After years of failing to do much more than embarrass Samsung Electronics in legal battles over patent infringement, Apple has rapidly obliterated Samsung's mobile division profitability, rendering it as barrenly unprofitable as every other Android or Windows licensee with razor thin margins in the phone, PC and tablet market.

Samsung's collapse in profits caused by Apple, not Xiaomi

While Apple's critics might prefer to credit Xiaomi for Samsung's decline, the South Korean giant's plummeting profitability is not due to a major drop in its low priced, high volume phones and tablets but rather an implosion of Samsung's profitable, high end Galaxy S and Note models that directly compete with iPhones— including its Galaxy Note 4 flagship that launched at the middle of the second half of the year.

Samsung's Note 4 launch was hyped by tech media writers, including Brad Molen of Engadget, who called it "the best big-screen phone you can buy right now."

That claim was supported by misleading benchmarks that obscured the reality that Samsung's Note 4 shipped with screen resolution that its processor wasn't engineered to handle, further dinged by Google's lackluster OpenGL performance in Android.

It's even more clear today than it was in the previous quarter that smartphone buyers were opting for Samsung's larger phablets like the Note series purely because of the large screen, not because Samsung was "innovating," not because of anything particularly attractive about Android as a platform and certainly not because of a purported edge in performance or all of those ecstatic reviews (neither of which were true).

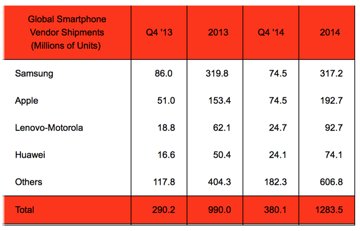

As soon as Apple released its own large screen iPhone, the popularity of Samsung's Note collapsed. Estimated phone shipments from Strategy Analytics suggest that Samsung's total phone volumes in Q4 were only down 13 percent over the year-ago quarter, but the company's reported profits from mobile plummeted by more than 64 percent.

In Q3, Samsung announced a similarly devastating 74 percent drop in its mobile profits. Analysts have been noting through 2014 that the company faces increasing competitive pressure from both Apple on the high end and from high volume sales of lower end models increasingly being produced by Chinese companies, in particular rising star Xiaomi.

Samsung is clearly facing a battle on both fronts. However, based on the numbers the company has reported, the catastrophic drop in profits Samsung suffered in the third quarter has come from a thermonuclear assault by Apple targeting its core revenue and profit generators: the high end phones that had been contributing most of the profits of the entire Samsung Electronics. The damage Apple has caused Samsung will only get worse as the company's low end is ravaged by other Android licensees.

Samsung documents the cause of its profit implosion

Samsung still hasn't paid Apple the nearly $1 billion judgement it was ordered to pay back in 2012 for patent infringement. However, it did report a much larger $3.2 billion YoY drop in quarterly profits within its IT & Mobile Communications (IM) group— which is roughly comparable to Apple's operations, following the previous quarter's $4.7 billion drop. The cause of this sudden collapse in profits is not a mystery.

Samsung's profit collapse was not principally due to Chinese phones flooding the market. IDC reported that Samsung's phone shipment volumes in Q4 were even better than Strategy Analytics surmised, estimating that numbers were down by just 11 percent. For Q3, IDC similarly reported a YoY decline of just 8.2 percent.

Samsung itself reported only a "slight decline in smartphone shipments" in Q4, following a sequential "slight growth in shipments" in Q3, when Samsung flat out stated that its phone shipments in the quarter were "driven by mid to low-end products." Going forward, Samsung guided investors to "expect smartphone competitions to intensify" in 2015.

That means Samsung missed out on high end sales. While IDC had estimated that Samsung's total sales were down just 8.2 percent, analyst Ben Bajarin reported that Samsung's premium phones were down by nearly 50 percent in Q3.

In Q3 2014 Samsung's Galaxy S products + Note products saw nearly 50% decline in sales both QoQ and YoY according to my mix estimates.

