Google appears to have a formidable lead in developing "smart services," including intelligent search, voice assistance, map routing, imaging and other app features powered by artificial intelligence. Yet at its annual Google IO developer conference, the company failed to show developers how this edge would do much for them, given that most Android devices aren't updated and that Google's own updated, premium-priced Android devices aren't selling.

The reaction to Apple's iPhone X crushing Google's AI Pixel 2

Instead, Google IO focused attention on making Android a platform for knockoffs of Apple's iPhone X. That's not a huge surprise, given that Google (and the world, and all of its mobile developers) just witnessed the incredible impact of Apple's new premium flagship.

iPhone X's novel styling and 3D face-sensing hardware technology sold at a premium, globally, in huge volumes to mainstream users while Google's own AI-laden Pixel 2 flopped— even in the U.S., despite fawning media attention over its AI-version of Apple's dual-lens Portrait mode from 2016, free cloud storage and the promise that this time, Google would offer software updates for at least three years.

Last year, the hot take on iPhone X's premium price and its radical changes to navigation and styling (including ditching the Touch ID Home button and adding Face ID via a new 3D structure-sensing True Depth sensor built into the display) was that it could only possibly appeal to a minority of early adopters, while mainstream buyers would seek out lower-priced conventional phones.

At the same time, Google's Pixel 2 was hailed as the AI device that did your thinking for you and didn't trouble users to learn anything new. It copied one of the previous year's iPhone features and wasn't as expensive as Apple's latest, fanciest phone (despite still having a premium price). There was some clear expectation that people would buy it.

Just six months later, the new story is that everyone expected the iPhone X "notch" to be hit and that a broad range of customers are willing to spend significantly more for compelling features and styling on the device they use more than any other, every day. Essentially, everyone was wrong and nobody wanted to admit it. It's as if Apple has a time machine and knows what will be popular in the future

It's as if Apple has a time machine and knows what will be popular in the future. Everyone else waits around for Apple to show the future before copying it, but not before criticizing it and offing a competing idea of what audiences will want, albeit one destined to fail.

Given that this happens every year, you'd think tech media luminaries would clue into the pattern, rather than embarrassing themselves once again with accolades for whatever lead balloon Google or Microsoft or Samsung is launching. Here, take a look at the recent history of May's Google IO event, particularly in comparison to Apple's Worldwide Developer Conference that kicks off in June.

Google IO's circus of flops and Apple immitations

To summarize the last few years: at Google IO 2014 it introduced Android L with a focus on Enterprise Mobile Device Management and security, as well as a new Material Design UI for Android. Both were reactions to Apple's vast lead in the Enterprise and its rapid deployment of the fresh new UI introduced with iOS 7 the previous year.

The difference was that Android L didn't fix Google's enterprise problem, and it didn't rapidly roll out a new appearance to users. It took years for Material Design to reach the mainstream of Android users because licensees didn't bother to update most of the hardware they'd already sold.

At the next year's Google IO 2015, Android M rolled out copies of Apple's iOS permissions system, its copy and paste, its smart sleep features, HomeKit, Car Play and scrambled to catch up with iOS fingerprint authentication so it could copy Apple Pay.

The unique work Google introduced were tricks to make web pages look more like apps, something that didn't really take the world by storm. That year, while most of Google IO was about copying last year's iOS, the previous year's Android L had barely reached 10 percent of the Android installed base. That means Google was falling a year behind in both directions.

At Google IO 2016 Android M produced copies of Apple's FaceTime, iMessage and QuickType keyboard in the form of Duo video calling and Allo instant messaging with text prediction. The difference was supposed to be that Google's AI was so advanced it could talk for you, suggesting entire responses based on how it thinks you would talk. Turned out both were flops nobody cared about.

Google also rolled out Daydream VR, a hardware platform that didn't matter very much commercially (as VR turned out to be the opposite of a big hit), and introduced Android app support for Chromebooks. The big problem there: Android tablets (like Google's own Pixel C) could already run Android apps but there really weren't many optimized for tablet-sized screens, making it hard to see why they'd be able to rescue the failure of Chromebooks.

Of course, they didn't. Chromebooks remained a flop among individuals and business users. Google canceled its own, as well as its Android-based Pixel C. Rather than being more flexible and faster at innovating than Apple's platforms, Android is just failing more broadly as Apple continues to successfully expand its reach beyond phones and tablets into wearables and home devices.

The other flop Google IO gave attention to was Project Ara, the modular phone concept users could swap parts in and out of. Despite being featured at IO, it was canceled within the next year, making Google look like it was deliberately working to waste developers' time with impractical ideas, like the Beleaguered Apple of 1995.

