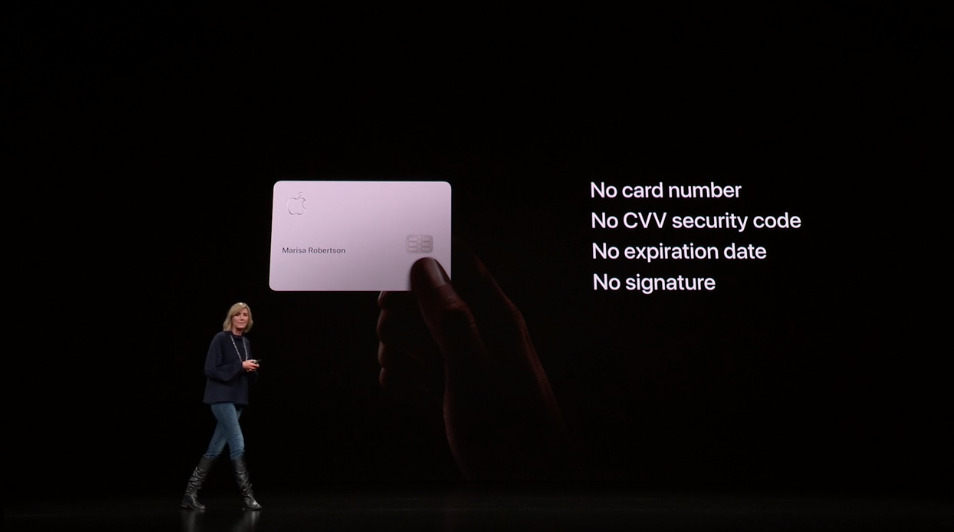

To enable Apple Card purchases at merchants that don't yet accept Apple Pay, the company designed its own physical credit card in partnership with Goldman Sachs and MasterCard, associating the Apple brand with a new set of "digital-first" credit features. It also features unique iOS app functionality with a strong focus on the privacy of your data.

The titanium Apple Card is the company's thinnest product ever, with your name laser-etched on the front next to an Apple logo. The new Card also supports an EMV chip for payment terminals that want you to insert a card. This is an embedded chip, similar to a phone SIM, that is built into the card. When you insert it, the terminal powers up the chip and reads from it. This takes a few seconds to process, but offers another layer of security over mag stripe.

It doesn't have an account number written on it. To make a purchase somewhere that wants that number, you can look up the virtual account and Card Verification Value numbers in the app, and even regenerate them as desired.

As with other Apple Pay credit cards, there is also a separate number encoded on the mag stripe, and its last four digits and a CVV confirmation number appear in Wallet so you can verify a purchase with a merchant, even without knowing the full number. Apple Card's rear mag stripe is even designed to look like an Apple product.

The only other thing on the back of the card is the logo of the bank and the issuing credit card network. Those partners can't feel too bad about being relegated to the rear, however. As Steve Jobs no doubt would have said, "the back of this thing looks better than the front of the other guys, by the way."

Apple Card notably doesn't include an NFC tag, which some modern cards do in order to support tap to pay. Apple does ship its new Card in packaging that facilitates pairing with iOS using an NFC tag. So the lack of an NFC tag on the Card itself is clearly on purpose, not something the company overlooked.

