Analysts on Wall Street came away generally pleased with this week's announcement of Apple Watch launch details, viewing the new platform as a way to extend the company's valuable ecosystem and generate more revenue from high-margin products.

Following Monday's "Spring Forward" event, analysts provided their reactions to the announcements to AppleInsider and investors. A rundown of their takes follows.

Morgan Stanley

Katy Huberty originally believed the average selling price of the Apple Watch would be around $450. But with pricing announced on Monday, and the stainless steel model starting at $549, she now believes the ASP over the first 12 months could be around $618.

Huberty's assumptions call for Apple to account for 1 percent of the 30 million unit-per-year Swiss luxury watch market with its high end Apple Watch Edition, starting at $10,000. She also forecasts the rest of Apple's sales to be split between the entry-level Sport and mid-range collections.

Her initial estimates called for Apple to earn 45 percent margins on the Apple Watch, but she said that even that number could prove conservative when sales begin.

Morgan Stanley has maintained an "overweight" rating for AAPL stock with a price target of $160.

Piper Jaffray

To Gene Munster, the "killer feature" of the Apple Watch is its design. He believes this point may have been lost on many investors, after Apple's stock closed essentially flat following Monday's announcement.

"Apple is trying to reinvent how people think about watches in general, not smartwatches," Munster wrote. "As such, we believe the design of the watch and the Apple brand are the two biggest selling points and the technical features are a value add vs. a standard watch."

Like Huberty, Munster also raised his average selling price projection for the Apple Watch. His new forecast calls for the device to have an ASP of $550, up from his prior estimate of $500, after pricing in the mid- and high-end of the lineup came in higher than he expected.

Piper Jaffray has also maintained its price target of $160 for AAPL.

UBS

Though the Apple Watch received a good reception on Monday in the eyes of Steven Milunovich, he also believes there isn't yet a "killer app" for the wrist-worn device.

"(Apple CEO Tim) Cook has said the breadth would surprise consumers, and perhaps that is sufficient," he wrote.

Milunovich also cited supply chain checks which suggest that manufacturing ramp up for the Apple Watch has been slow. The recent yield rate for the device is said to be around 75 percent, and a labor shortage after the Chinese New Year at Quanta Computer has reportedly led Apple to reach out to Foxconn for help.

Milunovich forecasts Apple to sell 6 million Apple Watch units in the June quarter, followed by 10 million per quarter after that. UBS has maintained its "buy" rating on AAPL with a price target of $150.

Evercore ISI

Not only does Rob Cihra think the Apple Watch will be successful, but he believes it will be the only successful smartwatch on the market. His forecast calls for sales of more than 18 million units in calendar year 2015, earning $10 billion in revenue and accounting for 4 percent of Apple's total.

By early 2016, he believes the Apple Watch will have an attach rate of about 5 percent with the overall iPhone installed base.

To Cihra, the Apple Watch hits the "style intangible" he believes is necessary for a product that's just as much about fashion as it is about function.

His ASP target for the Apple Watch was revised to $535, up from his previous prediction of $500. He expects the Sport model to account for about two-thirds of the mix.

Evercore has raised its price target on AAPL from $140 to $160, and continues to advise investors with a "buy" rating.

J.P. Morgan

Rod Hall was at Apple's event Monday and got his hands on an Apple Watch, and he came away impressed. Even with only native apps, he believes the Apple Watch will provide a lot of value to iPhone users.

Still, Hall reduced his earnings per share estimates for this year by 0.5 percent, and next year by 1.5 percent. That's becasue Apple's pricing on the stainless steel model actually came in lower than he had expected.

Hall also believes that Apple's advertised 18-hour battery life for the Apple Watch may prove conservative in real-world use.

His estimates call for an average selling price of $379 for the Sport version, and $750 for stainless steel. Overall blended ASP is pegged much lower than his peers, at $398.

Hall has maintained his "overweight" rating for AAPL stock with a price target of $145.

