Lorraine Luk and Juro Osawa collectively speculated.

Based on that report, clickblog Business Insider published "Xiaomi Is Creating An Uncertain New World That Apple Must Learn To Live In," which gravely warned that "the news that Chinese smartphone manufacturer Xiaomi makes a healthy profit could horrify executives at both Samsung and Apple."

It mused that the report "suggests that new phone makers can use Android to arise from nowhere and steal vast chunks of market share, profitably."

It was later reported by Reuters that Xiaomi had actually only earned $56 million, one tenth as much as had been previously reported. While the privately-held Xiaomi does not have to publicly report its earnings, it had included them in a securities filing related to an investment in another company.

AppleInsider reported that the Wall Street Journal had been wrong, although the paper didn't correct its report and Business Insider didn't address its alarmist sensationalism based on the incorrect report either.

in 2015, Apple's iPhone 6 grew so popular in China that it displaced Xiaomi for first place in unit volumes, despite iPhones selling for an ASP 5.5 times higher than Xiaomi.

Six months later, the Wall Street Journal has shifted its glowing adoration of Xiaomi to a much more critical tone.

That calls to mind the doe-eyed, enthusiastic coverage of Samsung by Wall Street Journal reporters including Daisuke Wakabayashi, Ian Sherr and Evan Ramstad who spent 2013 promoting the idea that Apple had "lost its cool" to Samsung, that its "formidable growth had petered out," that Samsung "was eating its lunch" and that developers were shifting their efforts to Android, all before later acknowledging that "the story line" the paper had authored was not really true, that most of Samsung's huge unit shipments were actually not very profitable and that Android was not really stealing away any significant developer interest from iOS.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

William Gallagher

William Gallagher

Brian Patterson

Brian Patterson

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

Christine McKee

Christine McKee

28 Comments

Yep another 'stalking horse' ends up in the knackers yard.

I never understood the bullishness around Xiaomi becoming a services company. How many companies are profitable selling cheap hardware? And what we're all these services Xiaomi was going to make money off of to cover the cheap hardware?

There is shame in China apparently. Besides that I prefer their squared off edge vs the round 6s I have.