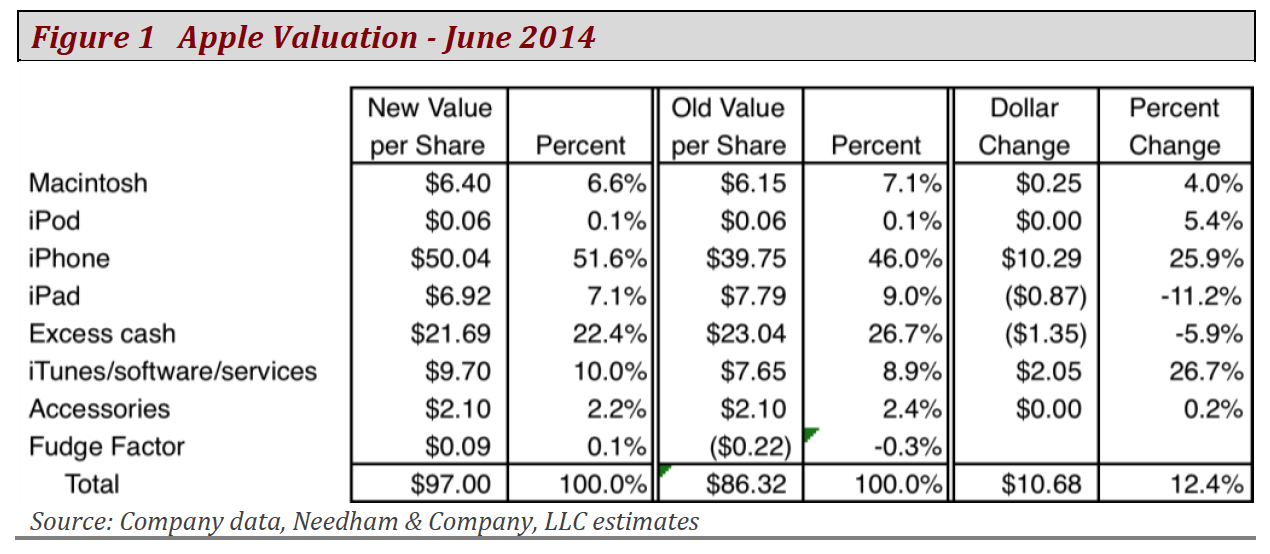

Investment firm Needham on Tuesday broke its typical semi-annual schedule and updated its price target for Apple stock to $97, citing stronger than expected iPhone sales and also the surprise announcement of a new programming language called Swift.

