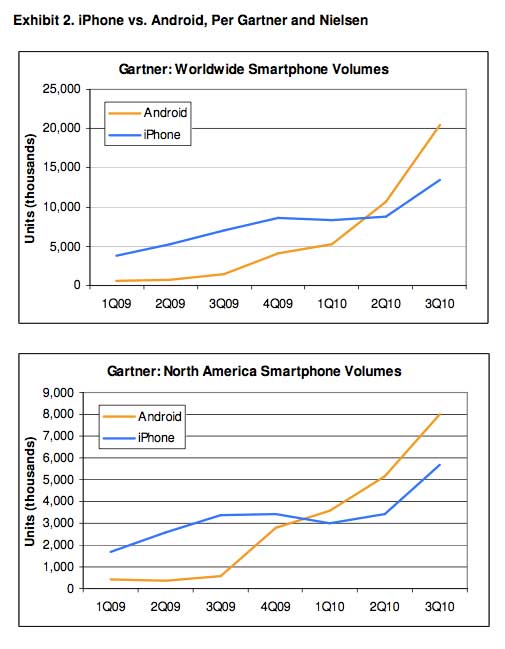

Yair Reiner with Oppenheimer said in a note to investors on Monday that he believes the market dislikes Apple because Google's Android mobile operating system is gaining momentum. He said investors are likely worried about the sustainability of the price premium of Apple's iPhone as handsets running Android become more prevalent.

"If so, the more lasting consequence of an Apple-Verizon deal won't be the number of incremental iPhones sold, but the scale of competition between iPhone and Android could tip sharply in Apple's favor," he wrote.

"If so, Apple's earnings won't just rise from the additional Verizon units — they'll finally get some respect."

Reiner noted that Wall Street investors typically grant companies with 70 percent earnings per share growth a "premium valuation." But AAPL stock is valued at just 14 times its EPS, which is equivalent to the Standard & Poor's average.

"The main risk to Apple is that Android, by creating an equally compelling experience, could make iOS less sticky and restore some bargaining leverage to carriers," he wrote. "There's no better way for Apple to blunt this threat than by making headway at Verizon, whose patronage has been critical to Android's success with both consumers and developers."

The analyst also questioned why Apple and Verizon would finally make a deal now, if the rumors prove true. Numerous mainstream media outlets have independently reported that the iPhone will debut on Verizon in early 2011.

Reiner speculated that Apple has been motivated by a desire to slow Android, though he admitted Verizon's inspiration is "less clear." He said perhaps Apple offered an exclusive long-term evolution 4G phone to the carrier, or in an "unlikely" move, perhaps Apple "caved on price."

"For Apple, having access to Verizon’s network would constitute a significant strategic coup for which it may be willing to make some sacrifices," Reiner wrote. "But given the near-term advantages the iPhone could confer on Verizon, we think Apple has the leverage to conclude a deal that significantly advances its two key, intertwined goals (preserving the iPhone’s price premium and trimming Android’s sails) without giving up much."

To kick off 2011, Oppenheimer has increased its fiscal year revenue and EPS estimates for AAPL to $86.4 billion and $19.01, respectively, to reflect the anticipated debut of the iPhone on Verizon's network. While Reiner believes it could happen in the first half of 2011, the firm has conservatively assumed the handset will be introduced with the fifth-generation iPhone in the third calendar quarter of the year.

Neil Hughes

Neil Hughes

-m.jpg)

Chip Loder

Chip Loder

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

Christine McKee

Christine McKee

Sponsored Content

Sponsored Content

79 Comments

I hope it is LTE only. That would make it the must have geek device.

So I guess a stock climbing to over $300 per share in one of the worst economic times ever was not enough to earn their respect??????

So, if Apple's iPhone comes to Verizon this year, will Apple's "magic" rub off on Verizon's share price?

So I guess a stock climbing to over $300 per share in one of the worst economic times ever was not enough to earn their respect??????

My thoughts exactly! What a moronic statement eh?

So I guess a stock climbing to over $300 per share in one of the worst economic times ever was not enough to earn their respect??????

The price per share isn't meaningful in the way you state it. It's all about earnings multiples, which it's correctly stated here are very low for a company experiencing such rapid earnings growth. BTW, the multiple stated is forward PE, which means it is based on consensus estimates of future earnings. The truth is, the markets have always questioned Apple's model of doing business which it seems is always anticipated to be on the verge of unraveling. So expecting anything to change on that front due simply to a Verizon iPhone seems like wishful thinking to me.