At last year's Google IO 2017, Android O again featured a series of features taken from previous versions of iOS: Apple Data Detectors renamed as "Smart Text Selection," iOS 8's web browser-like forms AutoFill in apps, iOS 9's iPad floating Picture-In-Picture feature and Find My Device, iOS 4.2 feature Apple released in 2010.

Google also demonstrated some AI-powered machine vision and AR app features with its Google Lens app to garner some attention for Android. This app didn't change the world so much, particularly for developers. As we predicted at the time, Apple subsequently launched more than just a demonstration app using these technologies: at WWDC 17 it introduced ML and AR platforms for developers to work with.

The new Core ML and ARKit not only made new technologies available to developers, but iOS 11 deployed them broadly and rapidly to a vast installed base, immediately making iOS the largest AR platform— literally out of nowhere. As we noted at the time, Apple's installed base of premium iOS hardware was around nine times the size of the minority of Android users who had higher-end hardware running up to date Android software.

While Google had introduced Tango AR concepts years earlier for a couple experimental niche hardware products, ARKit brought advanced world tracking and Visual Inertial Odometry to a broad range of iOS devices running an A9 or better chip. Apple also introduced unique face tracking AR features to its best iPhone X, charting a path for future development and giving users a key reason to buy its most premium hardware.

Meanwhile, the deployment rate for new versions of Android continued to slow. So while Google keeps trying to catch up with what Apple introduced a year or more ago, those updates only trickle out into Androidland at a glacial pace. While Google keeps trying to catch up with what Apple introduced a year or more ago, those updates only trickle out into Androidland at a glacial pace

That helps to explain why Google has worked to put more of its AI prowess into the Pixel hardware it controls rather than trying to roll it out as an Android feature that any licensees can use. However, the proprietary features of its Pixel phones ended up doing little to generate actual sales. Pixel sales were terrible.

That makes it easy to understand why at Google IO 2018, the company is now back to showing off features of Android for hardware cloners seeking to build phones that look like an iPhone X, with no chin buttons and with a camera integrated into the face. Note that neither of those ideas came from Google's Pixel 2 team, which just a few months ago delivered a conventional phone with a bezel button for navigation and no notch.

Google also looked to Apple's year-ago WWDC 17 in delivering a Machine Learning development platform. And Android P also looked to last year's iOS for features ranging from Markup (editing screenshots), text zoom, contextual menus for lookup, and the OS-level dual camera lens support that Apple introduced on iPhone 7 Plus in 2016.

At the same time, it also worked to bring more of its AI-powered Assistant features for Android to iOS, rather than trying to keep them proprietary to Pixel or the Android platform.

Lastly, Google threw out its Duplex demo of Assistant placing synthetic phone calls to a real person, ostensibly to show that it could be used for something useful, like chatting with service people without personally wasting your own time. In reality, the real application for such a technology would more likely be robocalls by people trying to sell things or influence elections. That sounds as desirable as a robot speaking on your behalf in a text chat in Allo.

Alternatively, maybe it will never actually appear— just like the Google Photos feature last year that was supposed to magically erase a chainlink fence from your image.

Apple's hardware and the AI race

Virtually all media commentators appear confident in the common appraisal that Apple desperately needs to catch up with Google in AI features, yet essentially none seem to be concerned at all that Google has not made any ground in its own battle for winning hardware sales in the premium segment, where the vast majority of profits are.

Common thinking suggests that Google will someday soon win over hardware buyers by way of its superior AI-powered services, but that hasn't happened over many years of Google offering superior search services, industry-leading Maps Navigation services, impressive imaging demos, its often-touted lead in voice recognition and assistance and many other proprietary, advanced, notable and valuable services that have often been unique and exclusive to its Android platform.

That should cause people to think.

Conversely, when Apple's iPhone debuted back in 2007, the rival smartphone platforms that were making money back then were also differentiated by valuable, proprietary services: Blackberry was tied to BES messaging, Windows Mobile was tied to Microsoft Exchange Server, smartphones in Japan were tied to 1seg mobile TV and WEP internet, while various "carrier friendly, good enough" phones running Symbian were tied into carrier features such as MMS and video chat. iPhone didn't ship with any of those.

Those services were hailed by media pundits as the reason why Apple would never beat "Crackberries," or Microsoft's monopoly on the Enterprise, could never enter Japan and would face public revolt for not supporting the industry standard in picture messaging and video clips. Ten years later, all that prognostication looks pretty foolish. Apple destroyed every bit of the status quo within just a few years, and those supposedly cherished, proprietary services didn't offer much resistance.

