Has Apple lost its magic? It's kind of remarkable that pundits and analysts of all stripes are suggesting as much at this point, but really not all that surprising because they've been saying that every spring right up to Apple's Worldwide Developer Conference for years.

In a report by the Wall Street Journal "MarketWatch" blog, Dan Gallagher recently wrote, "considerable doubt has crept into the investment community about the company’s ability to live up to its past record of product innovation."

And so, in 2013, three years after iPad began turning the PC market upside-down, six years after the iPhone transformed the mobile industry and more than a decade after iPod redefined media playback, the "investment community" is concerned that Apple has not only lost its momentum, but has no real vision for extending it either. Ye of little faith.

End of a lucky streak?

Apple has certainly been lucky over the past decade. Had it faced more focused, responsive competition from Microsoft in the first half of the decade, the fledgling Mac OS X might not have gotten the exposure it needed to survive and the iPod might never have gotten big enough to be the success that helped fund the company's future developments.

And had Palm, BlackBerry, Windows Mobile and Nokia's Symbian not all degenerated into terrible products people had no love for just at the moment Apple was ready to release iPhone, the company's major success in entering the mobile market might never have happened.

And had Microsoft and its Tablet PC partners, led by Samsung, Dell and HP, not all collectively failed so miserably to capture the attention of consumers and professionals in the enterprise, it would be easy to imagine a world where Apple's iPad never had a chance to shine.

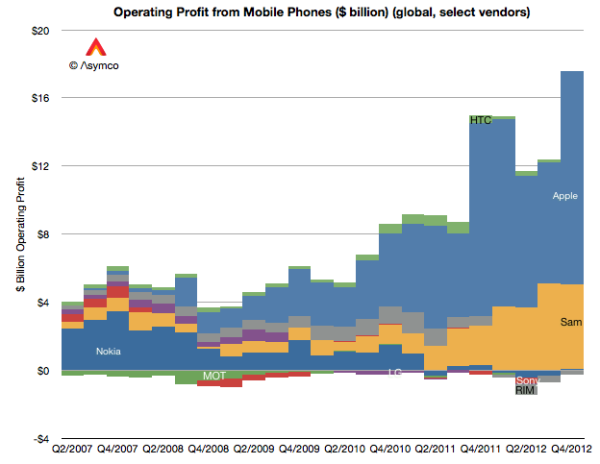

But of course, Apple's success hasn't been entirely the product of other companies' failures. If that were the case, a lot of other firms' attempts to create new products would have automatically been successful and Apple wouldn't be alone in collecting three quarters of the revenue of nearly every major industry it has entered.

Over the past decade, Apple has built a tech empire that rivals the scope and influence of Microsoft in the 1990s, differentiated primarily in that Apple's products are being sold openly next to the competition; Microsoft helped ensure that there simply wasn't any competition. And this factor seems to be a key reason why the media, pundits and investment community analysts have such a hard time understanding why Apple is still in business.

A long winter of discontent

Every year, Apple has had a "quiet period" in the spring, sandwiched between the previous year's blockbuster holiday season and the new releases of the following summer. And every year, competitors have jumped to make the most of this in an attempt to portray Apple as stagnant and mired in the past. Every year they've been wrong.

Looking back just five years to 2009, the tech media was enraptured with Palm's new webOS. Glassy eyed pundits were predicting great things for the new platform and the Palm Pre's new hardware, contrasting iOS and last year's iPhone 3G as being washed up and old fashioned in comparison. It wasn't until WWDC, and the new iPhone 3GS, that Palm lost its spotlight and virtually collapsed overnight.

