Following the announcement of Apple's record-setting June quarter revenue of $53.8 billion, analysts have been quick to pass judgment on the iPhone maker's fortunes, with Apple exceeding expectations but still with some trepidation present for the fourth quarter results ahead of an anticipated high-performing 2020.

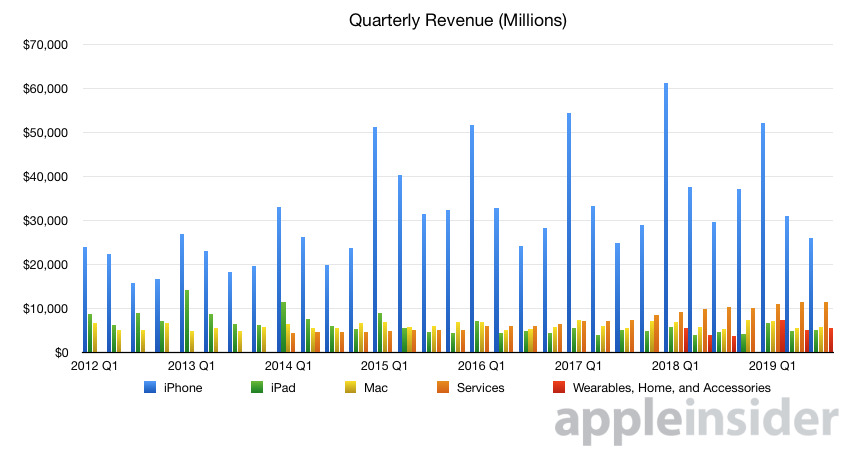

On Tuesday, Apple revealed it earned $53.8 billion in revenue, on the high end of its forecasted range, and higher than both last year's $53.3 billion result and the Wall Street consensus of $53.7 billion. While iPhone revenue was down from $29.9 billion last year to $26 billion this year, growth in the Services arm, iPad, Mac, and the "Wearable, Home, and Accessories" category helped offset the decline.

JP Morgan

The "low bar of investor expectations" over iPhone is an underappreciation of Apple's "multiple levers" for maintaining revenue, JP Morgan writes in its investor note seen by AppleInsider, with trade-in programs, financing options, and broader distribution channels helping it "cycle past the worst of the iPhone headwinds." The firm's iPhone outlook for Q4 has been raised from 42 million units to 43 million.

Services growth is in line with its expectations, with momentum set to increase with higher engagement. The 13% year-on-year growth, was driven by the App Store, Apple Music, cloud services, AppleCare, and triple-digit Apple Pay growth, but it could go further over the next year with subscriptions tipped to grow from a current 420 million to beyond 500 million in 2020, as well as a relaxation of App Store gaming in China.

The combination of the iPhone revenue maintenance, the upcoming launch of new services, and the expectation of major upgrades for the 2020 iPhones are "key reasons to own the stock over the next 12 months," the firm believes.

In response to the results, JP Morgan has raised its EPS forecast for the full 2019 fiscal year from $13 to $13.25, and the December 2019 price target from $239 to $243.

Rosenblatt Securities

Apple's results are in line with both consensus and Rosenblatt's expectations, the firm insists, with EPS also beating both the $2.10 of the consensus and its own estimate of $2.08. The sale of iPhones are "weaker than expected," with a short-term rebound in June through some Chinese promotions, but July sales are expected to be down sequentially in the country.

While the quarter typically reflects the company's production ramp, Rosenblatt remains "concerned about the potential of a production cut after the September iPhone launch, which may impact guidance for the December quarter." Wearables beat consensus estimates with AirPods providing "significant upside for Q2" and beating estimates.

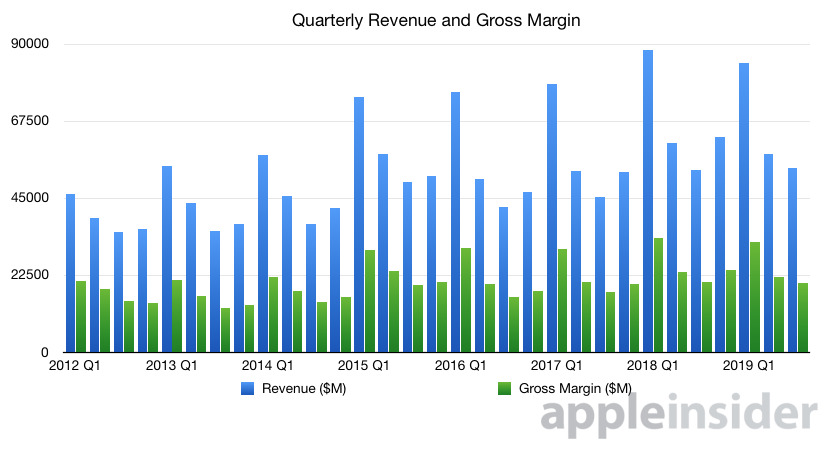

"We are not surprised by how Apple guided for F4Q19, as the guidance normally reflects new product sell-ins instead of actual demand and sell-throughs," the investor note believes. Gross margin guidance suggests "limited improvement" compared with the performance in the second half of 2018, "driven by ASP growth," with stable component costs and memory prices not giving Apple leverage for gross margin improvement.

Rosenblatt maintains its "Sell" rating on Apple "as we believe the risks for the company to guide down will most likely occur in CQ4, after the new iPhone launch in September, and we think iPhone sales will continue to be disappointing."

Rosenblatt has kept its price target of $150.