— Ben Bajarin (@BenBajarin) October 30, 2014Given that premium phones have historically made up about a third of Samsung's total unit sales, that indicates that Samsung not only lost lots of high end sales, but also substituted profitable sales with unprofitable volume filler, resulting in a "weak smartphone product mix," exactly as the company admitted. Apple earned 13.4 times as much money as Samsung while shipping roughly the same number of phones, by selling higher end iPhones rather than "carrier friendly, good enough" devices.

As a result, Samsung's mobile division reported just $1.8 billion in operating income in Q4, down from $5 billion at the launch of its Note 3 last year.

Apple's operating income was $24.2 billion, up 36.9 percent over the year ago quarter. That means Apple earned 13.4 times as much money as Samsung while shipping roughly the same number of phones, by selling higher end iPhones rather than "carrier friendly, good enough" devices.

Targeting Samsung's profit pillars

Samsung is fully aware of the value in selling higher end products. In its most recent earnings statement, it communicated to investors that its plan for 2015 involved both a "focus on increasing smartphone shipments and securing profitability with new product portfolio."

Since 2010, Samsung's product portfolio has largely been based around copying Apple's iPhones and iPads. Targeting Samsung's tenacious "fast follower" role— including its cloning of Apple's product designs, user interface features, product configurations, capabilities and even its marketing and packaging— has been difficult for Apple, and particularly fruitless in the courts, which have taken little action to protect Apple's patented inventions.

To devastatingly eviscerate Samsung's most valuable targets— effectively bombing Samsung back into its Stone Age prior to its copying the iPhone— Apple needed a very sophisticated warhead.

Producing a large screen phone with adequate 64-bit CPU and leading GPU processing power to drive it, and then giving it clearly differentiated features including Touch ID and Apple Pay as well as Continuity features that tie it into the Mac desktop, iPad and the upcoming Apple Watch, were all elements of a "thermonuclear" plan to strip Samsung of its Galaxy S and Note 4 profit engines.

Samsung has long been a high volume phone maker relative to Apple, but its profitability in mobiles began to surge immediately after the company embarked upon its 2010 strategy to duplicate Apple's iPhone as closely as possible with the Galaxy S. The company also attempted to replicated Apple's iPad business, but with far less commercial success.

While Samsung failed— along with other Android licensees— to ever earn big profits from tablets, the company did gain new success with its Galaxy Note hybrid "phablet," a product that introduced tablet-like features but sold as a smartphone in subsidized carrier contracts.

Unlike Apple's iPad, which sells for around two-thirds the price of an iPhone, Samsung positioned its Galaxy Note as a more expensive smartphone than even its Galaxy S flagship. Last year's Galaxy S4 had a retail price on par with Apple's iPhone 5s, but the larger screened Note 3 was priced $100 higher.

Samsung doesn't always get full retail price for its phones, frequently offering buy-one-get-one offers to drive volume sales. It has also bundled free tablets with phone sales. Both practices drive down the company's Average Selling Prices and its profits.

Even so, the profitability of its Galaxy S and Note models carried not only Samsung's other more basic phone sales, but also the entirety of its IT & Mobile group (which also makes tablets, computers and networking gear) and even made up the majority of the profits of Samsung Electronics— an enterprise that spans from appliances and TVs to video displays, memory chips and ARM processors. At the beginning of 2014, Samsung's premium phone sales were driving 70 percent of Samsung Electronics' total profits.

Strangely, while analysts regularly expressed concerns about Apple deriving more than half of its profits from iPhone, nobody in tech media blogs seemed concerned that an even greater percentage of all of Samsung Electronics' profits were coming from its version of the iPhone, or about what might happen if those revenues were to ever collapse.

