Bloomberg's latest scoop uses Apple's upcoming education event as an opportunity to advance the idea that Google's Chromebooks (and Android tablets!) are taking over new markets while iPads stare into the inky black void of doom. That's wrong, here's why.

Where's the beef?

On Friday, Bloomberg boldly claimed to reveal Apple's "private plans" for the company's "field trip" education event scheduled next Tuesday in Chicago, stating it would "introduce new low-cost iPads" and— wait for it— some kind of software that (here's the kicker) has something to do with education.

The piece credited the entire story to anonymous "people familiar with the matter," who "asked not to be identified" because this stuff was so secret. But there's nothing revealing about Apple annually updating its iPads; the existing 2017 iPad was last refreshed almost exactly a year ago on March 21.

Despite its low price, Apple's iPad 2017 web marketing focuses entirely upon its premium features, not its affordability

Despite its low price, Apple's iPad 2017 web marketing focuses entirely upon its premium features, not its affordabilityLast year, the new entry-level 9.7 inch iPad (effectively a faster, cheaper, newer edition of iPad Air 2) was released with nothing more than a PR statement. The fact that Apple is hosting an event this year suggests that perhaps there's something else going on beyond just "trying" new "low-cost iPads."

Despite supposedly being armed with "private plans" provided by "people familiar with the matter," the site didn't manage to offer any sense of what the introduction of "new low-cost iPads" might involve in terms of features. It even stopped short of claiming any changes in pricing.

Instead, it coached the event as being an attempt by Apple to fight its way back into the education market after losing market share to cheap Google Chromebooks and low-end Windows netbooks. (Because we know Apple's driving force is winning "market share" at all costs).

Beyond "revealing" a big secret nothing, an overwhelming amount of what the article stated about Apple and the education market was either wrong, false, misleading or simply ignorant.

False: Apple has not forsaken education for "high margins"

"Steve Jobs made schools a priority for Apple early in its life," it stated. "But as the company has driven toward mass-market and higher-margin products in recent years, Google and Microsoft have had success breaking into classrooms with inexpensive laptops and tablets."

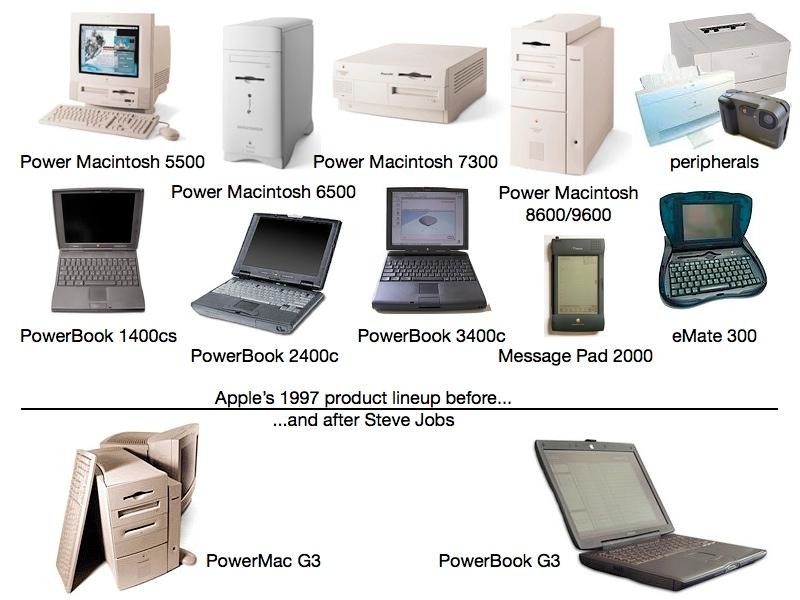

Apple has always actively courted both schools and the mass market of "the rest of us." Jobs noted education as one of Apple's strongest remaining markets in 1997. But the idea that it has only recently charted a "mass-market" direction is silly, and the wording that Apple has "driven toward" higher margin products (and the implication this is a post-Jobs trend) is simply false.