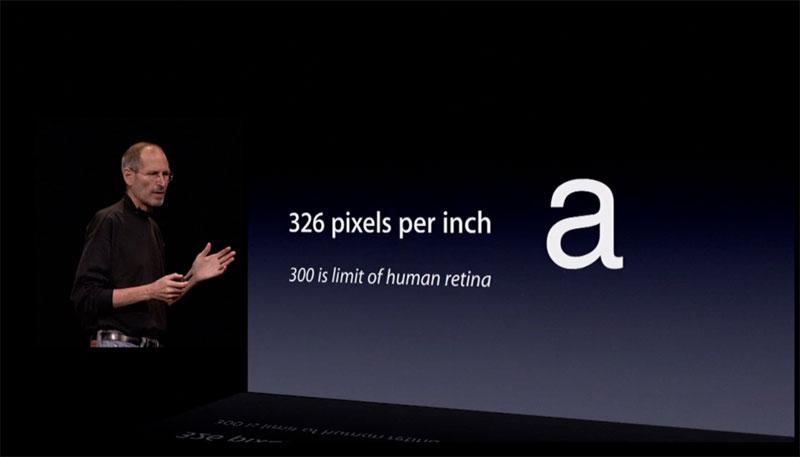

2010 was slightly different because Apple actually released its new iPad at the beginning of the year. But while the tech media remained suspicious about its potential, they fawned over the "multicore" future offerings of Motorola and other Tegra powered devices with higher resolution displays. They seemed to be genuinely surprised when Apple debuted iPhone 4 with its own advanced chips and Retina Display. Who knew the most profitable hardware maker could keep up?

In 2011, Google tried to replicate the iPad's first year of success with its own Android 3.0 Honeycomb tablets, which captured much of the attention in the spring. Android also gained broad support for 4G LTE networks, enjoying more than a year or two of a very significant, exclusive feature. And again, there seemed to be an almost disappointed surprise when Apple released its own new stuff that kept iOS at the top of the charts for yet another year."It’s been a long winter†- Gene Munster of Piper Jaffray

Last year, iPad 3 and iPhone 5 brought LTE to iOS, ending a key exclusive feature for Android while also raising the bar for key hardware features from camera and display quality to raw performance. But ironically, the broad series of new products Apple launched last winter have now triggered a new cycle of "that was probably the end of Apple's run" pontification.

"It’s been a long winter,†the MarketWatch report cited Gene Munster of Piper Jaffray as observing. Six months of no major new products, oh my!

There was a time that Apple's annual iPod updates seemed so hard to keep up with that Saturday Night Live spoofed the continual refreshes (below). Seasoned OS X developers will also recall the widespread complaints that Apple was advancing its new Mac platform too rapidly in the first half of the 2000's decade, resulting in a slowing of the interval of new releases from 12 months to more like 18.

Relative innovation

While it's true that Apple's mobile competitors release new waves of products every few months, the level of innovation they achieve in these updates is much less significant. Even huge new flagship product lines, like Samsung's GS4 and HTC's One, are differentiated mostly by app-level features: camera capture and editing or eye tracking playback controls that on iOS would barely pass for a $2 third party app.

The most "innovative" components of the Android platform have been failures, ranging from NFC Google Wallet payments to minor novelties like induction charging (a feature Palm tried to exploit back in 2009 on the Palm Pre, which despite similar media fawning, didn't result in excited customers).

Apple's competitors certainly do have strengths that exceed those of last year's iPhone. Nokia has great camera technology, for example, but it is tethered to an oddball operating system that hasn't proven to be popular even in the enterprise where Microsoft should have some pull. And Samsung has been building ARM chips for years, but hasn't been able to maintain a real lead in performance over Apple, in part because it is straddled to Google's hobbyist Android platform.

Compare the technology deliverables from RIM, Nokia, Samsung, HTC, Microsoft and Google and contrast these with Apple, and it becomes clear why Apple is collecting three quarters of the entire mobile industry's revenues.

What is apparently less obvious is the fact that after collecting all those resources, Apple enjoys incredible capital advantages in orchestrating component sources and building new software and services.

