Apple's latest record-beating earnings are not enough to prevent analysts predicting doom — because no amount of money ever will be.

Before Apple announced its latest earnings, there was speculation that the company was in trouble. Enough so that analyst Samik Chatterjee stood apart for how he wrote that he was "not as worried as the Street" about the earnings.

After the Apple earnings, there is talk that Apple's Services growth is slowing down, and so investors may need to be concerned.

In between these came the actual earnings report, in which Apple broke records and also came in ahead of analysts predictions.

It's too simplistic to say that Apple earning $83 billion in the last three months means the company is safe forever. But it's also too simplistic to say anything other than $83 billion is a lot of money.

Even the biggest companies can fail, and even incredibly successful products can just vanish. Look how the iPod went from universal to practically forgotten, although also look at how it was Apple that chose to do that to its own product before anyone else could.

Nonetheless, Apple isn't going to close down in the next quarter, next decade, or next quarter-century. If Apple failed to sell a single product, it would still have enough cash to keep going without changing plans — or cutting recruitment.

For people whose job is advising investors on long term prospects, it's also peculiar how so many analysts concentrate on each earnings call to the exclusion of anything else. That cash reserve, for instance, kept Apple's multinational machine going through the coronavirus pandemic.

You can and should argue that Apple handled the pandemic very well, in part because of supply chain mastery — but that needed cash to keep going. And it has those reserves both because it sells products people want, and because it also always looks to the long game.

Analysts seemingly do not, and there is a whole class of expert who chooses not to. Everybody makes mistakes and nobody knows everything, but sometimes you have to wonder when the driving force behind a prediction is to get attention.

You can say anything you like today and whether or not it gets you more YouTube views, more readership, or more click-through ad sales, tomorrow the world has moved on. Since you can't be disproved today, you can say what you like and change it tomorrow to whatever you either truly believe or seriously hope will earn you money.

But if you can't disprove what anyone says today, you can take a look back at, say, what they predicted ten years ago. The world was very different in 2012, but Apple was so clearly doomed.

"All downhill from here"

Usually if a company is genuinely doomed, the first thing to go is anyone paying any attention to it. You might get a brief flurry of nostalgia when the firm actually goes under, but usually that's it.

In 2012, though, Apple was specifically said to be extremely doomed, like it never has been before, after the loss of Steve Jobs — and John Browett.

That's what The Guardian said in an article headed "We've passed peak Apple: it's all downhill from here." Written by Dan Crow, said the removal of Browett and of Scott Forstall pointed "to a subtle downward trajectory."

At least you've heard of Scott Forstall. Browett was hired in January 2012 to oversee the Apple Stores but was out of the company by October 2012.

It's very hard to judge from outside Apple just what impact any one hire can have on the company, but sometimes there are clues. Such as how prior to Apple, Browett was best known for running the UK's Dixons electronics store.

Dixons has its place, but it's never had a reputation for quality so far more surprising than Apple ejecting him, was Apple hiring Browett in the first place.

"Insanely Doomed"

In 2012, Paul Turner was still plugging the "Insanely Doomed" book he'd written after Steve Jobs died, and was using the Huffington Post to argue his case. He railed against the "underwhelming" iPhone 5, the "copycat" iPad mini, and how fighting Android made Apple "look mean-spirited."

At the heart of his article, though, was that Android was "making massive strides in smart-phones and tablets." Turner said that last was really why Apple may have been a short-term winner, over the previous decade or more, but ultimately it would be a long-term loser as Android takes over.

To be fair, perhaps Turner has changed his mind over the last decade. But back in 2012, Elon Musk was changing his mind about Google's Android versus Apple between every interview.

"I think probably Google will win on the phone because Jobs is out of the picture," Tesla CEO Elon Musk told attendees at a 2012 UK Foreign and Commonwealth Office event. "It matters quite a lot who runs the company."

Btw, I don't think Apple is doomed. Just won't unseat Google from 1st place with Larry P in charge. http://t.co/hsIAekAw

— Elon Musk (@elonmusk) November 20, 2012

Elon Musk there, modifying his position over Twitter. Some things never change.

And some do, but briefly.

A brief oasis of sanity

There was one moment in 2012 that stands out as worthy of a Dear Diary entry. Forbes magazine offered an unusually calm and reasonable analysis of Apple.

In a piece called "Is Apple Really Doomed, or is Mobile Computing Just Maturing?", writer Michael Wolf disagreed with naysayers.

Specifically, he meant that after "Apple helped the world realize what exactly mobile computing would look like," smartphone technology was "settling into a period of iteration and evolution rather than disruptive revolution."

Back to the doom

Of course, by then mobile computing also meant the iPad. It still does, but presumably there are some very surprised faces at CNET.

"Tablets are a category that Apple completely dominates, with 80 percent market share," said CNET. "Android competitors have flailed, but Amazon's Android-based Kindle Fire is likely to outsell the iPad in 2012 due to its low price ($199)."

"While the Kindle Fire will nibble at the iPad from the low end," continued CNET, "at the higher-end, $500-plus price range, full-fledged computers based on the ultrabook and Netbook form factors and Windows 8 Metro will begin to compete with the iPad..."

Everybody is better than Apple

Curiously, no one seems to predict the demise of Android or Google. That would be because Android design leads the world, or at least it nearly does and that's good enough.

"The new version of Android, Ice Cream Sandwich, is almost at parity with the beauty and ease of use of iOS," continued CNET. "In fact, more than 370,000 apps are now available for Android, including most of the ones that people want."

The publication did say Siri was a great new feature, though it disparagingly pointed out that Apple just bought that, it didn't create it. Besides, "Android already has similar apps and Microsoft's TellMe will not be far behind," it continued.