The same PC makers behind today's Windows and ChromeOS netbooks in 2018 were making "inexpensive" Windows and Linux netbooks in 2008 and "inexpensive" Windows PCs in 1998. Cheap computers have been "breaking into classrooms" since 1978. The only thing to change has been the names of the companies making them.

Despite Bloomberg portraying the pyrrhic victories of commodity cloners as being an unprecedented and wholly new commercial success, Apple has never not faced "inexpensive" competition in education.Apple has never not faced "inexpensive" competition in education

For companies like Apple that are actually innovators, "mass-market" and "higher-margin" are often not even in the same direction.

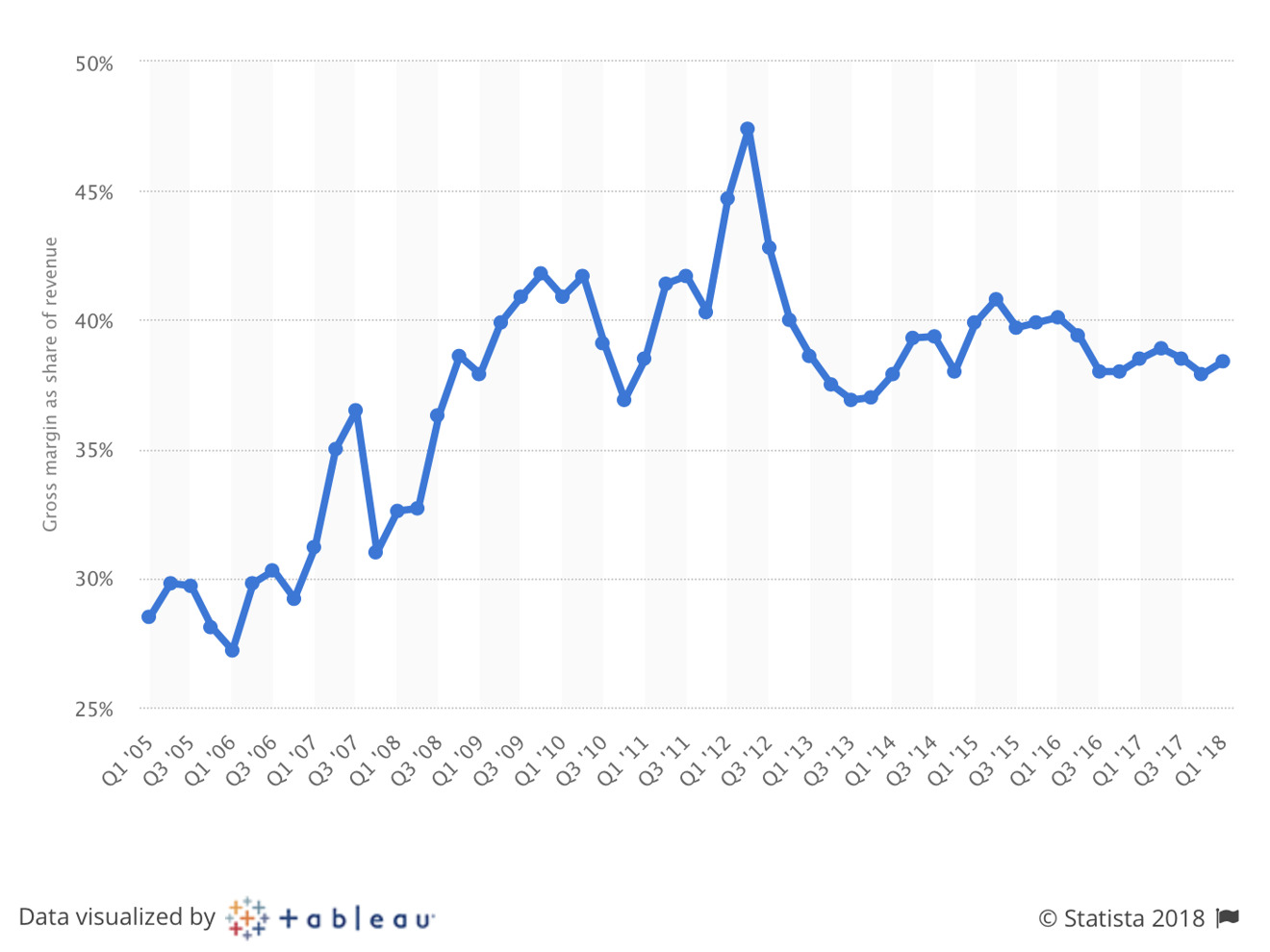

During Apple's high-end (but niche market) Macintosh heyday in the late 80s, the company notoriously targeted 50 percent hardware margins. But Apple's gross margin as a percentage of revenue was below 30 percent during volume sales of "mass-market" iPods in the years before iPhone.

Apple's gross margins. Source: Statistica

Apple's gross margins. Source: StatisticaiPhone and iPad helped turned that around, again boosting gross margins back toward a peak of nearly 50 percent in 2012. But Apple's margins in the years since (including the Chromebook period) are now hovering around 38 percent, the same range as when Jobs was selling white MacBooks running iWorks '09.

While it might sound "truthy" to say Apple fatefully turned its back on education to pursue "mass market" and "high margins," the reality is that Apple has always marketed itself to schools as being better for learning, despite competitors offering cheaper products— the same way it markets premium products to consumers and the enterprise.

Further, many of Apple's newest products, including AirPods, Apple TV 4K and even the luxurious, high-priced iPhone X involve lower margins because (regardless of their price tag) they involve expensively engineered components.

False portrayal of the education market

The idea that Google and Microsoft are rolling in rich success because they outsmarted Apple in education is also fiction. Google began dumping Chromebooks on U.S. K-12 schools over the last few years because nobody else wanted to buy them.

ChromeOS and Google's Cloud apps were initially intended to reach the enterprise, but failed. They were next pointed at consumers and pro users— led by Google's own pricey, unpopular Chromebook Pixel in 2013— but individuals didn't want them either.