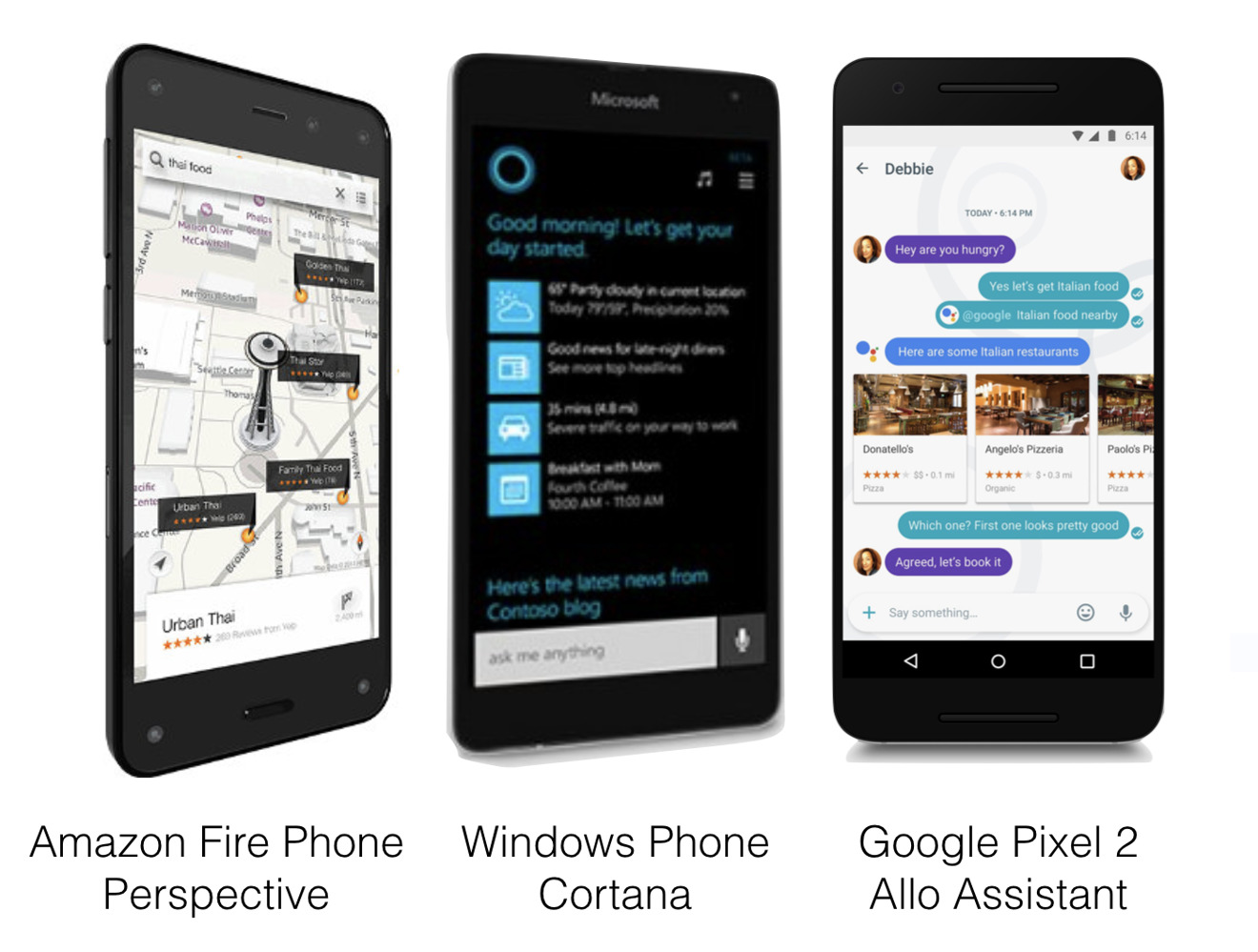

After iPhone grew dominant, various companies with major resources behind them attempted to win phone hardware territory by introducing new services and features. Microsoft ineffectually put billions into Windows Phone and Cortana; Blackberry attempted to put together a browser and advanced new OS for BB10 and Amazon spent heavily to develop its Fire Phone with "Perspective," shopping features, photo analysis, face detection and Alexa voice features— but it flamed out immediately.

Clearly, despite what everyone in the media repeats, a few flashy new services do not cause buyers to jump ship to another phone platform. Apple has continually won markets and expanded its extremely profitable iOS platform on the basis of solid hardware with a stellar reputation for support and longevity— despite "missing competitive features" throughout its entire history as a product.