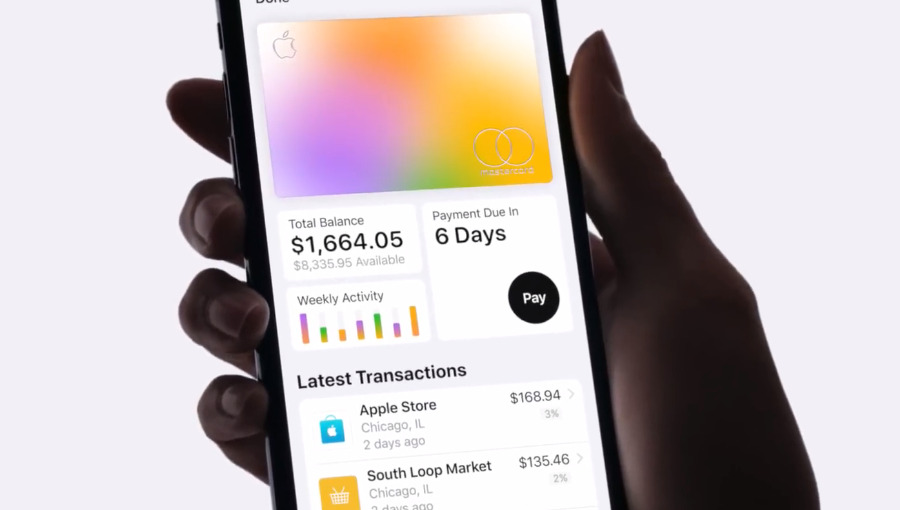

Apple wants you to tap using Apple Watch or an iPhone, so you have one device to carry rather than a series of tap cards. It also wants you to pay with your device because that way iOS can tell you what you're spending and where, and chart out your expenses for you.

Why Apple doesn't want your data

Apple isn't acting as the bank, and doesn't ever log into your account to access your records. Software on the phone itself is charting out and presenting your spending, and it doesn't report this information to Apple. That frees Apple from having to deal with a constant stream of hundreds of thousands of information demands from police, relatives of a deceased person, or anyone else asking Apple to open up access to somebody else's device for any reason.

Apple isn't just making up the idea that "it doesn't want your data." As a hardware maker that earns most of its revenues from sales of privacy-centric devices, it sincerely does not want to assume ownership of the data of a billion people's devices and deal with access requests. That's a unique position.

Other companies do want to comb through your data looking for things they can sell to advertisers. Most hardware makers are earning such minimal margins that they have to resort to advertising. PC makers have long been notorious for bundling adware and other bloat. Phone makers and ad networks do this on a much broader and sophisticated scale in mobile. Even recent "smart televisions" have made user tracking and content reporting a primary revenue source that subsidizes their TV manufacturing.

And while other companies do have to occasionally deal with law enforcement requests for user data, police don't have to ask Google to help them access data on an Android device. Google didn't make device encryption a priority, and the "security features" of Android makers, from finger print readers to simplistic facial recognition, have frequently been nothing more than gimmicks that afforded little real protection or security.

There is no other major hardware maker standing up to demands from state police over data, certainly not in China where state-owned phone makers are legally obligated to cooperate with the government. In 2016 James Comey's FBI flat out lied about encryption in its fight against Apple's privacy stance and its opposition to backdoors. Rather than back down, Apple persisted until the FBI gave up its case.

Apple's local, secure privacy vs. Google's open cloud

That public history gives Apple a unique position to authentically sell its own self-interest in not having nor wanting access to your data as a privacy feature. You're not being tracked and your data isn't being collected, stored, and moved around. That means there's not going to be a Facebook-like series of mistakes where some huge collection of data about you and everyone you know was left on wide open and unencrypted on a server that was made available to everyone.

On an iPhone, your Apple Card banking data is stored the same way your personal Health data is stored. And all of the calculations and analysis presenting your purchase history are performed locally, just like the on-device processing in Photos that scans all your pictures to identify the type of photo, what objects are your pictures, and who you've taken photos of. Apple can uniquely do this because all of its iPhones pack high-performance processors and a reasonable amount of RAM.

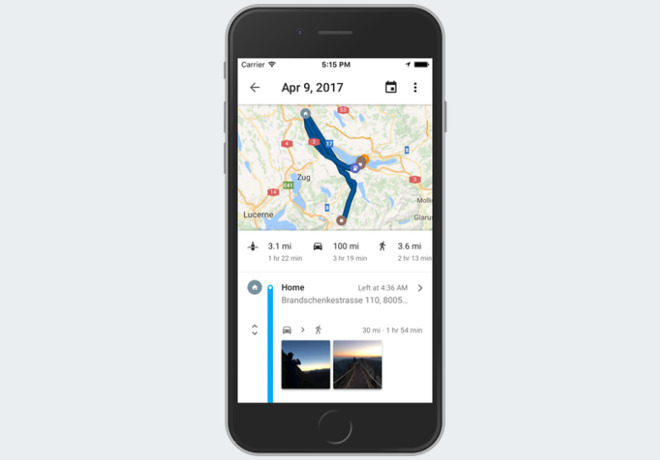

Most Androids— forced to market at an average selling price of $250— can't handle running those types of on-device artificial intelligence. Google's solution is to routinely ship all that raw data up to its cloud and analyze it so understands all sorts of things about you. And if the police in some country want to review it, they might get access from Google to where you've been, everything you've bought, who's in your photos, and what days you went to the gym, just in case they want to build a case against you.

