Nielsen: Android flourished before iPhone 4, but Apple 'most desired'

Nielsen's reported numbers only run through the June quarter, so they don't factor in iPhone 4, the largest and most successful smartphone launch ever. What they do show is the smartphone climate before Apple's juggernaut launch hit.

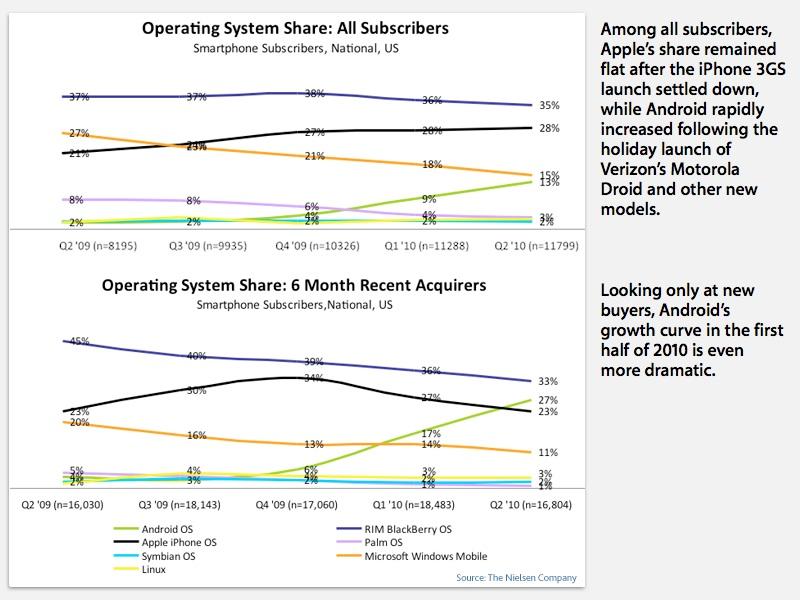

Over the past year, Apple's share of the installed base of all smartphone subscribers in the US initially inched up from 21 percent to 27 percent, trading places with Windows Mobile, which conversely slipped from 27 percent to 21 percent in the second half of 2009. Apple's share then remained flat into 2010 following its fast paced holiday quarter, while Windows Mobile continued to rapidly decline.

The holiday season is when Android's share began to rapidly grow in the US. The launch of Motorola's Droid, heavily promoted by Verizon as its alternative to AT&T's iPhone, helped stoke rapid "two for one" heavily subsidized handset sales tied to record high cancelation fees. In terms of installed base, Android collectively ratcheted up from 4 percent to 14 percent, nearly passing Windows Mobile and gaining a mass about half the size of the installed base of iPhone users within just two quarters.

However, when only looking at "recent acquirers," Android's numbers look even better. This set of figures exaggerates new sales, giving Apple a major bump in share between the 2009 launch of iPhone 3GS through the holiday season, and then the appearance of a dramatic fall as sales to new buyers tapered off.

Since nearly all of Android's mainstream users are new to the platform, its numbers among recent acquirers skyrocketed over the first two quarters of 2010, jumping from 6 percent to 27 percent, passing new iPhone sales and aiming toward RIM's BlackBerry figures, which show a steady decrease among new buyers over the last year (as opposed to RIM's relatively flat share among all subscribers).

iPhone still 'most desired'

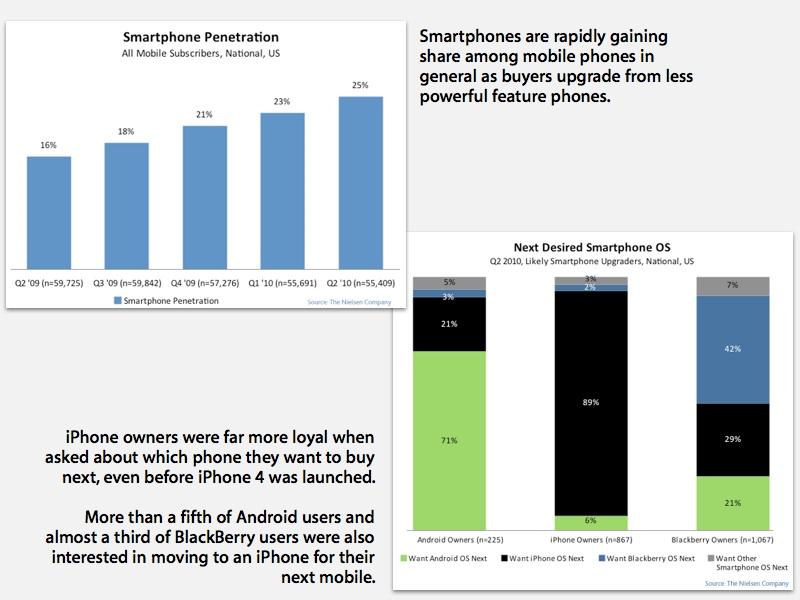

Despite the major influx of Android buyers stoked primarily by Verizon prior to the iPhone 4 launch, current iPhone customers told the research company that they were the most likely to buy another phone from the same vendor as their current one.

