Verizon iPhone to attract 9 to 12 million new US users for Apple

A new report filed by the Wall Street Journal said that analysts are closely watching the iPhone's expansion, with "many" agreeing that Apple "will likely sell 9 to 12 million iPhones on Verizon's network this year."

It contrasted that with estimates from Piper Jaffray & Co., which said AT&T sold 11.1 million iPhones in the first three calendar quarters of 2010, and around 14.5 million in the full year. AT&T's iPhone sales account for 12 percent of Apple's revenue and 30 percent of its iPhone unit sales, the report noted.

Piper Jaffray analyst Gene Munster expects Verizon to add 5 percent to Apple's overall sales with 9 million new units this year, but said the new deal could be twice as sweet if Verizon pursues attracting new iPhone subscribers rather than just trying to woo AT&T subscribers into switching.

Analyst Brian Marshall of Gleacher & Co. said Apple's new deal with Verizon could upgrade 5 percent of the carriers' existing customers to iPhones in its initial launch quarter, a transition that would be faster paced than AT&T's iPhone launch, which began in 2007 with a far more expensive model.

Marshall estimates that AT&T has around 17 million iPhone subscribers, but said "over time Verizon could be even bigger than that," setting an initial estimate of 12 million new iPhone users on Verizon this year.

The smartphone race

Verizon had 93.2 million subscribers at the end of September, making 12 million new iPhone users nearly 13 percent of its subscriber base. AT&T has 92.8 million subscribers, so its estimated 17 million iPhone users represent more than 18 percent of all users on its network.

AT&T and Verizon, along with the smaller Sprint and T-Mobile, have been long been battling for new subscribers and to retain their existing ones. However, since smartphones began to emerge over the past few years, the goal has shifted from new subscribers (who are harder to find) to upgrading existing subscribers to more expensive data contracts.

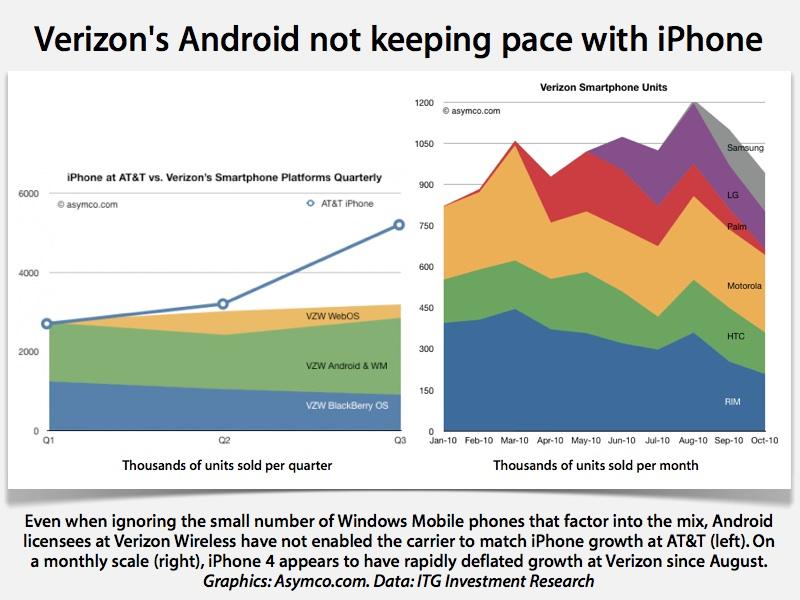

The iPhone was the first mass market smartphone in the US to successfully (and rapidly) encourage millions of users to sign up for more expensive plans, propping up AT&T's weaker network. Despite having slightly fewer overall subscribers than Verizon, AT&T has a larger mix of smartphone users, thanks in large part to the iPhone.

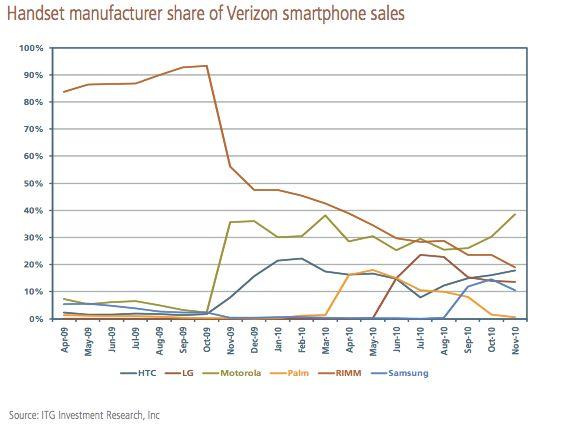

Verizon's smartphone mix was almost entirely represented by RIM's BlackBerry users through the end of 2009, but after RIM's attempts to deliver the Storm as an iPhone alternative flopped in 2008 and again in 2009, Verizon turned to Android licensees to deliver a credible alternative to the iPhone, which has been exclusive to AT&T in the US since it launched in 2007.

