Market watchers hoping for Apple to introduce a radically cheaper iPhone model this week came away disappointed, as the company opted to maintain its smartphone pricing strategy rather than aggressively cutting margins.

Shares of Apple were off nearly $30, or close to 6 percent, in morning trading on Wednesday as investors reacted to the announcement of the iPhone 5s and iPhone 5c. Negative sentiment surrounding the company mostly revolved around the iPhone 5c, which some market watchers hoped would be priced around $400 without a contract subsidy.

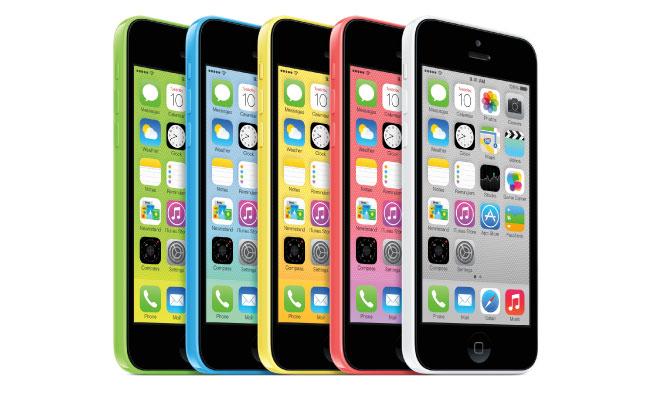

Instead, the entry-level 16-gigabyte iPhone 5c will run $549 unsubsidized in the U.S., while the same model can be had for $99 with a new two-year service contract. A high-end 32-gigabyte model will cost $649, or the same as a 16-gigabyte iPhone 5s.

Most notably, Credit Suisse, Bank of America Merrill Lynch, and UBS all cut their ratings on AAPL stock from "buy" to "neutral." Longtime Apple bear Alex Gauna of JMP Securities also maintained his "market perform" rating, saying he feels the iPhone 5c will especially be too expensive in China, which is a key emerging market.

Though market reaction was mostly negative following Apple's iPhone unveiling, not all analysts were inclined to cut their targets. David Evanson of Canaccord Genuity actually increased his price target from $530 to $550, citing technical advantages of the iPhone 5s over Android-based competitors, including the new Touch ID fingerprint sensor, M7 motion coprocessor, and 64-bit A7 CPU.

"We believe new capabilities in iOS 7 available Sept. 18 along with the features and new colors for the 5s and 5c should drive strong sales, particularly to Apple's large iOS base, Evanson said.

Timothy Arcuri of Cowen and Company said in a note to investors Wednesday that Apple "took the high road" with this week's iPhone 5c announcement, opting for profits over market share. He has maintained his "outperform" rating for AAPL stock, saying that Wall Street estimates for 2014 look "very beatable."

Gene Munster also maintained his "overweight" rating for AAPL, but admitted he was "wrong and disappointed" with the pricing of the iPhone 5c. Munster was also hopeful that Apple would announce a deal with China Mobile, but the iPhone is not expected to debut on the world's largest carrier until later this year.

Munster was expecting Apple to sell 50 million $300 iPhones in 2014, growing to 100 million in 2015, with 15 percent gross margin. Those projected sales have now been removed from his targets.

Amit Daryanani of RBC Capital Markets, meanwhile, showed optimism regarding the relatively high profit margins he expects Apple to achieve with the iPhone 5c. But he did admit that the $549 entry price of the iPhone 5c came in as a "slight negative," in his view, especially considering that the iPhone 4S remains as Apple's free-on-contract handset.

Neil Hughes

Neil Hughes

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

301 Comments

Yet they will sell millions and millions of these things and set new records.

I set a target that analysts will get it wrong again. How about they investigate the holdings these companies have in Apple. How nice to drive down the price in the week before it is released and buy cheap just to have it bounce back up when it sells "better than expected."

I think someone else said it as well: the strategy is a little elusive. If it were for the colour alone, the could have made the iP-C more like the existing iPod, which are simply gorgeous with their aluminium colours. It's a bit strange they chose plastic instead of coloured aluminium.

One thing I have to say is Apple probably know better than anyone else what a consumer is willing to pay for a phone. It sounds like the stock is down because analysis do not think people will pay the price. Again it the ideal of sell at next to no margins so the total unit numbers are high. These analysis only look at one thing unit shipment, they forget that Apple bank account is the largest in the world. verse the guys trying to sell cheap can barely keep the doors open.

Could just ONE analyst be fired for incompetence, please? One of them. Start small. I need some validation that the entire market isn't now completely full of idiots.

ANALyst are idiots. the 5C brings last year 5 with the usual $100 reduction, but with a much easier to manufacture (even if it is still very complex so costly) process. That means that margins will be better, both from usual repeat orders downcosts & new process. They will probably make more margin on the 5C than on the 5S. On a phone guaranteed to be a success. With the addition of docomo & china mobile to add this is big.