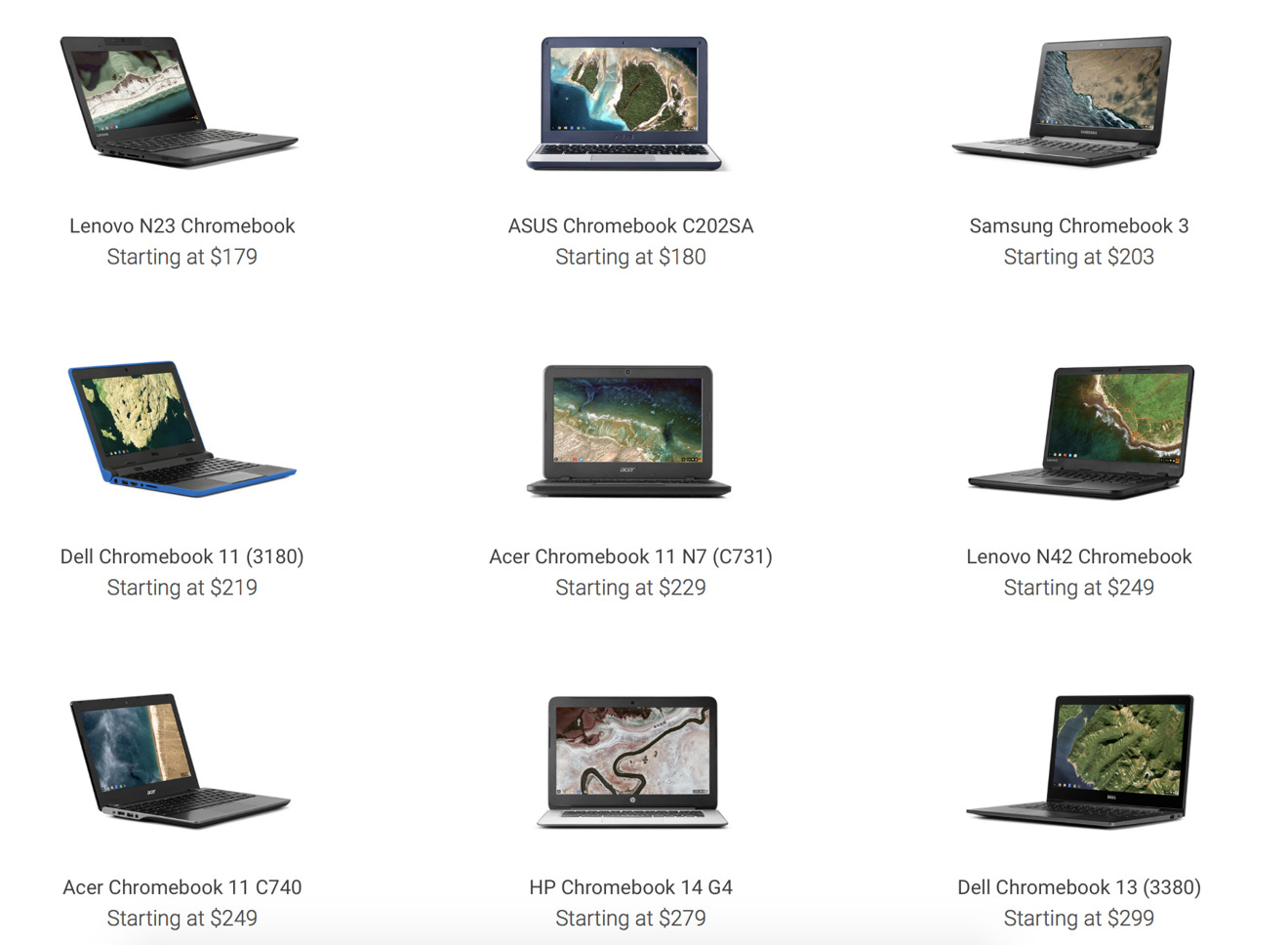

Google now has PC partners churning out ultra basic ChromeOS netbooks that are being sold to schools for next to nothing. Yet outside of cash-strapped K-12 schools districts in the U.S., Chromebooks have not appealed to college students or universities in higher education for the same reasons that consumers and enterprise have shown little interest in them.

The reason why U.S. K-12 Chromebook sales appear to be growing so fast (and why Apple's market share is shrinking) is largely because of Google's recent push to drive large numbers of nearly free ChromeOS netbooks in "1-1" programs that assign a device to every child to carry home, rather than selling a set of computers or tablets for use in a classroom.