IDC, Gartner and Strategy Analytics helped obscure Samsung's fate

Apple has long earned more money than Samsung while exclusively selling only higher end ($400+) iPhones. In fact, while Samsung was routinely reported to have shipped twice as many total phones as Apple, Apple was earning twice as much profit (it's now earning 13.4x as much, while selling about the same unit volume of devices).

The profits Apple was earning allowed it to make massive investments in OS software, apps and custom silicon. In contrast, Samsung largely relied upon licensed Android software from Google, Android apps from Google Play and generic Application Processors from Qualcomm (or off the shelf ARM chip designs printed in Samsung's own System LSI fab).

As a result, Samsung's product differentiation was increasingly based on building phones with large screens. As soon as rumors began hinting at larger iPhones, Samsung's sales of high end Galaxy S phones began to stagnate. Samsung doesn't detail in its quarterly reports how many premium phones it sells compared to its "carrier friendly, good enough" models, and market research firms didn't publicly detail the difference between premium phones and volume filler either.

Instead, firms like IDC have been blindly serving up smartphone market statistics focused entirely on shipment volumes and market share, regularly congratulating Samsung on its ability to ship huge volumes of devices. Now that Samsung's high end phone profits are collapsing, IDC is drawing attention to other companies that have the exact same focus, with no apparent recognition of cause and effect.

Xiaomi was hailed by Bloomberg in September 2013 when the emerging vendor's president Bin Lin stated in an interview that it had turned a profit for the first time, although the report noted that "he didn't supply a figure for profit." Instead, he focused on shipments and market share.

However, in December 2014 it was revealed that Xiaomi hadn't really been very profitable at all, having earned just $56 million in all of 2013, one tenth what the Wall Street Journal had initially reported.

Lenovo and LG, both nearly tied with Xiaomi for third place in quarterly unit shipments, are also focused on shipments and market share. In its most recent earnings report, Lenovo doesn't detail its profits by segment, but called attention to its "record worldwide smartphone shipments, up 38 percent," achieved despite a 6 percent revenue decrease from smartphone and tablet sales. It noted overall gross margins of 13.9 percent. Apple's margins are 39.9 percent.

LG reported an 18 percent YoY increase in smartphone shipments within its mobile group, but its profit margins collapsed to 1.8 percent from 3.8 percent in the previous quarter, when it had reported that its "profitability improved widely." LG could double its profitability and quadruple its sales and it would still be earning less than the beleaguered Samsung.

Essentially, every vendor apart from Apple in IDC's top five has the same strategy of being "focused on shipments and market share" rather than profitability, giving them the same trajectory as Samsung. IDC is applauding this just as it applauded Samsung right up to its profit implosion.

Meanwhile, IDC has gravely warned for years that Apple's market share continues to slip— in both smartphones and tablets— as it discovered new ways to increase its Others category to insure that its statistics keep telling this story of slipping market share.

However, Apple's profitability has continued to remain spectacularly high, even as shipment and market share leaders shifted from Motorola to Blackberry to Nokia to Samsung as their predecessors imploded in failure. Apple has made it explicitly clear that its goal is not market share but rather profitability, something that's only achieved by building great products that people want to buy. Gunning for market share is much easier: just ship tons of cheap products, and if necessary, give them away.

In fact, by publishing misleading market estimate figures that obscured the real value of Samsung's shipment volumes, research firms incentivized Samsung to make poor business decisions.

Google helped seal Samsung's fate

Without any obvious way for Samsung to differentiate its Android products— an issue that Google and Samsung had been fighting over throughout 2014— Samsung faces another big problem going forward.

Google is not only offering Samsung's competitors the same Android software, but it has been blocking Samsung from making meaningful changes that would limit Google's market power over Android. That is increasingly forcing Samsung to investigate its alternatives, and none of them are very attractive. It could return to licensing Microsoft's mobile software, which would put it in the same position with a different master, or it could try to go solo with its own Tizen.Google is not only offering Samsung's competitors the same Android software, but it has been blocking Samsung from making meaningful changes that would limit Google's market power over Android

The problem there is that maintaining a unique platform is very expensive. Microsoft and Google have both financed their mobile platforms using their high profit margins on software and services related to the PC desktop. Samsung's profits come primarily from its mobile phones, but even those profits (before they collapsed) generated half the margins of Apple (and an even smaller fraction of the 70-80 percent gross margins Microsoft earned up until last summer, or the 60 percent gross margins of Google).

