Just like April's deferred payments, Apple and Goldman Sachs are allowing Apple Card owners the ability to put off payments due in May without penalty.

As the world continues to wait for normalcy, unemployment and economic conditions keeps getting worse. With funds strained and government relief stretched thin as it is, Apple Card customers can defer their payments a month longer with no penalty.

This is in line with a majority of the credit industry, although interest will still apply. Not having another payment to worry about right now does help, even if it takes a little longer to pay off the card.

In order to opt into the Customer Assistance Program, Apple Card users will need to reach out to a support representative via the Wallet app on their iPhone.

Apple Card customers were allowed to defer payments in March and April too. It is likely that Apple and Goldman Sachs will continue to allow deferments throughout the duration of the coronavirus pandemic, given Apple CEO Tim Cook's statements on the matter during Thursday's earnings call.

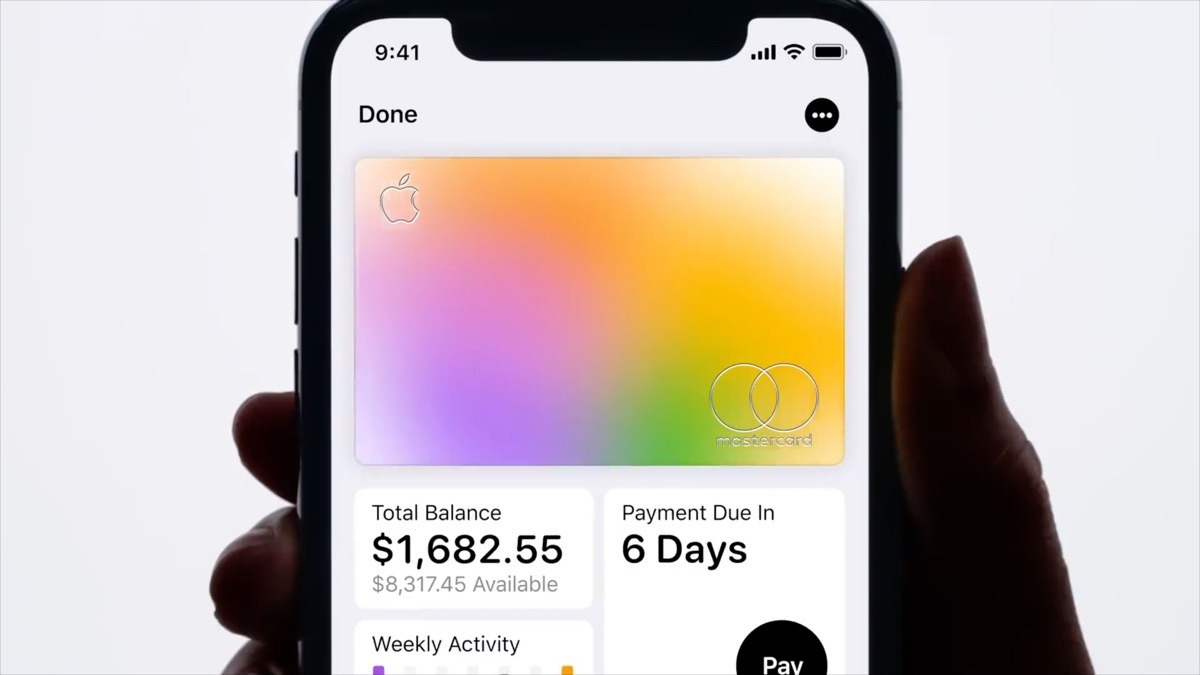

Launched on August 20, 2019, the Apple Card was designed by Apple and developed by Goldman Sachs. While the Apple Card is primarily designed to work with Apple Pay, Apple provides each customer with a physical, titanium card.

Wesley Hilliard

Wesley Hilliard

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

18 Comments

I've been paying all of my bills on time, virus or no virus. Deferring is merely delaying the inevitable. The bills will have to be paid in full eventually and stacking more of them together is only going to add to the total amount that somebody owes. Plus, the article says that interest will still apply, so this doesn't sound like a good idea if somebody has good economic sense.

People who can't afford a credit card shouldn't use credit cards, in my opinion.

If somebody can't manage to pay a $1000 bill one month, is it going to be any easier for that person to pay $3000 + added interest all of a sudden, if they defer for 3 months?

Anyway, how people decide to manage their own bills is their problem and their decision I suppose.

I would always pay my balance in full each month, but had to ask to defer my March balance that was due by the end of April. It took about a week after chatting with a representative for the balance to reflect being due by the end of May instead of April. I was able to pay some of the balance due, but not in full. When I reviewed my statement yesterday, they stayed true to their promise to defer any interest. The interest amount was $0. I will still try to pay as much as I can of the balance due by the end of May, but I am thankful to have the option again to defer to the end of June. Unprecedented times we are living in...