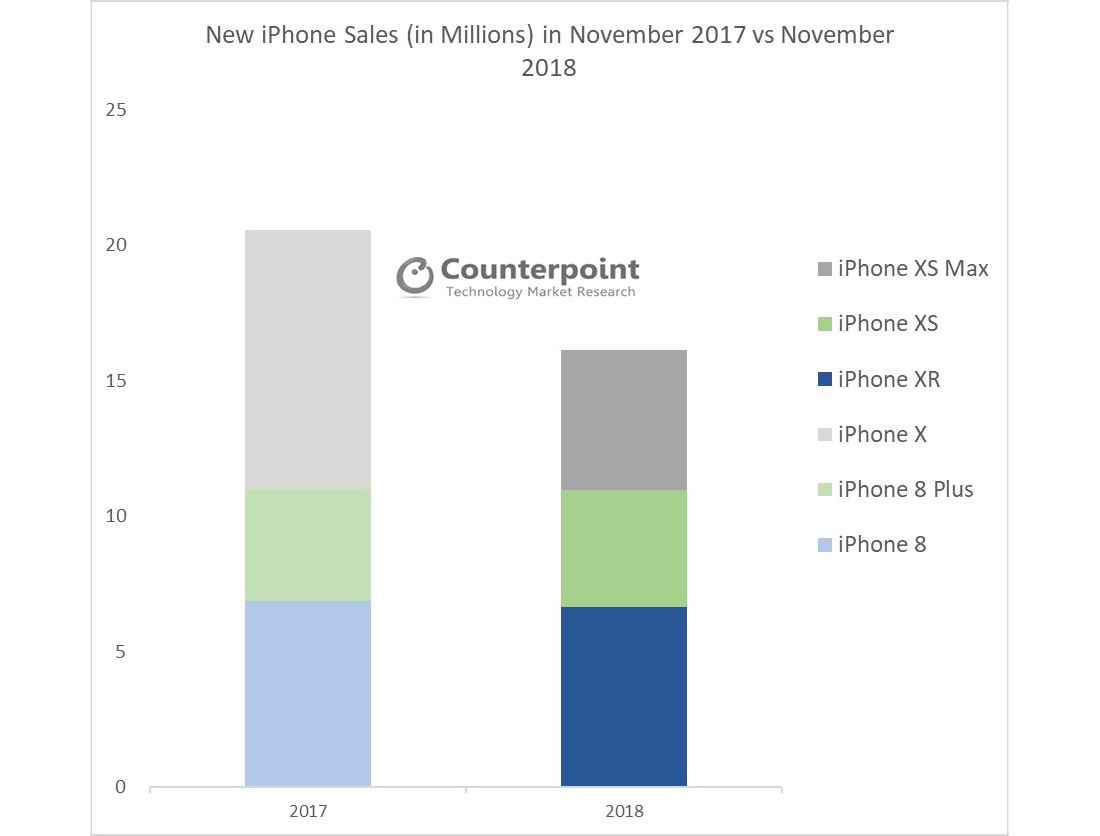

The sales of iPhones went down in November by a fifth compared to 2017, according to sales estimates from Counterpoint, but while the iPhone XR is said to have become Apple's most popular currently-sold model, it hasn't reached the same volume of sales as the iPhone X in the same period the previous year.

The iPhone XR outsold both the iPhone XS and iPhone XS Max in November, the Counterpoint model tracker service advises, with the iPhone XR 64GB model being the most popular option in the month. Despite the promising sales, the iPhone XR has not only failed to reach the same level of popularity as the iPhone X, but also lags behind the iPhone 8's November 2017 figures by approximately 5 percent.

The iPhone XS, by comparison, is up 3 percent year-on-year compared to the iPhone 8 Plus, while the battle of the most-expensive models of each year has the iPhone X in 2017 beating the iPhone XS Max of 2018 by 46 percent. It is noted that cumulative sales of the iPhone XS Max was 50 percent higher by November 2018 compared to the iPhone X, as it was made available to purchase at an earlier time.

"We estimate iPhone XR to further eat into the share of higher-priced iPhone XS and XS Max during December 2018," advises Counterpoint.

Counterpoint's suggestion is similar to that of other analysts, such as Ming-Chi Kuo. In a December note to investors, Kuo trimmed his prediction of iPhone sales in the first quarter of 2019 to between 38 million and 42 million units, an effective year-on-year reduction for the period of between 16 percent and 24 percent.

Historically, Counterpoint has been pessimistic on sales and shipments relating to Apple, with the actual results as reported by Apple coming in higher than the suggested figures. There will be no comparison figure supplied by Apple for the holiday quarter, however.

According to Counterpoint, the sales for the 2018 models took a hit in November due to slower sales in the Asia Pacific region, the United States, and Europe. The declines in the U.S. and Europe are put down to lengthening replacement cycles combined with a decrease in operator discounts during the iPhone launch period, while the Asia Pacific sales excluding China and India are said to be due to the relatively high price of the iPhones compared to alternatives offered by Chinese smartphone vendors.

For China specifically, sales were said to be steady due to the popularity of 11.11 or "Single's Day" sales. However, sales of the iPhone XR remained lower than expected due to "a lack of innovative features and just one camera," as well as the fact that, while it is the cheapest new iPhone, it is "still expensive compared to local competitor products."

Reduced iPhone sales for the market is also due to the ongoing trade tensions between the United States and China, which has resulted in companies urging employees to boycott of Apple products and to buy from Chinese brands in retaliation.

In advising reduced revenue guidance to investors on January 2, Apple CEO Tim Cook highlighted underwhelming sales in China accounting "for all of our revenue shortfall," with weak iPhone upgrades and other "macroeconomic challenges" being cites as reasons for the financial misstep.

On January 7, U.S. Commerce Secretary Wilbur Ross advised Apple's revenue expectations were not due to trade tensions between the two countries, expressing "I don't think Apple's earnings miss had anything to do with the present trade talks."

Counterpoint also expects an increase in sales of older iPhone models in emerging markets, including the iPhone 7 and iPhone 8, due to the high pricing of newer models.

Malcolm Owen

Malcolm Owen

-m.jpg)

Charles Martin

Charles Martin

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

18 Comments

Yes, December information might be interesting. Facts are nice.

I understand more consumers choosing to buy default 64GB iPhone XR model but I thought for extra $50, 128GB XR would have been best selling.