You can't criticize experts for predicting 2012 would be the year of TellMe when in fact Microsoft dropped it completely... in 2012. But you can criticize them for not equally disparaging how Microsoft bought in TellMe.

Cause and impact

Sometimes experts can spot the right information, but make the wrong prediction. Such as when in April 2012, analyst Walter Piecyk of BTIG Research, revealed that it was the carriers who had made the iPhone a hit.

That success wasn't down to iOS, wasn't even down to the iPhone itself, it was because carriers had subsidised it. Now they were reportedly tired of losing money on the deal, and they were all going to end that, just you wait and see.

"We expect post-paid wireless operators to remain firm in their plan to stunt the pace of phone upgrades in 2012," said Piecyk. "We expect Apple's iPhone sales to drop to 27.5 million units in Fiscal Q3, resulting in a revenue estimate that is $1 billion below consensus."

Maybe Piecyk was right. After all, it's now sufficiently less common for people to buy iPhones on subsidised contracts that Apple no longer promotes that in its keynotes.

Instead, Apple appears happy to get by on just selling us phones that cost $1,000 — or more. And through its own iPhone Upgrade Program.

Apple's business has changed

That upgrade program is a much bigger clue to the future of Apple than its shedding of an Apple Store executive. The change in subsidies from carriers, whether ot not that happened in the way Piecyk predicted, is also key.

Even ten years ago, Apple was no longer the company that made computers and sold them retail. It was negotiating tough contracts with the previously all-powerful cell carriers, for one thing.

Apple was also already long down the road that began with the iTunes Music Store and, so far, has culminated in Apple TV+. And every thing Apple did in 2012, certainly everything it does now, is interwoven in ways outside experts can only guess at.

Apple TV+ was predicted to be a flop because it had such a small library at launch compared to Netflix, but now it's Netflix that's in some trouble, and is bleeding subscribers. Apple won't say how many viewers its streaming TV service has, and that's led people to assume it's very few.

They could be right. But only inside Apple is there really even a clue just how much, say, making another season of "Schmigadoon!" is going to lift iPad sales in the short-term.

But even that doesn't matter. Apple has the money to wait as long as it wants for something to pay off.

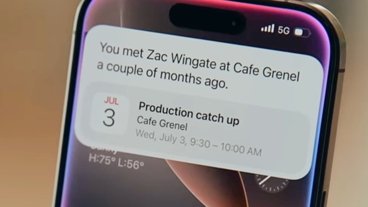

When you can't measure internal figures, and when Apple cuts back on what data it reveals, you start to look outside the company.

And it's outside Apple where doom is clearly coming like a storm on the horizon. The App Store could be forced to change, new laws and regulations could limit Apple, and Facebook can change its name in order to win the battle for the metaverse.

Apple keeps pressing on. It doesn't answer to anyone it doesn't legally have to, it doesn't often rise to any bait, it just keeps making its devices — and its plans.

There's a definite commercial advantage to Apple keeping total control of how apps are distributed to the iPhone and so there is a definite commercial disadvantage coming if the App Store's exclusivity is broken.

But we already know Apple is ready. Law changes and new regulations in regions like the Netherlands are often seen as test cases, as ways to see just how doomed Apple is going to be as its alleged monopoly is smashed.

In reality, those same legal issues could well be seen inside Apple as test cases for how it's readying its response to any outcome. With the Netherlands, for instance, the company held out against any changes for a protracted period.

And then when it capitulated, it did so in a way that could only benefit the very largest of app development companies. Cutting its commission from 30% to 27%, or 15% to 12% depending on type of purchase will make a difference to firms the size of Epic Games that already have their own payment processing systems.

It won't make a tempting difference to any smaller developer. So Apple complies with the law, yet makes it so that few will elect to move away from using its in-app payment services.

And if they do, Apple is still going to get its commission — one way or another.

William Gallagher

William Gallagher

-m.jpg)

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

-m.jpg)

17 Comments

You guys are SO right. When has Apple ever been valued correctly…

A well written article, thank you.

You can look up on wikipedia the "Monte Carlo Fallacy" which says that people will think a change is "due" so if, in roulette, for example, the colour red comes up 10 or 20 times in a row, people will bet lots of money that it will come up black on the next roll, even though history does not affect the future when it comes to games of chance.

It's the same thing with Apple's profits. People see all this money pouring in, and they think it has to end someday. So they predict gloom and doom, for no other reason than Apple's recent string of successes.

https://en.wikipedia.org/wiki/Gambler%27s_fallacy#Monte_Carlo_Casino <--

Well consider the sources in the first two...The Guardian absolutely LOVES to shit all over Apple anytime they can think of some absolutely bullshit to write about. As soon as I see The Guardian write any article it immediately goes to the bin.

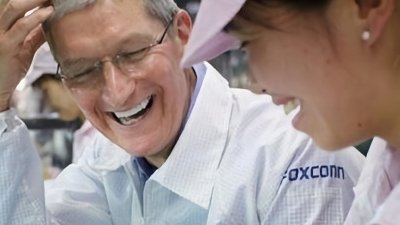

Elon Musk is IMO an idiot. Yes a good leader is great, but you're only as good as the people who work under you. If you surround yourself with the best people they will make you look like a great leader. This is exactly what Tim Cook has done in my opinion. He weeded out the toxic people (Scott Forestall) and those who just didn't fit Apple's values in the end, even if he was the one who hired them. I bet Elon is a great micromanager of everything with all of this companies because he can't hire anyone he can trust.

Stock analysts present an existential conundrum. If you are so good at predicting the fate of companies and the price of their stock, why are you sharing your predictions for free instead of making a killing in the stock market?