And as Amazon demonstrated last year with its Fire Phone flop, trying to create a new smartphone platform with meaningful differentiation— even when starting with working Android code— involves a lot of resources and tremendous risk.

Samsung is now back to square one; it's stuck partnering with Google the way HTC, LG, Lenovo, Xiaomi and others are, with a similarly hopeless outlook for ever being wildly profitable again. Essentially, Samsung's phone business is now in the same place as its tablet business, or the tablet business of every other Android licensee. It can spend lots of money trying to look different, but in the end Android is all about serving up ads for Google, not for enabling individual licenses to make money.

How can Samsung rebuild its profit engine?

After years of bloggers explaining how Apple's profitability would be eroded away by commodity Windows and then Android licensees makers, Vlad Savov, writing for the The Verge, sought to explain away Samsung's current problems by stating that all the company really needs to do is produce a "portfolio of better-designed phones," a sentiment echoed by Samsung itself.

Samsung isn't the first company to lose profitability and the find itself unable to get it back due to fierce competition. Blackberry, Nokia and HTC are all examples of companies that worked hard to win back customers with "better designed phones" but simply could not turn back the clock.

Going forward Samsung will lose its position as the default alternative to Apple; Xiaomi is already an even more shameless copy of Apple than even Samsung. And at the same time, Google has partnered with HTC, Asus, LG and Motorola to launch its latest Android 5.0 Lollipop on Nexus branded devices.

Without a dominant Samsung defining Android, Google will likely find itself dealing with more AOSP vendors (like Amazon, and most vendors in China), making use of Android without the obligation to follow Google's directions. That could lead to greater innovation and more experimentation, albeit without benefiting Google. In any case, Android now faces a huge wildcard because its largest advertiser and most dominant licensee by far is experiencing a major collapse in profits due directly to its use of Android.

Given Android's still unresolved intellectual property issues with Oracle, the company's abandonment of Motorola and the departure of Android's founder Andy Rubin, Google's overall strategy for its alternative to iOS may experience some of its biggest changes ever in 2015.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

William Gallagher

William Gallagher

Malcolm Owen

Malcolm Owen

Brian Patterson

Brian Patterson

Charles Martin

Charles Martin

134 Comments

Awesome! I've always been a proponant of Apple conducting thermonuclear war against Android. This is what Steve Jobs wanted.

Android manufacturers are certainly feeling the hurt nowadays! Now it's time to go biological and chemical also! Wipe them out! Don't spare anything! I want to see them hurting even more.

It's hilarious how Fandroids always talk about the billion+ activations, but who really gives a crap? Most Android manufacturers aren't making much money. They can have their billion+ activations. It's worthless.

Maybe Samsung can make some more commercials insulting Apple users. That ought to do the trick.

This makes me happy. Plus the fact that Flash is dying, and my Apple shares are up. What a great week.

Molen is a complete hack. I've never seen someone so blatantly anti-Apple in a liveblog. He singlehandedly got me to stop going to Engadget, period.

These once again says that research entities like IDC, Gartner and other are hired help and will tell the story the way their customer wants to hear. Sadly, in this case, one of their customer, Samsung, became a victim.

I think consumers are realizing that no matter what the Samsungs of the world say about their phones being "premium", it's still lipstick on a pig.

Schadenfreude at its best. I really want to read a future news article about Samsung having to shut down operations, or introduce some kind of drastic "cost cutting measures" in order to "remain competitive".

Karma's a b!tch Samsung. You deserve everything coming your way.