BMO Capital Markets

Apple's presentation gave "interesting and compelling use cases" for the Apple Watch, in the eyes of Keith Bachman. He was particularly excited about having an airline boarding pass on his wrist to free up hands while traveling.

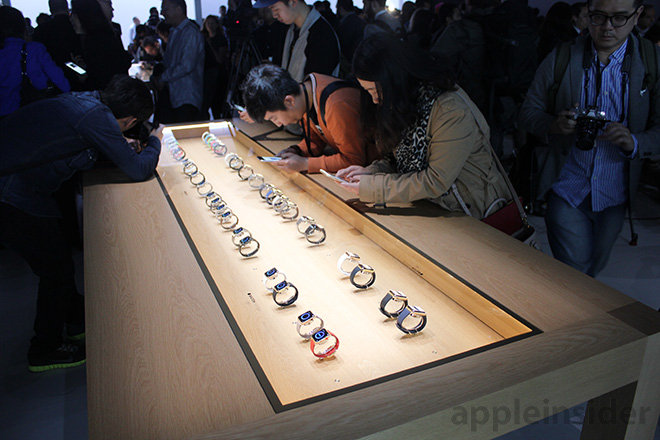

Bachman was also present at Monday's event, and noted he was also surprised at how light the Apple Watch is to wear, even at the larger 42-millimeter size.

Bachman has not changed his forecasts, which remain at 19 million units with an average selling price of $420. He assumes 35 percent margins on the Watch itself, and "solid" margins on the various bands available.

BMO has maintained its "outperform" rating on AAPL with a price target of $135.

Cowen and Company

To Timothy Arcuri, the Apple Watch presents "fashion over form (for now)." He believes initial pricing is too high for the current feature set.

In Arcuri's view, "v1.0 is more of a set-up for v2.0." He estimates sales of 5 million units in the June quarter, and 8 million in the September quarter, with average selling prices just shy of $450.

Arcuri believes that Apple may update the Apple Watch platform very soon. He suspects that "2.0 Watch versions" will debut this fall and will not require tethering to an iPhone — Â something that he believes limits the potential market significantly.

Cowen and Company continues to have a favorable "outperform" rating on AAPL stock, but has not yet updated its underwater price target of $115.

Wells Fargo

Noted Apple bear Maynard Um's price target has been underwater for awhile, but he revised it following Monday's presentation to a new valuation range of $120 to $130. He has also maintained his market perform rating.

Unsurprisingly, Um came away disappointed from Monday's event, citing battery life that requires daily recharging, and an April 24 launch that is six weeks away.

Neil Hughes

Neil Hughes

Bon Adamson

Bon Adamson

Thomas Sibilly

Thomas Sibilly

Marko Zivkovic

Marko Zivkovic

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

Christine McKee

Christine McKee

53 Comments

Knock knock - With Apple watch coming, what Android wear smartwatches do ? Answer is "Run for the HILL".

Knock knock - With Apple watch coming, what Android wear smartwatches do ? Answer is "Run for the HILL".

More like Lets See Who Can Copy What Faster

More like Lets See Who Can Copy What Faster

They can't. Apple has a five year lead on them, minimum. And they'll never catch up from an OS standpoint. Especially since we didn't have Google spies on the board this time.

Maynard Um...I'd be embarrassed to take financial advice from him.

I show article on Phandroid about you can buy 5 android watches for one very high end apple watch. Well, here is my answer. Yes, I can buy 5 of either toyota corolla or GM somthing, Honda civic, Ford something, WW beetle, Subaru something, etc cars for one Mercedes S500 or BMW 7-series or Audi or Lexus 4 series, etc. So more of one is not equivalent to one of other. In software programming, 5 Android smartwatches != or

It will definitely be interesting to see what the effect will be on other smart watch makers, i.e., will they try to make more bands, try to advertise their product as more a luxury-type device. But of course, they were going to do that anyway, :) .