At the same time, while Blackberry, Microsoft, Palm, Nokia and even Amazon eventually threw in the towel on smartphones after spending big on services that didn't capture buyers' attention, Apple's massive operational profits from sales of iPhones have funded the development of services that are actually extremely sticky and hard to leave: FaceTime, iMessage, the App Store, HealthKit, iCloud and Apple Music.

Could Apple (or anyone else) have speculatively developed such critically important services before lining up a pipeline of premium buyers? That seems extremely unlikely. Yet that's the strategy that virtually every other smartphone platform vendor has attempted, including Google and its Android partners.

None have mastered the hardware profits game before trying to build out attractive services to attract new buyers and retain their existing customers. Somewhat ironically, the only other company that has ever been significantly profitable in smartphones (yet still far less profitable than Apple) is Samsung, and it has been quite terrible at developing attractive services at all. It even failed at selling its Milk music.

Xiaomi and other Chinese phone makers have pursued a "profit-free hardware, someday they'll pay for services" business model that hasn't actually worked. Over the last few years, Google has recognized that its own model for Android sucks and that it should be selling expensive hardware like Apple. It just hasn't been able to do this.

Google in the premium hardware race

It's hard to argue against the fact that Apple and Google have very different corporate DNA that simply makes them good at different things. Despite surging past Google in size and profitability over the past decade via sales of iPhones and other premium hardware, Apple has failed to duplicate Google's savvy in search and AI assistant intelligence (including Siri functionality), and is similarly still working to catch up in other areas, including Maps data and routing (it trails behind in bike directions, inside maps and so on) and specific photo features.

Conversely, despite being years ahead of Apple in work on everything from Maps to NFC-based tap payments to voice-based telephony and search (Google Voice appeared years before Siri), Google has been surprisingly incompetent at using any of its advanced technologies to actually sell hardware, where the majority of the profits are in the mobile industry.

This isn't because Google hasn't been trying to sell hardware. Google hasn't been spending incredible billions of dollars on hardware design and development and making massive hardware acquisitions for no reason. It just hasn't been any good at it.

Apple has been mercilessly critiqued for its rough starts with MobileMe cloud storage, iOS 6 Maps, Siri and even its brief fling with adding social networking features to iTunes with the short-lived Ping commenting feature. Yet across the same years, Google has been given a pass while clumsily failing over and over in its attempts to deliver hardware, from Google TV to Nexus phones to Nexus Q to premium Chromebook Pixel netbooks to tablets to wireless earphones and even its most AI-embodying flagship Pixel phone— one of the biggest flops in the history of the industry, particularly in comparison to the exaggerated amount of adulating media cheering it received.

Apple's best efforts at search appear to lag behind Google's most basic offerings. At the same time, one of the most complained about features of Apple's hardware (that it requires "proprietary dongles," a beef groused about for 20 years from the original iMac to today's MacBook Pro) is the only hardware Google has ever been sort of successful at bringing to market: its Chromecast proprietary dongle for TVs.

The incompetent competition driving Apple's excellence

In an ideologically pure world, some committee would have decreed that Apple build the hardware and Google drive its services, the arrangement that iPhone actually appeared with in 2007. However, the nature of the free market allowed Google to assume it could do everything at least as well as Apple (as Microsoft had ostensibly managed to do with Windows PCs in the prior decade), forcing Apple to defend itself from the existential threat of a world of third-rate hardware vendors powered by Google's Android.

Capitalism clearly forced Apple to double down on its hardware efforts to produce intensely desirable hardware, culminating in world-changing product releases from iPhone 4 to iPhone 6 and today's iPhone X— which is literally changing the face of everyone else's phones in imitative efforts to catch up with Apple's relentless pace of innovation.

Where is Google in all of this? Despite pioneering Maps Navigation on the 2009 Motorola Droid, Google Wallet on the Galaxy Nexus in 2011, Daydream and Tango on ZenFone AR and various AI features on Pixel phones in 2016 and 2017, its service features haven't driven the profitability required to advance and update those features and keep them attractive enough to draw any real attention to Android as a platform.

Apple isn't comfortably enjoying its lead. WWDC 17 thrust iOS into leadership in areas where the company was assumed to be hopelessly behind. Since then, it launched iPhone X and HomePod, two hardware products that occupy new territory for the company.

Now, a year later, Apple is prepping WWDC 18 to show off the next advancements for its platforms. You can expect it will involve more than just a copy of what others did last year, and that its advancements will rapidly deploy to a huge installed base.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Charles Martin

Charles Martin

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Sponsored Content

Sponsored Content

72 Comments

I used to enjoy DED articles, but to be honest this constant bickering and "everyone else is wrong" is starting to get boring and monotonous.

At least the other writers here bring some variety in their articles.