Google's K-12 Chromebooks (and Microsoft's own stab and doing the same with low-end Windows 10 S notebooks as growth in the PC market stagnates) are a desperate last-ditch effort to ship a huge volume of hardware that would be even more unprofitable if there were any fewer shipments, not some sort of five dimensional chess.

False narrative supported by numbers out of context

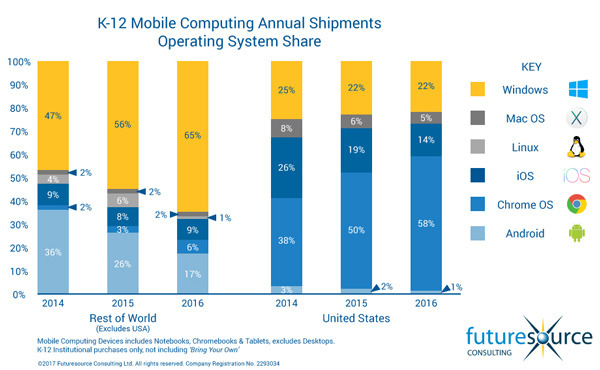

The article picked numbers from a report by Futuresource Consulting as supporting its narrative when the facts actually do not.

It broadly portrayed Google's education efforts as looking outstanding by stating that "Google's operating systems on Chromebooks or Android tablets held 60 percent of the market," compared to 22 percent for Windows PCs and 17 percent for Apple. But Android tablet adoption is actually falling and counts for nearly nothing in U.S. K-12: less than 1 percent.