Apple Maps & Apps at WWDC

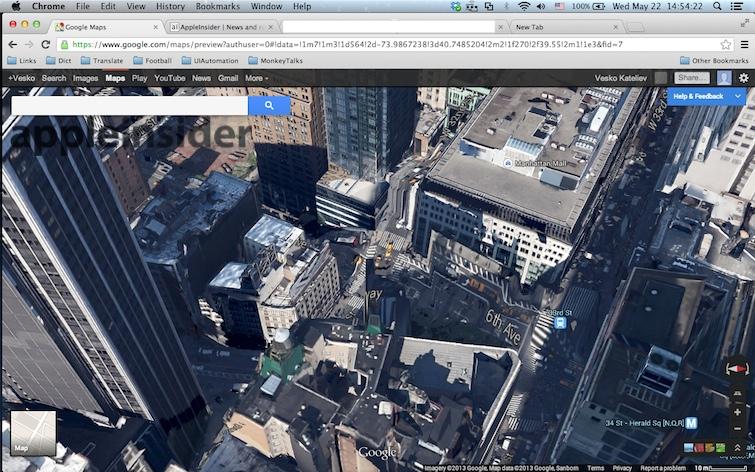

Case in point: Apple's Maps. Last year, Apple's efforts to evict Google as the default maps provider in iOS 6 were castigated by the media for both perceived minor flaws and certain significant drawbacks. But Apple's Maps were a 1.0 effort, and the extent of its importance and performance is only obvious when you look at what Nokia and Google have released in the year since.

Nokia spent $8.1 billion to buy Navteq to get itself into the maps business. Google has been acquiring mapping companies for half a decade prior to Apple, and has offered its Maps+Navigation product for Android since 2009. Yet in one year, Apple went from being entirely dependent upon Google to being a leading mobile maps provider itself, with a product that compares favorably to the latest apps offered by Google and Nokia.

This would be like Google offering a Microsoft Office alternative and rapidly taking over half the market in one year. Google Docs has been around for more than six years, if you're taking notes. And nobody complains that Docs isn't anywhere near in feature parity with the functionality of every Office app, nor expects Microsoft Office to be instantly obliterated by Google in order for Docs to be anything but a miserable failure.

Speaking of productivity apps, the top selling apps on the top selling tablet platform are Apple's own Keynote, Pages and Numbers. And this comes despite the fact that Apple hasn't rapidly advanced these apps since their original launch, apart from building iCloud integration with its desktop Mac versions.

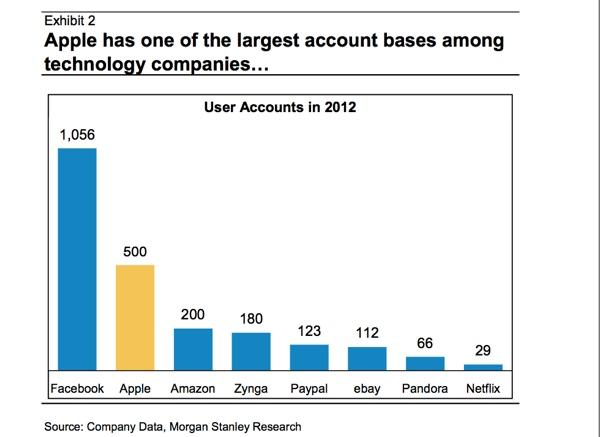

Passbook, another curious placeholder, has gotten broad support from third parties in its first year. Apple's been coy about where it plans to take this, but it appears the company knows about the potential it has for entering the digital purchasing market, given the vast account leverage it has with iTunes and the App Store.

And speaking of Apple's vast insight into what its iTunes customers buy and like (via Genius), the rumored iRadio should be an equally interesting development.

Analysts and the tech media struggle to comprehend competition

These are the sorts of "product innovations" that the "investment community" is concerned about, and whether such features can prevent the wholesale migration of Apple's iOS customers to Android, something that isn't happening and hasn't happened at any point in the last 6 years of iPhone. Apple is making iOS "stickier," but its customers weren't leaving even back when MP3s made it relatively easy to do so.

So far, this concern has apparently been based on the fact that Samsung and other phone makers that existed prior to the iPhone are still around today. Apple didn't completely obliterate all competition the way Microsoft's Windows 95 effectively did in the mid-1990s, through a combination of exclusive contracts with hardware partners and efforts to block third party development for alternative platforms.

