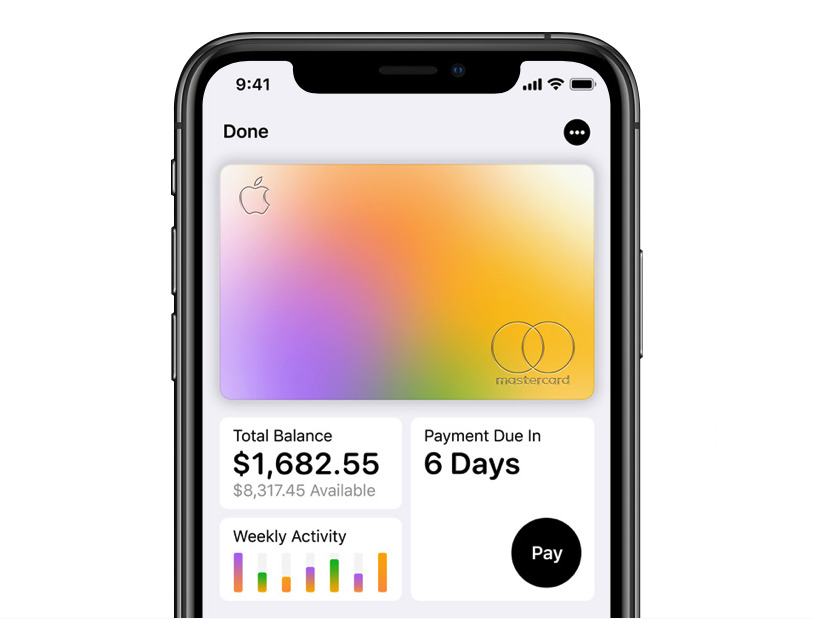

After months of waiting, Apple Card has been launched and is potentially available to all iPhone users in the US. If it's right for you, Apple Card is going to change everything.

Since Apple Card was announced back on March 25, 2019, we have steadily learned more and more about it, but now it's here, you can apply for it yourself.

There are conditions, but after a brief small rollout, it's now open to applications from everyone in the US. And there are strong reasons to want one.

Applying

You'll have to have an iPhone. That's because applying is going to be done through the Wallet app. There are other requirements, to do with your finances.

Whether you get an Apple Card or not depends on your personal, financial situation, but the process of applying for it is swift.

Then Apple is not going to reveal its algorithm for determining who does or does not qualify, but it's unlikely to be any different to other credit cards. In which case, you may already know whether you can expect to qualify.

If you do get it, though, you get it just about immediately. If you apply right now, when the Card has just been launched, you're likely to find it slow as everyone else applies too, but that should only affect how many minutes it takes for you to get a decision. The actual steps you go through will be fast.

From the moment your application is approved, you are the owner of an Apple Card — just not yet an actual card. Wherever you pay online, you'll be able to use your Apple Card right away.

If you elect to get a physical card, which you really should, then that already famous titanium credit card will arrive in the post after a few days. It'll look like every other credit card, and unlike any other, too. While the shape is the same and it'll have your name on it just like usual, it won't have any numbers on it at all.

The physical card can be optional because once you qualify for an Apple Card, its details will be in your Wallet and you'll be able to pay at any contactless or NFC terminal too. However, with the physical card, you'll also be able to use Apple Card wherever you can't currently use Apple Pay.

Security

One of the strong attractions of the Apple Card is this business of it having no number on it. This card is going to be the most secure credit card around, and that's for many reasons.

If someone steals your card, they don't know the number. If they manage to spend something on it, you'll know because your iPhone will tell you.

And you'll also be able to temporarily freeze or permanently delete the card if you need to. There's no keeping a list of bank phone numbers you have to ring, you cancel it right through your iPhone.

When you absolutely have to give someone your actual credit card number, you won't have to give them your actual one. Apple Card will generate a number you can give just to them and just for this transaction.

How it works in stores

If you've used Apple Pay, you already know how most of this goes. You can use your iPhone or your Apple Watch on the NFC terminal, or you can insert the physical Apple Card into a store's reader.

Apple has rather trained us to know how to do all of this, but what's new is what happens after we've paid.

First, every single transaction is monitored in detail — for you, not for Apple. While Apple itself won't know what you've bought or where you got it, you will be able to see exact details.

Rather than seeing an unknown name on your statement at the end of the month, you see the name of the store right now on your phone. If you're looking back over a couple of days and can't recognize the name, your iPhone will show you the location on a map.

And you can also split purchases up into categories that you later track to see just what you're spending your money on.

Every day, every time you use the Card or any time when you need to know, all possible information is available to you immediately. You can't stop people being financially irresponsible, but you can do a lot and Apple has.

Every day

Speaking of every day and every purchase, Apple Card will pay you money each time you use it for anything.