To look at the data and then specifically credit "Android tablets" as playing a role in U.S. market share is like reporting that people starting using iTunes because of iPods "and Ping," after looking at the data of Ping's low traction. Does Google really need more media outlets actively covering up the failure of Android tablets?

The idea that Apple is freshly trying to "win back students" from Microsoft Windows is also weak given that Windows share in education has remained stagnant since 2015. The only real change occurring in education is that Google began forcing tons of Chromebooks into U.S. schools in an experiment that hasn't been put on pause yet.

Apple's Mac and iOS sales to U.S. K-12 education have fallen over the past few years relative to the years of surging growth in the headline-grabbing K-12 market. But growth stopped this year at a plateau of around 12 million units. So the dire-looking drop in K-12 iPad sales between 2015 and 2016 really represents a decrease of only about 269,000 units, a rounding error of the 43,753,000 iPads Apple sold last year.

That also means that all of the Chromebooks that Google's various partners produced in total for U.S. K-12 education amounted to just 7.4 million units in 2016 and 5.35 million the year before. Google's expansion of the market accounted for essentially all of the growth in K-12, growth that is now no longer happening.Google's expansion of the market accounted for essentially all of the growth in K-12, growth that is now no longer happening

Last year, Futuresource noted that growth was occurring because of "1:1 learning programs and a strong replacement market."

Chromebooks don't last long, which initially helped drive repeat sales. But now growth has stopped, indicating that current sales of Chromebooks are largely replacements, contributing to shipments but not an expanding installed base.

Google doesn't make hardware and doesn't earn any ChromeOS licensing revenue (it's in education to expand its ChromOS base, service that base and collect data), so flat replacement sales mean a zero-growth business. ChromeOS licensees are not making any money serving replacement hardware to a stagnant base of around 7 million users on a tight budget. Futuresource noted last year that 90 percent of all Chromebooks are sold in the U.S.

Overseas, things look quite different. In the Rest of the World, Chromebook adoption is lower than iOS. And while Android tablets were once commonly used in education in regions including Asia, globally Android tablet use in education has collapsed by more than half in two years, giving generic Windows PCs back the majority of unit share.

Notably, over the same period iPads used in education overseas retained their share of the market, so the failure of Android tablets isn't simply a trend away from tablets, but specifically an abandonment of Android tablets.

Isn't it interesting that Bloomberg focuses on a difference of a quarter million iPads in U.S. education rather than the much larger collapse of Android tablets globally while portraying Chromebooks "and Android tablets" as being a runaway success in the U.S. market?

Android tablets are so dead even Google has given up on them. But that also tells us something about the potential for Chromebooks.

Unsustainable businesses don't last

Another significant bit of reality left unaddressed in the Bloomberg narrative portraying big tech companies as desperately fighting for all the gold in education is that market share is not the same as revenue or profit share.

While noting that "the global educational technology market generated $17.7 billion in revenue," there's zero thought given to who collected most of that. It wasn't Google or its Chromebook partners, who lead market share in the U.S.

Much of that "technology" revenue was not related to unit sales of student devices. But by any measure, none of Google's Chromebook partners brought in more revenue than Apple in education, and their earnings on those $150 netbooks were virtually zero.

That's not exactly a phenomenal portrait of success. It's the Android tablet business all over again. We were told year after year that cheap Android tablets were taking over Apple's iPad business and there was nothing Apple could do. But that's not what was happening. Pundits looking at only the thin surface of market share numbers either got it wrong or were lying or otherwise didn't know what they were talking about.

Today, Android tablets are in the same bucket as Android smartwatches or the Windows and Linux netbooks that looked to be so important back 2008. Today's ChromeOS netbooks appear to be following suit in blowing out a short-term, large volume of low quality, unprofitable hardware that can't sustain its own production.

