Apple Savings is now available for Apple Card users. Here's how it compares to other high-yield savings accounts in March.

The finance sector isn't new to Apple, with Apple Wallet, Apple Pay, Apple Card, Apple Pay Later, and now Apple Savings. Customers have multiple avenues to entrust vital financial processes to Apple.

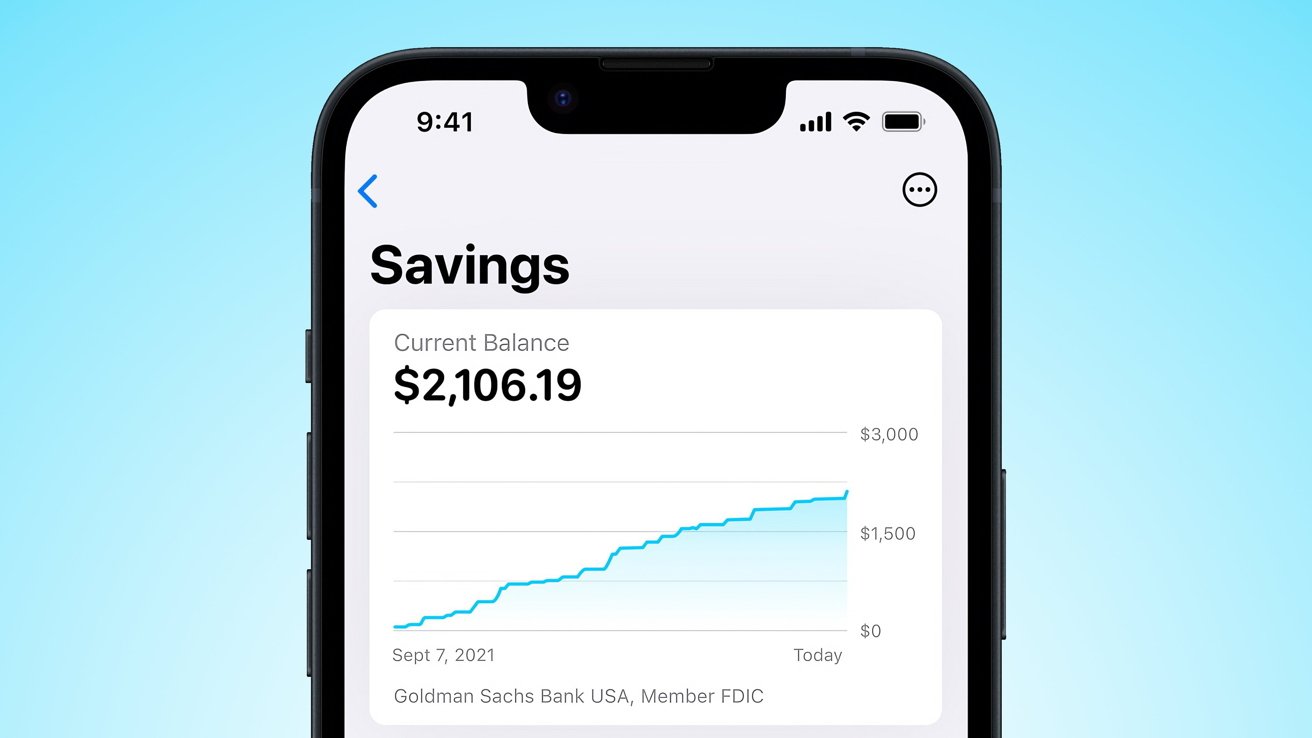

Apple Savings is a high-yield savings account provided by Goldman Sachs. It requires users to have an Apple Card and be over 18 years old. Otherwise, there are no minimum balances or fees associated with the account.

Here's how Apple Savings compares to other savings accounts. Interest rates are current as of March 25, 2025 — but as Apple says, this can and will change with time.

Apple Savings vs other banks

For the most part, Apple is competitive, but there are some notable differences.

| Apple | 3.75% | $0 | $0 | $0 | $250,000 |

| Marcus | 3.75% | $0 | $0 | $0 | $3 million |

| UFB | 4.01% | $0 | $0 | $0 | N/A |

| PNC | 3.95% | $0 | $0 | $0 | $5 million |

| SoFi | 3.8% | $0 | $0 | $0 | N/A |

| Vio Bank | 4.41% | $0 | $0 | $0 | $2.5 million |

| Barclays | 3.90% | $0 | $0 | $0 | N/A |

| Citizens | 3.70% | $0 | $0 | $0 | N/A |

| American Express | 3.70% | $0 | $0 | $0 | N/A |

| Bank of America | 0.01% | $100 | $500 | $8 | N/A |

Note that some values have changed since this article first run in April 2023. Several banks have increased their APY to be more competitive since Apple joined in, with Apple falling behind some of the competition.

Apple decreased its APY for the first time in April 2024 from 4.5% to 4.40%. It decreased three times more in 2024, first in September to 4.25% then in October to 4.10%, and finally to 3.90% in December. It decreased again in March 2025 to 3.75%.

The maximum balance portion of the table was interesting, as many of these accounts list a specific value. Banks that did not directly reference a maximum balance are labeled as N/A. Apple's maximum of $250,000 is directly related to FDIC insurance limits, without extra fees.

All-in on Apple and digital

Users have to access their account via the Apple Wallet app on iPhone or the Settings app on iPad. There is no website or other option for Mac, Windows, or Android users.

Every other bank listed has an app and website to manage accounts. Most banks even offer ATM access for withdrawals — Apple Savings does not.

Apple's Savings is competitive in the industry, even though users have to be all-in on Apple and retain either an iPhone or iPad to manage the account. Users can transfer money to Apple Cash or a certified bank account, but the Savings account isn't available for direct payments to Apple Card.