Verizon's "Droid" branded marketing blitz, which began in late 2009 with Motorola's Droid and HTC's Droid Eris, helped to nudge Motorola back into profitability and induced HTC to focus more resources on Android than the slow selling Windows Mobile phones it had been making.

However, with the launch of iPhone 4, growth in Verizon's Android sales appears to have leveled off, sending the carrier back into negotiations with Apple.

Verizon picked up the iPad last fall, and is expected to heavily promote the iPhone this year. Its next new wave of Android devices supporting the company's LTE data network and promoted and last week's CES even, aren't expected to hit until the second half of the year.

AT&T vs Verizon

Verizon is expected to attract at least some AT&T iPhone users who are affected by their carrier's poor level of service, but the Wall Street Journal report cited Forrester Research analyst Charles Golvin as saying that "initial sales will mostly involve existing Verizon customers who want to upgrade to the iPhone and Sprint Nextel Corp. and T-Mobile USA customers who weren't willing to switch to AT&T because of its poor network reputation."

AT&T has worked to tie existing iPhone users into two year contracts, particularly family and business plans that provide stronger incentives to stay put. The company also recently offered the iPhone 3GS for just $49 with a contract. Verizon is said to be offering the iPhone with its existing contracts, which are very similar to AT&T's.

Kuo Ming-Chi, an analyst with Concord Securities and formerly DigiTimes of Taiwan, has estimated that Apple's Chinese manufacturing partners will ship 7.1 million CDMA iPhones that can work with Verizon's network in the first quarter. While those devices won't work on AT&T and other GSM providers globally, they could be sold to other CDMA carriers in China, Israel, South America and India, and may have the potential to be unlocked for use on Sprint's network in the US.

Daniel Eran Dilger

Daniel Eran Dilger

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

Marko Zivkovic

Marko Zivkovic

David Schloss

David Schloss

Wesley Hilliard

Wesley Hilliard

Mike Wuerthele and Malcolm Owen

Mike Wuerthele and Malcolm Owen

70 Comments

I am guessing a decent number will be from SF, NYC, places where there is no 3G service from at&t. There may be others, but I don't know anyone switching to Verizon. They are all existing customers wanting to switch from either a feature phone or BB.

and may have the potential to be unlocked for use on Sprint's network in the US.

Provided sprint allows it to be provisioned. It's said they aren't too keen on allowing devices on their network that they don't sell.

Whatever makes my shares of Apple stock go up, I'm fine with it.

Verizon's data plans similar to AT&T for now. It will only be until after the two sides have plateaued regarding sales, that is when the fight to have the better plan to attract the table scraps of remaining potential customers by incentivizing with a one-upmanship begins, to the benefit of all of us.

Provided sprint allows it to be provisioned. It's said they aren't too keen on allowing devices on their network that they don't sell.

I tried to activate an unlocked CDMA Motorola phone and they wouldn't do it. They told me they only activate sprint branded phones.

I think this will severely impact Android sales. I think we'll even see people switching from Android to the iPhone. The iPhone's poor service on AT&T reached the level of pop culture in the US, being routinely featured on SNL and late night talk shows. It was also a major part of Verizon's campaign against the iPhone. This is now coming to an end (with no less than Verizon itself making the announcement). That's a big deal in terms of public perception.

Since there's no way any of the so-called advantages of Android touted by Android fans (openness, customization, etc) have played any significant part of Androids growth, it's likely most Android customers purchased Android phones because they wanted something iPhone-like but did not want to switch carriers. It is, after all, a copy of the iPhone, so we can assume anyone purchasing an Android phone was a potential iPhone customer. Now the only thing separating the iPhone and Android phones is cost.

I also find it unlikely that Motorola, HTC, et al, have significant brand name recognition or customer loyalty. Android has been primarily associated with Verizon itself through it's Droid campaign in the US and that's now also coming to an end. No doubt a great many Android purchases were stopgap measures by people who are waiting for the iPhone on Verizon. If it's not too difficult for them to switch, I think many of them will do so.