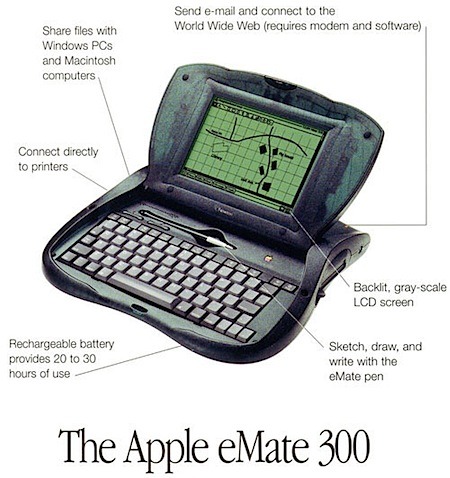

Apple itself has first-hand experience in discontinuing products that it once considered strategic, but was eventually forced to admit were not worth continuing: Xserve, Displays, AirPorts— and returning to the subject of low-cost education offerings— the 1997 Newton eMate 300.

That device was much cheaper than a Mac or even Windows PCs of the time. It shipped with a stylus, a solid physical keyboard, a touchscreen display, lots of different ports and even memory expansion. Despite having all the features pundits today pine for, Apple stopped selling it because its production wasn't sustainable.

Apple could have achieved impressive "market share" for the eMate in a small market segment by making it a loss leader subsidized by other sales, but that's not a sustainable business practice.

The "set-for-life" K-12 canard

Overblowing the value of shipping out a huge wave of low-value hardware that isn't sustainable is only part of the nonsensical narrative Bloomberg repeats in the piece. The other fiction is that once kids are exposed to a learning device, they're programmed for life to keep supporting whatever they used in grade school.

"The sector is prized among industry giants," the article claimed, "because students learn to use a certain type of device, then head into the workforce and spread the technology wider."

That's never been true.

American kids who went to grade school through the 80s were mostly exposed to Apple II, TRS80 and DOS PCs. For anyone who graduated prior to around 1995, the details and brands of those ancient computers were largely irrelevant to their experience in the job market.

Macs maintained a very strong hold on U.S. K-12 education, yet the generation who grew up with Macs at school didn't magically give the platform similar market share in the enterprise or most other job markets. Instead, most recent enterprise Mac adoption has been driven by iPhone. And iOS adoption was driven by consumer choice, not by kids being taught on iPads in grade school.

The fact that most schools globally used Windows PCs hasn't stopped iOS from being the platform most Millennials use in the affluent mobile world overwhelmingly dominated by iPhone and iPads, and it didn't reverse the slide in PC sales that began ten years ago. The fact that pundits back then were talking breathlessly about sales of cheap netbooks in education never resulted in igniting a graduating class with a thirst for cheap Acers.

Familiarity with specific software titles (such as Microsoft Office or Adobe Creative Suite) can contribute to the base of skills among students entering the workforce, but these are more often learned in higher education rather than K-12, and college students are not choosing to buy low-powered ChromeOS netbooks that can't even run many of the most popular apps they need in the job market.

False: iPad is not doomed because everyone else failed in tablets

After dramatically inflating the commercial and strategic importance of K-12 to flatter Google's netbook dumping as a genius business venture, Bloomberg then paints iPad as a business sliding sideways with a bleak future.

It stated that Apple's tablet strategy has "helped the iPad business return to growth after multiple declining quarters. Still, demand for tablets is weak. According to research firm IDC, the market shrank by about 7 percent in 2017."

Tablet demand is weak only looking at collapsing Androids and Microsoft's stagnant Surface PCs, which barely sell a million units per quarter and have never actually grown across many years of trying.

Bloomberg dismissively compared Apple's 13 million iPad and iPad Pro sales in the last quarter against its highest quarterly peak of 22 million sales from three years ago, when iPad mini was driving volumes. But selling 13 million iPads in a quarter makes Apple's tablet business bigger in volume than all of Dell's PC sales and nearly as large as either of the world's top two PC makers, HP and Lenovo, even before counting Macs.

And growth in iPad sales is occurring despite the fact that that the product remains valuable for many years. Apple officially supports iPad models in iOS 11 dating back to 2013, and even older iPads still remain usable. Yet Apple sold almost another 13 million to its installed base and to new users last quarter, expanding its installed base.

