Wells Fargo Securities believes Apple may have just completed yet another record breaking quarter, driven by a forecasted shipment of 36.5 million iPhones for the three-month period ending in June.

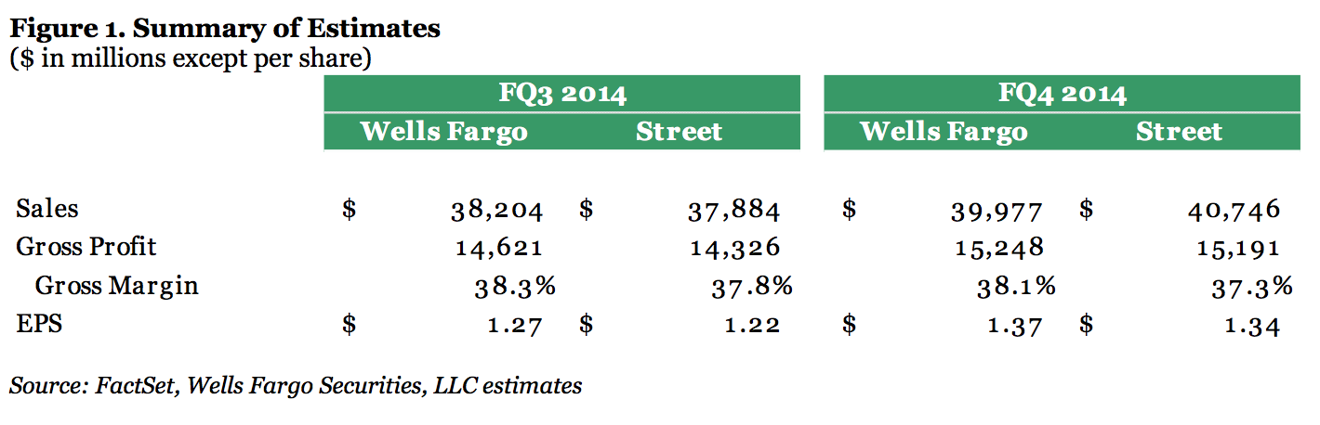

Analyst Maynard Um projects that Apple may have earned $38.2 billion in revenue in the June quarter, an estimate higher than the $37.9 billion average expectation from Wall Street. In particular, he sees Apple setting a new June quarter record for iPhone shipments, easily topping last year's 31.2 million units.

Um noted that Apple added 16 new iPhone carriers since the end of April, bringing its worldwide total to 332 carrier partners. In addition, the iPhone also launched in four smaller countries — Brunei, Kosovo, Kazakhstan, and Lebanon.

While these new countries and carriers are likely to have only added a small number of iPhone units to Apple's total, Um believes growth was also driven by Apple's promotional activity in the channel.

Though his forecasts are above average, Wells Fargo's Maynard Um has maintained a "market perform" rating on AAPL stock.

Beyond the iPhone, Um sees Apple having sold 12 million iPads, 3.9 million Macs, and 1.9 million iPods in the quarter. He's also predicted gross margins of 38.3 percent, higher than Apple's guidance of 37 to 38 percent, along with earnings per share of $1.27, higher than the Street's expectation of $1.22.

Despite his expectations of a record quarter, Um is still bearish on Apple's longer-term prospects than many of his colleagues. The analyst has maintained a "market perform" rating on AAPL stock, with a valuation range of $86 to $96 per share.

Part of his reason for that is a belief that Apple will ultimately have to choose between growth and margins. He said that the remaining opportunity in the smartphone market is smaller in size and better suited to low-end products, a space where Apple does not currently compete.

Apple will report the results of its third quarter of fiscal year 2014 on July 22, representing its first earnings call with new Chief Financial Officer Luca Maestri at the helm. AppleInsider will have full, live coverage of the event, which starts at 2 p.m. Pacific, 5 p.m. Eastern.

Neil Hughes

Neil Hughes

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

Christine McKee

Christine McKee

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

9 Comments

I'm amazed sales are not going down as people wait for the iPhone 6. That phone is going to go ape s*** crazy.

More relevant would be a link to a track record of Um's accuracy... which has historically been lousy. I think Phillip Elmer DeWitt keeps accurate records of such things.

Apple has better product mix than last year, better availability and better market coverage, so sales numbers going up don't surprise. So much about "high end market saturation" and other boll...s But the best is even coming: product portfolio will be extended to larger screen sizes and later also to mediocre priced segment. I wouldn't want to be Apple competitor in next few years ;)

"Part of his reason for that is a belief that Apple will ultimately have to choose between growth and margins." I'll save you some time Maynard, they chose margin over sales several decades ago.

"Um noted that Apple added 16 new iPhone carriers since the end of April, bringing its worldwide total to 332 carrier partners." It's more than the 16 new carriers added in the last quarter. Apple added new carriers in the January-March quarter as well, and added both NTT DoCoMo and China Mobile since reporting 2013's Q3 numbers. When comparing year over year, Um should also be comparing the carrier numbers against last year, not against the start of this most recent quarter. Silly analysts. No wonder they're constantly wrong.