Under Microsoft, the Windows PC market appeared to have vibrant competition, with various hardware partners selling a range of computers at different price points. However, this competition didn't deliver much in the way of true innovation. Between 1995 and 2005, lots of these PC makers merged or went out of business while Microsoft collected the lion's share of profits, but the PC itself remained a pedestrian box with the same overall design and minor annual tweaks in performance specs.

Contrast that to Apple's mobile devices between 2001 and 2011, where the simple original iPod morphed into a powerful tablet computing platform with the world's largest, richest selection of public software and private corporate apps.

Unlike Microsoft, Apple didn't try to kill the open web as an alternative to its own native apps. Instead, Apple had maintained the world's largest open web browser codebase to ensure that anyone else, from Nokia to Google to Samsung, could build devices running HTML5, achieving the greatest cross platform compatibility that rich Internet apps have ever enjoyed (despite several efforts by Google to derail this).

While the open web eventually helped to break Microsoft's Windows stranglehold on the PC, the openness of WebKit and the HTML5 specification has only helped Apple. That's because Apple isn't competing to end competition; it's working to offer the best products of all of its competitors.

This is why Apple does better when it is competing against several alternatives (as it did in MP3s and early smartphones), rather than just one monoculture, whether real (Windows) or imagined (Android). And conversely, it's also why Microsoft has fared worse with the more competitors it faces. Google's similar business plan is similarly threatened by competition from multiple parties, especially from competition within and among Android licensees and forks like Amazon's Kindle Fire.

That simple reality can't be hidden by any amount of phony market share data for gerrymandered markets that conflate tablets with PCs (but only if they're not iPads), or liberally define "smartphones" in an attempt to bury the iPhone in a sea of junk rather than looking at it for what it is: the most valuable segment of the entire global phone market.

Apple is winning the game it is playing, and that makes WWDC all the more interesting for the insight it will provide on how the company plans to keep advancing its score.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Chip Loder

Chip Loder

Marko Zivkovic

Marko Zivkovic

Wesley Hilliard

Wesley Hilliard

Christine McKee

Christine McKee

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

203 Comments

Oh, cloud of doubt. It's an Apple event. It never lives up to the expectation, even when it exceeds the expectation. People (Wall Street) are worthless idiots. If every single Apple product WAS updated simultaneously, as they desire, at every single Apple event, they'd complain that Apple didn't update them enough.

They'll never be happy. The point for Apple is to make people (real people) happy and ignore Wall Street. And they're gonna do it. They always do, you know? We're two days out and how many leaks have we had? None. Not a one. Everything we know, Apple has told us.

It's gonna be big.

Here's to OS X and iOS, as well as hopefully Haswell Macs. And here's to Apple, showing us that they won't give up on workstations. Hopefully.

Updates (+ iPad mini) are not enough, I am sorry to say. I couldn't care less if Apple announced next-to-nothing on the hardware front at WWDC. I can wait until the Fall for that. I want to see software ideas that hit the ball out of the park. I want to see software innovation, or at least a roadmap for it, that puts the competition -- especially Google -- years behind and having to catch up.

Updates (+ iPad mini) are not enough, I am sorry to say. I couldn't care less if Apple announced next-to-nothing on the hardware front at WWDC. I can wait until the Fall for that.

I want to see software ideas that hit the ball out of the park. I want to see software innovation, or at least a roadmap for it, that puts the competition -- especially Google -- years behind and having to catch up.

Agreed, hardware is easy for Apple, I want Apple to take software to the next level and blow my mind. I have no pre-planned ideas, but Apple have set the standard for software development and looking to be amazed. If I am not then hopefully, it will be major upgrade that keep Apple ahead of the pack.

I like this article, and I like to share appleinsider articles that are well written, but when you add things like "Google's hobbyist Android platform", it turns this into a name calling territory. Also, why doesn't the chart show the number of Google accounts? I believe that number is on par with what FB has. Comparing the number of credit cards on file would be a better metric.

I hope a ray of sunshine evaporates your cloud of doubt revealing this editorial to be wildly wrong, disingenuous, and even foolish.