That many Chromebooks were pushed into U.S. education (the only market really buying them) across two years, and then growth stopped. Despite a high replacement rate for cheap hardware that isn't designed to last, Chromebook K-12 sales growth has flatlined. Yet iPad is still finding 13 million new buyers in new markets in a single quarter.Chromebook K-12 sales growth has flatlined. Yet iPad is still finding 13 million new buyers in new markets in a single quarter

In Apple's most recent earnings call, chief executive Tim Cook stated, "Based on the latest data from IDC we gained share in nearly every market we track, with strong outperformance in emerging markets.

"Worldwide, almost half of our iPad sales were to first-time tablet buyers or those switching to Apple. And that's true in some of our most developed markets, including Japan and France. In China, new and switching users made up over 70 percent of all iPad sales."

Other tablets are not performing similarly. "NPD indicates that iPad had 46 percent share of the US tablet market in the December quarter, up from 36 percent share a year ago," Cook stated.

"And the most recent surveys from 451 Research found that, among customers planning to purchase tablets within 90 days, 72 percent of consumers and 68 percent of business users plan to purchase iPads. Customer satisfaction is also very high, with businesses reporting a 99 percent satisfaction rating for iPad."

How do the facts support the aggrandizement of flat ChromeOS sales in K-12 and the belittling of Apple's global iPad growth in a market segment nobody else can functionally compete in?

Not such keen insight

Bloomberg is either intentionally distorting reality for its readers, or fundamentally does not understand very important concepts in capital markets and is blind to clear patterns that keep occurring among hardware makers trying to take Apple's position without doing to the work to earn it.

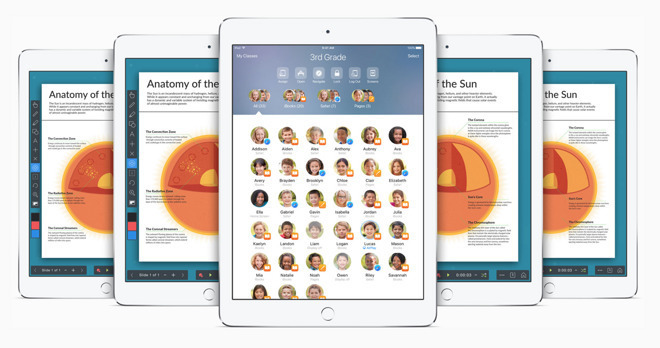

Apple's iPad strategy can certainly be criticized. The company only recently added more extensive iPad-optimized UI features in iOS 11, and its support for shared iPads in school settings was first released with iOS 9.3 just a couple years ago. The resetting of the iPad entry point from a low cost, consumer-oriented iPad mini to the lower-priced iPad 2017 is only one year old.

Over the past three years, Apple's predictable annual iPad refresh was interrupted by the introduction of new iPad Pro models, which deliver not just the company's vision for the future of computing in general, but also features desired by educators, including the Smart Connector for attaching a non-wireless keyboard (that doesn't need to be charged separately) and Apple Pencil, offering a strong differentiation from other tablets.

All of those steps could have been prompted (at least in part) by pressure from Google dumping cheap, easy to deploy Chromebooks on U.S. K-12 education.

But it's premature— perhaps asinine— to suggest that the solution to Apple competing against low-end commodity loss leaders is to slash its own pricing. The only time Apple ever did that was in the early 90s, when its cheap Performas, infomercials and commodity PC licensing deals nearly destroyed the company.

Apple doesn't throw out new products without any strategy and then slash prices in desperate fire sales to find buyers the way ChromeOS licensees Samsung, LG, Acer, Asus, Lenovo and HP do; or like Windows netbooks makers Samsung, LG, Acer, Asus, Lenovo, HP and Dell; or like Android tablet makers Samsung, LG, Acer, Asus, Lenovo, HP and Dell.