Cowen

The quarter was "better than expected," with iPhone holding its ground with improving demand. Trade-in and financing programs rolling out to more markets and retail partners for the second half of the year suggests there could be more device upgrades on the horizon, with the areas anticipated to become long-term staples to "support the evolving nature of purchasing behavior."

Services continues to be a positive for the company, with record revenues in a number of areas helping its cause. While there will be new subscription offerings in the fall, Cowen doesn't expect them to be "GM accretive on the onset," but will make more of an impact as they ramp up.

For other areas, wearables growth has "room to run" given low attach rates to the iPhone, while the pricing of Apple TV+ and Apple Arcade will provide the "first clues on the competitiveness/attractiveness of the new offerings."

Cowen reiterates its "Outperform" rating, and updates its price target from $220 to $250.

Morgan Stanley

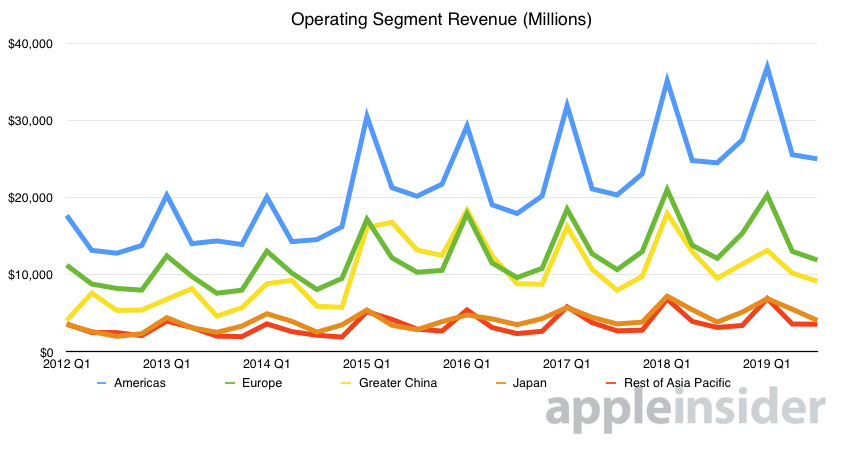

The results "largely played out" to Morgan Stanley's expectations, with the stabilization of iPhones as markets recover and replacement cycles nears the peak as one of a few main positive notes. Emerging markets saw growth, including BRIC countries going up 3% year-on-year after a 25% YoY decline in the first quarter, as well as Mainland and Greater China both seeing progress.

Wearables are now a "meaningful growth driver," with the category accounting for 10% of revenue, or when tied to the iPhone user base, account for 32% of revenue combined with Services. Smoother revenue seasonality is to be expected from the sector.

The operating leverage is also better, with the guidance for the September quarter the first since December 2017 where Apple has guided to a sequential improvement in gross margins, attributed to lower memory costs and an overall mix shift towards Services.

The "only real disappointment" for Morgan Stanley is the stable but not accelerating Services growth. While consistent with the March quarter, and individual sections seeing growth, currency headwinds and difficult year-on-year comparisons in Apple Care due to distribution channel expansion last year didn't allow Services to "flow through to an acceleration."

Morgan Stanley offers an "Overweight" rating for Apple, and a price target of $247.

Macquarie

Apple reported a "Strong" quarter where fears over China "did't materialize," according to Macquarie. iPhone trends improved, though still down year-on-year, and Services grew with the assistance of China's approvals for games.

"Interesting that the world's largest company sees games in one geo as important for growth," the firm muses. Wearables, iPad, and Mac revenue were "also solid."

"Management's tone was very positive and they mentioned excitement for the pipeline of products," it is noted, though it is deemed "not unusual" with expected investment into AR, health, and "potentially auto" to help bolster Apple's revenue reach.

"All of this is quite positive, and while we are not negative on Services growth, we do remind investors that all Services are not equal and that an understanding of structural margins and growth trajectories in each is important," Macquarie warns.

Macquarie has a "Neutral" recommendation for Apple's shares, with a price target of $210.

Malcolm Owen

Malcolm Owen

-m.jpg)

Charles Martin

Charles Martin

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Sponsored Content

Sponsored Content

5 Comments

And some Clowns on here say Cook should go haha.......

Zhang from Rosenblatt on MSNBC kept correcting questions about Apple's "wearables" as "Airpods" like that's all they think the wearables are. Forget the whole Apple Watch thing.

Tim always promises there's an amazing pipeline and for once, he might be right... the Macbook Air is doing well, the Watch is doing well, I suspect the Mac Pro will do well, and while analysts keep talking about Services = AppleCare, I don't think Apple's streaming will fail. It has potential to at least match Netflix which is values at $145 billion.

And then there's the AR glasses. Still believe they're coming....

What's perhaps not fully appreciated yet is Apple emphasizing subscriptions will jump at least 20 percent next year. And that's off a sizeable base of 420 million existing subscribers. Someone has confidence that TV and video Arcade will ramp even faster than Apple Music apparently. (I doubt they'll classify new creditcard holders as "subscribers")

If 60 million of the 80 million additional subscribers predicted by CEO and CFO next year pay $10/month that equals $7.2 Billion a year in added revenue year one. Not too bad-- almost equal to google cloud in its third year. The analysts yesterday tried in Q&A for more insight. Maybe they can ask Apple specifically if the 80 Million new subscribers excludes Apple Card.

Three out of five analysts have a positive outlook on Apple's future. For someone who was around in the 1990s, this is always something of a shock.