Nearly 90 percent of iPhone users said they'll buy another iPhone for their next mobile, compared to just 71 percent of Android users who'll buy Android again, and just 41 percent of BlackBerry users who said they'd get another phone from RIM.

In contrast, 21 percent of Android users and 29 percent of BlackBerry owners said they want an iPhone next. Just six percent of iPhone users said they'd buy an Android phone next, and only two to three percent of Android and iPhone users said they'd get a BlackBerry phone. Again, these numbers were collected before the launch of iPhone 4.

Blockbuster iPhone 4 sales not yet reported

Nielsen reports that US smartphone penetration is up dramatically, jumping from just 16% in the second calendar quarter of last year to 25% of mobile sales this year. By the end of 2011, the company predicts smartphones will pass sales of basic feature phones. That portends tremendous growth potential for all smartphone makers, but in particular offers good news for Apple, considering the virtually unlimited growth potential for smartphones throughout the near future.

Apple's strong loyalty ratings, mirrored by parallel satisfaction ratings that indicate far more users are happy with their iPhones compared to other smartphone products, suggest that Apple has prime positioning to take full advantage of the current smartphone boom.

RIM is scrambling to release both its new BlackBerry OS 6 and new phones with a iPhone form factor, as well as a new table product similar to the iPad, but all of this efforts are a quarter or two behind Apple's iOS 4 and iPhone 4.

Similarly, Microsoft is gearing up to migrate its stagnant Windows Mobile into a new iPhone-like Windows Phone 7 platform with a curated store and tightly regulated hardware, but those devices aren't set to hit until the end of the year. Microsoft also just suffered a major disaster with Verizon in the aborted launch of its KIN phones.

Palm, which demonstrated poor results over the last year in terms of both overall share and new adoption, is being groomed by HP to serve as that company's new smartphone platform and a new platform for tablet devices, but those products won't hit until later in the year or early 2011.

Android makers have taken full advantage of the lull before the iPhone 4 storm to ship waves of advanced hardware with better screens and cameras than Apple's last generation of iPhone, but both Motorola and HTC appear to be suffering production issues that may limit the number of new phones that can be shipped in the second half of the year. Apple is also struggling to build enough iPhone 4 units to meet demand.

Daniel Eran Dilger

Daniel Eran Dilger

Amber Neely

Amber Neely

Thomas Sibilly

Thomas Sibilly

AppleInsider Staff

AppleInsider Staff

William Gallagher

William Gallagher

Malcolm Owen

Malcolm Owen

Christine McKee

Christine McKee

126 Comments

I would be interested to see Android's numbers on competing networks... Apple really needs to get the iPhone on Verizon's and Sprints networks already.

Since nearly all of Android's mainstream users are new to the platform, its numbers among recent acquirers skyrocketed over the first two quarters of 2010, jumping from 6 percent to 27 percent, passing new iPhone sales

So Apple's new acquisitions drop by nearly a third from a high of 34% down to 23%, while Android's explodes 450%.

Looks like Gartner called this one.

I'm sure many people held off buying an iPhone waiting for iPhone 4. The leaks probably cost Apple more than a million sales.

How's that lawsuit against Gizmodo going?

So Apple's new acquisitions drop by nearly a third from a high of 34% down to 23%, while Android's explodes 450%.

Looks like Gartner called this one.

Apple will always look different because theirs is one product following a set release timeline. It will dip, and then it will boom (as it is doing now). Android encompasses an array of devices so its growth will be more steady and predictable.

Also, this doesn't actually mean anything material (in any context). Android is sold in a range of expensive to cheap devices to a userbase who may either be excited to experience Android and its market, to mom-and-pop who aren't going to be up to dealing with the greater challenge of working on a cross-platform market and just want a nicer phone to do all the basic smartphone stuff with (photos, text messages, email, etc.). The low price point (buy one get one, low end models) increases this factor. Android will soar (in fact, I won't be surprised if it eventually does surpass iOS, provided Apple sticks with AT&T) but the material impact to Google, the Android Market, and Android Developers will be impacted in a completely different way than market share will impact the centralized and accessible iOS.

Fun statistics, but just not meaningful.

Also, it doesn't include the iPod Touch. Similarly, it would not have included a similar Android product if it were available. A shame, because such things are meaningful to competing markets and developers.