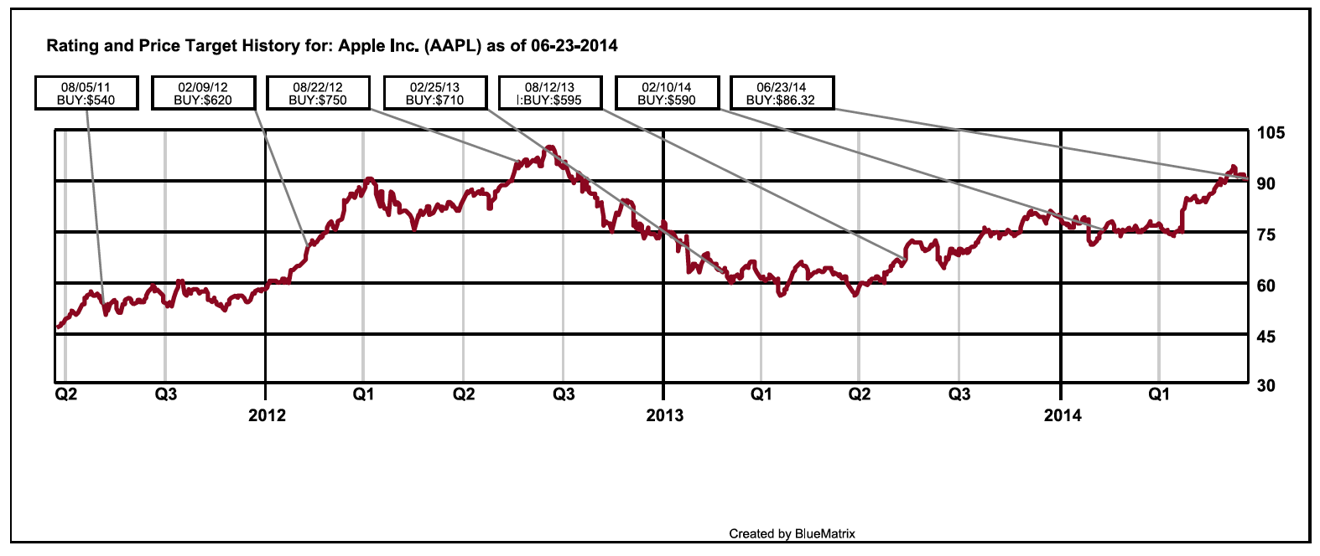

For the last five years, analyst Charlie Wolf has revised his Apple price target twice per year, in February and August, after the company would report its first- and third-fiscal-quarter results. In February, Wolf had a pre-split price target of $590 — Â a number that Apple quickly exceeded thanks in large part to blockbuster iPhone sales that surpassed market expectations.

After the 7-for-1 split, Wolf's target was at $86.32, still well below Apple's trading price. Given that his projection looked on track to remain underwater until his next scheduled update in August, Wolf opted on Tuesday to break out of his pattern and revise his target higher to $97.

Wolf cited three reasons for the unexpected increase, chief among them being the surprise success of the two-and-a-half-year-old iPhone 4S in the March quarter. Apple's most affordable handset accounted for an estimated 25 percent of iPhone sales in the quarter, which suggests that consumers in emerging markets are buying in to the company's ecosystem.

Another reason for Wolf's increase was the introduction of the new Swift programming language at Apple's annual Worldwide Developers Conference earlier this month. The analyst said on Tuesday that he believes Swift was the most significant announcement from this year's WWDC.

"If software does indeed drive hardware choices, we believe Apple has leapt ahead of the tools available on the Android platform," Wolf wrote. "This in turn should translate into an increasing percentage of high-end Android users switching to the iPhone when they upgrade."

The final reason for Wolf's increase is his expectation that Apple will launch a larger-screened iPhone this fall. He believes a new iPhone with a screen size in the five-inch range would target a segment of the market that's estimated to account for 25 percent of high-end smartphone sales.

Needham & Company is the latest investment firm to raise their price target on Wall Street. Earlier this month, Cowen & Company upped its projection to $102, while RBC Capital Markets also revised its target to $100.

Neil Hughes

Neil Hughes

-m.jpg)

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

12 Comments

Of course.

Nice work, Wolf. ???? (is it possible to roll one's eyes while they're still closed?)

I raise the target to $100 without Apple having to do a damn thing.

Completely OT:

I got what I consider a wonderful birthday present recently... a handful of AAPL. It's the first stock I've ever owned.

Yeah, I'm not expecting to make a load with it, it's more a pride/vanity thing. But I would have never had the courage to even investigate stocks, if not for this forum.

Snark all you want about the wisdom of my timing, but in the meantime, this is my way of saying "thanks" to the regular posters out there. You know who you are.

[quote name="PScooter63" url="/t/180873/needham-raises-apple-target-to-97-expects-swift-programming-language-to-enhance-iphone-superiority#post_2554839"][B]Completely OT:[/B] I got what I consider a wonderful birthday present recently... a handful of AAPL. It's the first stock I've ever owned. Yeah, I'm not expecting to make a load with it, it's more a pride/vanity thing. But I would have never had the courage to even investigate stocks, if not for this forum. Snark all you want about the wisdom of my timing, but in the meantime, this is my way of saying "thanks" to the regular posters out there. You know who you are. [/quote] If you have no real interest in following the ups and downs of the market, just commit to regular, scheduled purchases of the stock (usually monthly). You'll build value over time using this strategy, known as "dollar cost averaging".