Or like failed smartwatch vendors Nokia, Sony, Motorola, Samsung, LG, Acer, Asus, Lenovo and HP or like failed or struggling phone vendors including Amazon, Essential, Nokia, Sony, Motorola, Samsung, LG, Acer, Asus, Lenovo, HP and Dell.

Failed commodity hardware makers don't suddenly become an innovative force just because they join a software platform collective launched by an American company. And perhaps that's actually why they don't.

Commodity is a liability and weakness, not a strength

If anything, ChromeOS has made netbook makers less competitive, because everyone else can make virtually identical devices that look and work the same. That's the same plague that killed the sustainability of commodity Windows PC makers, commodity Android tablet makers and increasingly, even commodity Android phone makers.

That's also why Android's largest licensee Samsung has been trying to get its own Tizen platform off the ground, after initially failing with Bada, an earlier effort to roll out a mobile Linux distro that isn't tied to Google.

Android has served as a comfortably numbing but lethal soup that licensees jump into, but like frogs in the proverbial stove pot, as the water gets hotter they can't think to jump out and they can't survive staying put.

Samsung's been well aware of its predicament since 2011, when it authored documents (later revealed during the Apple-Samsung trial) that outlined its plan to "influence a 3rd mobile OS platform viability and scale by driving volume aggressively," noting that "what matters most in adoption" was "market penetration."

Samsung observed even back then that "this won't be easy," noting that "two thirds of developers say there is [little] chance OSes or hardware would become attractive enough to overtake Android as the No. 2 mobile dev platform, let alone the untouchable Apple iOS."

Despite its efforts to flood the market with massive numbers of handsets, Samsung has been unable to successfully launch its Bada or Tizen platforms, in large part because they have to compete against Android.

Even Samsung's apparent success with Android has been hollowed out by Android competition from China willing to make even less money to achieve market share— a death race to the bottom that even the individual players in China keep dropping out of because it simply is not sustainable.

Apple can continue to learn from educators— and even from Chromebook and Windows competitors— the same way that the company has observed areas where it was behind in other markets and worked to catch up and matched features, like those that first appeared on Android phones.

But of all the things Apple can outline in its education event, "new low-cost iPads" are the least likely to appear. Apple's historical move against cheap commodity has been to release a new leap in functional technology that makes its products more valuable at the same price point. The most obvious step is suggested by the calligraphy of the event's invite, which looks as if drawn by an Apple Pencil.

If Bloomberg were actually trying to report about the future of iPads, it might have noted that. But the article was written to puff up Apple's competition while denigrating the company as weak, poorly managed and desperately in trouble.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Chip Loder

Chip Loder

Malcolm Owen

Malcolm Owen

Marko Zivkovic

Marko Zivkovic

Wesley Hilliard

Wesley Hilliard

Christine McKee

Christine McKee

William Gallagher

William Gallagher

-m.jpg)

129 Comments

The school market is a lost chance for Apple - as long as it doesn’t deliver on the need for deployment tools (device management, app/version management, content mgt., rights/access mgt.) and keeps denying the need for multiple iOS accounts. Cook & co don’t even understand the concept of double instance multi-tasking (2 Word/Excel docs at the same time), making their post-PC claims near ridiculous. So an iPad with a pencil (if it comes at a Chromebook ‘s pricepoint to start with...) basically remains an overpriced sketchbook - that will never see structural implementation by the lack of a supporting infrastructure (what did Apple’s cooperation with IBM bring in ?) A cheap repackaging effort that only underlines the lack of a broader understanding of the sectors’ device/content mgt. needs. Better stay out of this market - edu won’t match Cook’s premium financial prerequisites anyway and it would make Apple’s “thinking in the best interest of the customer” just a fluffy claim - as they only want to sell boxes. Chrome does that - at better price/performance

Listen to Rene Ritchie’s recent Vector podcast with

This "Editorial" is quite defensive over rumoured devices that haven't even been announced yet. Can't you just wait until they announced and then start defending?

Also, these are just electronic devices. Imagine going back 10 years and reading the equivalent of these articles about Blackberries. How embarrassing for the writers.