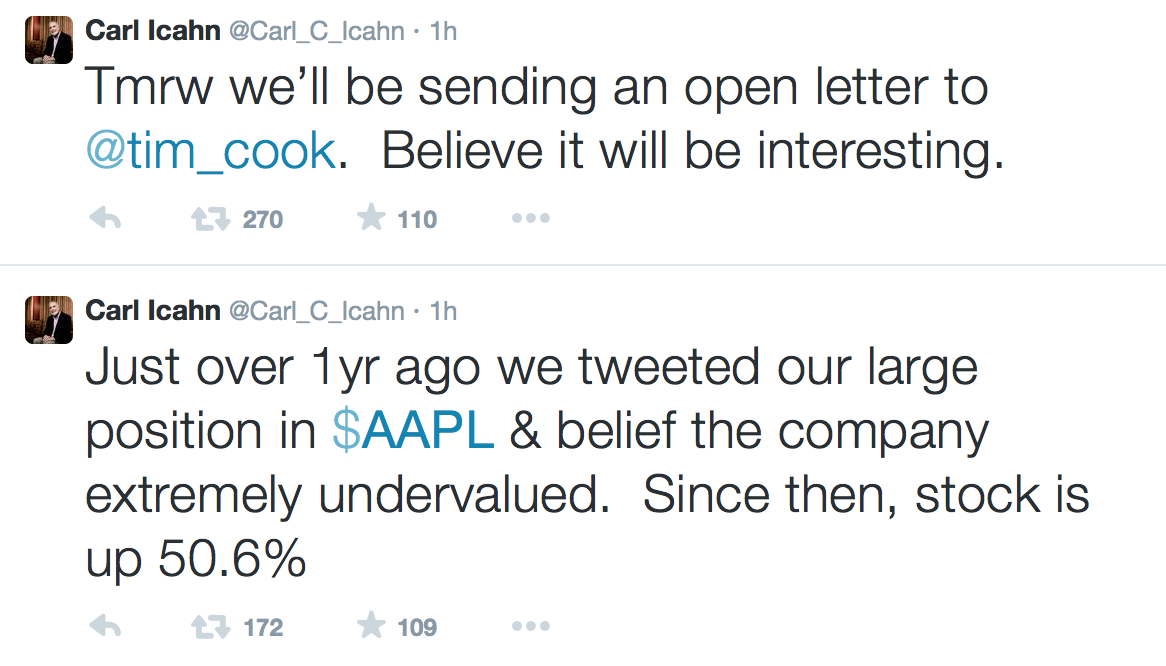

Investor and activist Carl Icahn, who previously had a public battle with Apple over its cash hoard, has revealed he will be sending another open letter to Chief Executive Tim Cook on Thursday, and indicated he believes the note "will be interesting."

Icahn also noted via his official Twitter account on Wednesday that it was just over a year ago he said he believed shares of AAPL stock were extremely undervalued. At that time, he revealed he held a "large position" in Apple.

Since Icahn disclosed his stake in Apple, shares of the company are up 50.6 percent, Icahn said. He invested another $1.65 billion in Apple this May, bringing his total stake in the company at the time to $4.4 billion.

Icahn made waves last year when he revealed he had met with Cook in an effort to push the company into a larger stock buyback to help boost earnings. At the time, Icahn owned about $1.5 billion worth of AAPL shares.

In the months that followed, Icahn turned up the heat on a prospective stock buyback, going so far as to file a shareholder proxy vote regarding the matter.

Icahn eventually dropped his aggressive effort, after Apple bought some $14 billion worth of its own shares in a matter of weeks in early 2014 — the largest repurchase on record for such a short period. Icahn said at the time that further actions were unnecessary given the company was "so close" to reaching his proposed target.

Exactly what Icahn might want from Apple this time is unknown, but even with its share buybacks, the hugely profitable company ended its last quarter with $164.5 billion in cash and cash equivalents. Of that, $133.7 billion was held offshore.

Activist investor Carl Icahn. | Source: ForbesThe activist investor has a history of causing trouble with tech companies, most famously opposing Michael Dell's efforts to take PC maker Dell private. He also won three seats on the Yahoo Board of Directors, and is credited with helping to oust the CEO of Motorola, essentially forcing the company into the arms of Google.

And earlier this year, Icahn had pushed for eBay to spin off part of PayPal, even going as far as to draw up a proposal to shareholders that caused bad blood between him and eBay's management. Though the proposal was ultimately dropped, eBay and PayPal did split last week, and Icahn was unsurprisingly pleased by the development.

"It is almost a 'no brainer' that these companies should be separated to increase the value of these great assets and thus to meaningfully enhance value for all shareholders," he said. "It continues to be my belief that the payments industry, of which PayPal is an important part, must be consolidated — Â either through acquisitions made by PayPal or a merger between PayPal and another strong player in the industry."

Neil Hughes

Neil Hughes

-m.jpg)

Malcolm Owen

Malcolm Owen

Christine McKee

Christine McKee

Sponsored Content

Sponsored Content

Wesley Hilliard

Wesley Hilliard

64 Comments

Hey Carl. Blow up your pants.

If this is not a form of stock manipulation, I don't know what is.

Icahn has clearly never heard of (or at least hasn't learned) the Post hoc ergo propter hoc fallacy.

So he's going to push for Apple Pay and Pay Pal to kiss and make up.

I love how rich people are so egocentric. All about what's good for Icahn.