Users can set up direct deposits to Apple Savings thanks to an account number and routing number provided in the app. Though, users should be wary before going all in on the Apple Savings account.

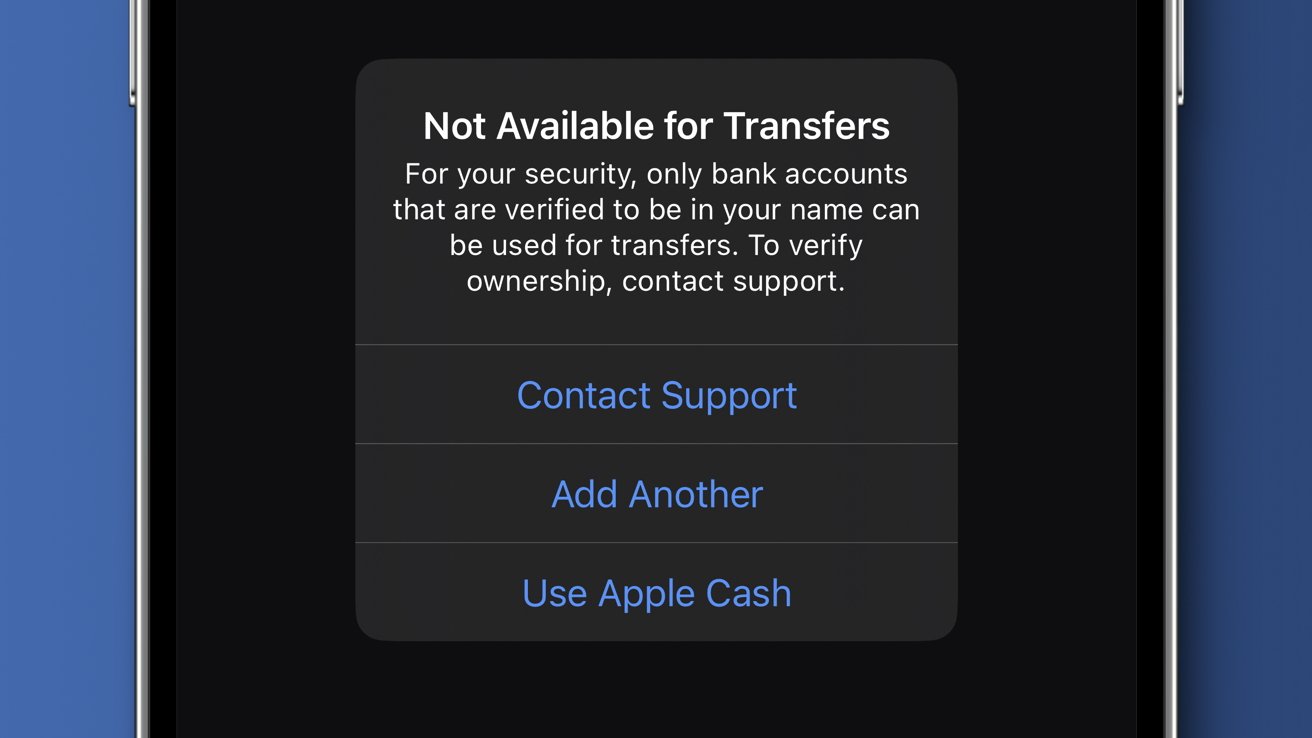

Some checking accounts do not immediately qualify for direct transfer from Apple Savings through the app. Apple says users with banks that do not qualify will need to use the account and routing number to perform transfers from their institution's website — at least until they get their external bank verified.

Alternatively, users can still add money to Apple Cash and then transfer the money to Apple Savings or vice versa. Paying Apple Card balances isn't possible with Apple Savings either, users will need to transfer from Savings to Cash, then to Apple Card.

Choosing Apple Savings over others

Apple Card users have an obvious entry point into the Apple Savings account. Everyone else will have a little overhead.

Other banks have little to no requirements to create an account. Most banks will create a checking and high-yield savings account after a person fills out a few forms, even without a history with that bank.

Apple users interested in an Apple Savings account will need to go through a credit approval process for Apple Card. Once approved, the Apple Savings account will become available.

We recommend checking with your existing bank to learn about their high-yield savings options before jumping on Apple Savings — there might be a better deal or easier access. That and the all-digital aspect of Apple Savings and Apple Card might not appeal to you.

For the average Apple fan that has no intention of switching away from iPhone, there is no risk in getting an Apple Savings account. Provided you're eligible for an Apple Card.

And of course, as it is with many Apple financial systems and regulatory differences worldwide, Apple Savings is US only. Everyone else will have to wait until Apple Card launches in other countries, followed by Apple Savings.

Update March 25, 2025: Changed the APYs to reflect current rates.

Wesley Hilliard

Wesley Hilliard

-m.jpg)

William Gallagher

William Gallagher

Andrew Orr

Andrew Orr

Mike Wuerthele

Mike Wuerthele

Bon Adamson

Bon Adamson

Marko Zivkovic

Marko Zivkovic

Amber Neely

Amber Neely

-m.jpg)

16 Comments

Any word on how quickly the money becomes available for withdrawal after you transfer it into Savings? I added money on Tuesday 4/18 and it is still not available to be withdrawn. I read somewhere that it said “a few days” but is looking more like a week which is fine, I just would like to know it will be 7 - x days.

Stop thinking like a poor person.. this is yet another place for the wealthy among us to deposit the max amount and earn high interest on their money.

My 5k transfer posted after 2 days but maybe cuz zi moved finds from Marcus GS to Apple GS.