Investors are overreacting to changes in the iPhone supply chain and manufacturing reports, Morgan Stanley suggests, with the company's continued Services growth highlighted as the better avenue for revenue increases than its hardware sales.

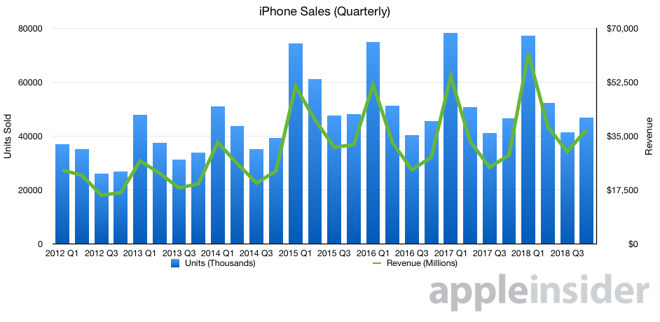

Noting the 8.5 percent decline in Apple shares since iPhone component suppliers like Lumentumwarned of weaker results, Morgan Stanley analyst Katy Huberty insists investors "remain narrowly focused on units, despite the increasing value of Apple Services," according to a note received by AppleInsider. The various supply chain reports, and weak growth in Apple's most-recent quarterly results have led to some parties forecasting doom for the company.

Referencing a note from earlier in November, Services provides Morgan Stanley "confidence in long-term growth and valuation upside as Services becomes a key growth driver." As the smartphone market as a whole matures and reduces its overall growth, Services "takes the growth baton from devices," advises Huberty, which should result in "more stable growth and higher margins at Apple."

To emphasize this, Huberty adds the normalized Services revenue growth for the full year of 2018 accelerated to 26 percent year-on-year, despite iPhone units being down 6 percent in the two years prior to 2018. This is said to suggest "unit sales and installed base growth and/or user engagement are not as tied as investors may think."

"While investors generally support our Services thesis, news flow around units is creating volatility and a buying opportunity while the investor base is still in the process of transitioning away from units," the analyst declares.

On the supply chain revenue pre-announcement stories, Huberty believes Apple's guidance for the December quarter already takes these claims into account. The wider revenue guidance range of $4 billion instead of $2 billion does indicate a greater demand uncertainty, due to the larger number of product launches at this time of year, as well as more uncertainty over the economy compared to last year.

Huberty also adds that the unit revisions are typically more severe for the supply chain than Apple due to inventory fluctuations and more bullish launch supply orders. It is also believed Apple reached its normal run rate production earlier in the year than normal as there was a lack of labor or component constraints.

As a result for this earlier order normalization, Apple cut its supply chain orders in November rather than a "typical December/January timeframe." It remains to be seen if it is simply a shifting forward of production cuts, or if more refinements are on the way.

As for the reports themselves, Huberty advises "a look back at the past seven negative revision at iPhone suppliers suggests these data points don't predict future share price performance, particularly beyond a one-month period."

In response to investors querying the risk to Services gross margin as Apple continues to invest in lower-margin areas, such as music and video, it is thought Apple could expand the company's gross margin easily, assuming a close-to 60-percent gross margin in the arm with 20 percent revenue growth year-on-year versus the 35 percent gross margin of the "flattish devices business."

Apple's highest margin services, which are believed to be the App Store and Licensing, will increase in the product mix for the Services arm over the next several years, while AppleCare and iCloud margins are also expected to scale. "These dynamics actually argue for Services margins expanding in the next few years," Huberty suggests.

Morgan Stanley is not the only firm to pick up on the importance of the Services arm. Loup Ventures analyst Gene Munster has repeatedly put forward the idea of "Apple as a Service," with the portfolio of software services offering reliable growth and having more of an impact in increasing revenue over iPhone sales.

Malcolm Owen

Malcolm Owen

-m.jpg)

Christine McKee

Christine McKee

Chip Loder

Chip Loder

Marko Zivkovic

Marko Zivkovic

Wesley Hilliard

Wesley Hilliard

-m.jpg)

16 Comments

Woah. An analyst without a reactionary, over the top response to the same old, tired, nonsensical supply chain rumors.

Have you noticed that all the suppliers that are reporting slowdown are around the Face Recognition sensors? I think they were banking on Samsung and the other Android phone makers to adopt this technology and they can't so they all had to cut forecast.. I assume that Apple sales will probably be up..

Guten Morgan.