There are many credit cards reward you, but often it's with points and always the aim is to get you to use the card more. Doubtlessly Apple wants the same result — it's predicted to earn $1 billion per year from Apple Card — but here it's coupled to that monitoring.

While you get a certain amount of money each time you use the card, that's part of having you be aware of your spending. Together with the ability to see just what you're spending, and then with how clear Apple is about the interest you'll end up owing, Apple Card presents an appealing package.

The rewards cash could be better, there are cards that offer more in certain circumstances. Whatever you buy on Apple Card, you get at least 1% of the purchase price back. That might be quite a rare figure to get, as it's the percentage when you're paying somewhere that does not yet accept Apple Pay and so is using this as a regular credit card.

If you buy anything through Apple Pay, via the Apple Card, then you'll get 2% back. And if you do that in an Apple Store or via any Apple-owned online store like iTunes, you get 3%.

Every day, you'll get the cashback from 24-hours of shopping delivered into your account. By default that's a separate Daily Cash account in your Wallet, but you can have it be paid into your actual Apple Card account.

So you can have this daily cash go toward paying off your credit card.

Paying off

The majority of credit cards present you with a bill at the end of the month, and while you can go online in the meantime, you tend not to. With Apple Card, the latest details are right there, on your iPhone, available to you immediately.

What's more, that detail includes how much interest you are probably going to have to pay at the end of the month.

While Apple doesn't charge an annual fee, and it doesn't charge you with late fees, it still works on a monthly cycle. And so you will owe the company money every month — in theory.

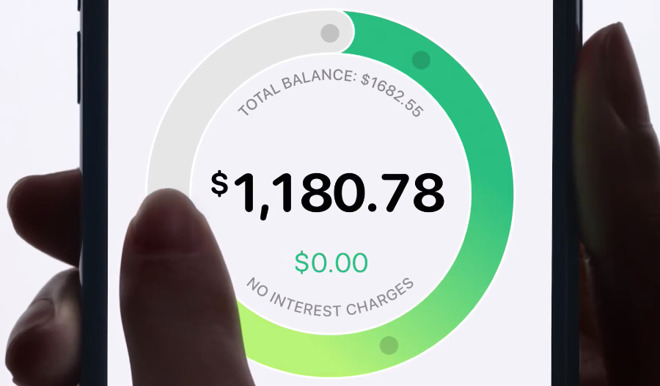

A simple slider shows you how much you'll owe in interest, depending on when you choose to pay off the card

A simple slider shows you how much you'll owe in interest, depending on when you choose to pay off the cardIn practice, you can pay off your card at any time, and if you do that regularly, you will be able to avoid high interest charges. The interest rate you pay is dependent on your financial situation when you apply, but in all cases the Wallet app will show you what you're going to owe.

It can only be an estimate, though. What it is really saying is that right now, if you spent nothing else and paid off nothing, at the end of the month, this is what you would owe.

Lost

You need to be responsible, though Apple Card is helping you more than most credit cards. If you are diligent about paying off the card, however, this is a really attractive offer.

As well as the business of it just being seamless to use, as well as it giving daily cash and letting us avoid high interest payments, it's also cutting out the banks as much as possible.

Apple is partnered with Goldman Sachs, but that firm is not going to stop your card on a whim.

We've had cases, for instance, where a bank has decided to refuse an Apple Pay transaction because we had used Apple Pay too often. We can't tell you how many is too many, because that bank does not publish the information and it refuses to tell us.

You know that won't happen with Apple. So alongside all the tangible benefits and features, now that Apple Card is here, it is surely going to disrupt old-style, consumer-unfriendly banking forever.

Keep up with AppleInsider by downloading the AppleInsider app for iOS, and follow us on YouTube, Twitter @appleinsider and Facebook for live, late-breaking coverage. You can also check out our official Instagram account for exclusive photos.

William Gallagher

William Gallagher

-m.jpg)

Andrew Orr

Andrew Orr

Malcolm Owen

Malcolm Owen

Wesley Hilliard

Wesley Hilliard

-m.jpg)

91 Comments

I'm curious to see how to set up payment to your card from the bank. I'm guessing we'll be able to simply point the camera at a blank check, and it will pick off the routing number and account number and confirm this for an ACH transfer.

I'm also curious what kind of "payment due" notifications will be provided. Yes, you can monitor, but if no statement arrives in the mail, I will want an alert, or even better, a way to set up an automatic payment.

"This Summer" means any time before September 23, 2019, given that Apple is based in the northern hemisphere.

Do you know what credit bureau they'll be checking before approving and issuing the card? I got my credit scored freezed since the hack in Equifax years ago.

I've got lots of credit cards that have apps on my iPhone, that I can lock, that I can make payments on my phone, see transactions,etc.

I'm just not clear what is so special (except for a metal card) about this card? In a nutshell, why would I want this card when I already have half a dozen other cards?