Google Maps can report where you've been to the police, resulting in jail time and losing your job before you can prove your own innocence, as it did for Jorge Molina. Imagine what a Google credit card could do.

Google Maps can report where you've been to the police, resulting in jail time and losing your job before you can prove your own innocence, as it did for Jorge Molina. Imagine what a Google credit card could do.As Apple continues to push the envelope in selling ever-sophisticated devices with access to some cloud services, Google has pursued an overall strategy of pushing its licensees to sell cheap end-user devices that connect to its extremely sophisticated cloud services for much of their smarts. That gives iOS the natural advantage of being able to honestly claim local device security and data privacy, while also allowing access to Google's services like Photos or Maps for people who don't care about their privacy. Android can't offer any real security, and certainly not at Apple's scale.

The Apple Card carriers

Effectively, the physical Apple Card is just a backup, not intended for primary use. It's preferable to have transactions occur on your phone where a local app can present and report your transactions. The titanium Apple Card only facilitates a payment with the bank, and does not report anything to your devices. However, as a physical metal credit card with users' names lasered onto it, Apple Card does associate customers' relationship to Apple with a tangible bit of hardware.

Sign up for an account and you're now a "card-carrying" Apple user. Every time it gets used, buyers will associate its security and privacy with Apple as a brand, another example of Apple's high tech, with feeling approach to making products that are not just technically advanced, but also emotional rewarding in their intuitive ease of use, secure satisfaction and purposefully delightful interactions.

The fact that Apple Card has no numbers and doesn't rely on the dubiously anachronistic security of a signature is a signal that Apple has again changed an industry, and is both smart and classy in working toward the interests of its customers. That's an incredible marketing halo for Apple to erect over the minds of its clients, and remind them of on a regular basis.

Some of the features Apple is releasing for Apple Card will eventually trickle down to other MasterCard issuing banks. In the future, more cards will lack a physically embossed number— remember that was for old fashioned carbon copy imprinters— and similarly move toward digital transactions using a form of NFC. Apple worked to introduce its Card right as all of the old legacy baggage of credit cards was ripe for throwing out, as the previous segment on Apple Card described.

The titanium Apple Card is also a brilliant way to induce more Apple Pay transactions. If you're used to pulling out a card to pay, Apple Pay can be a step you forget. But once you have a distinctive Apple Card, it's another reminder that you can also use your iPhone or Apple Watch to tap to pay, keeping your Card in pristine condition. Apple Card's app presentation of your transactions and purchase history make it even more useful to increasingly rely on Apple Pay transactions rather than using other cards.

Conversely, even users who are Apple Pay savvy will likely find other uses for the physical Apple Card they carry as a backup. Some significant percentage of Apple's vast installed base of affluent users are going to be crushing down substances and cutting lines with it. It appears to be almost perfectly designed for this use. And while that's almost certainly not part of Apple's strategy, it's still inescapable that a lot of people are going to be associating Apple's futuristic, rigid-edged, easily cleanable, flexible titanium premium-status card with partying.

A bigger Wallet for a smaller wallet

Once you sign up for an Apple Card account, it opens up the opportunity for Apple to also slim down the rest of your wallet by increasingly having your iPhone serve as door key authentication, as identification, and to potentially enter new markets from driver licensing and insurance, to mobile passports, to health care and gym memberships, to home access and everywhere else Apple would like to be making your life easier and more secure so that your next device will also be running iOS.

As users adopt parts of Apple's coherent strategy, it becomes easier to use other parts as well, deepening the ecosystem that invests users into Apple products. Apple's Wallet app presents your use of money in a way similar to how the Health app presents your physical activity.

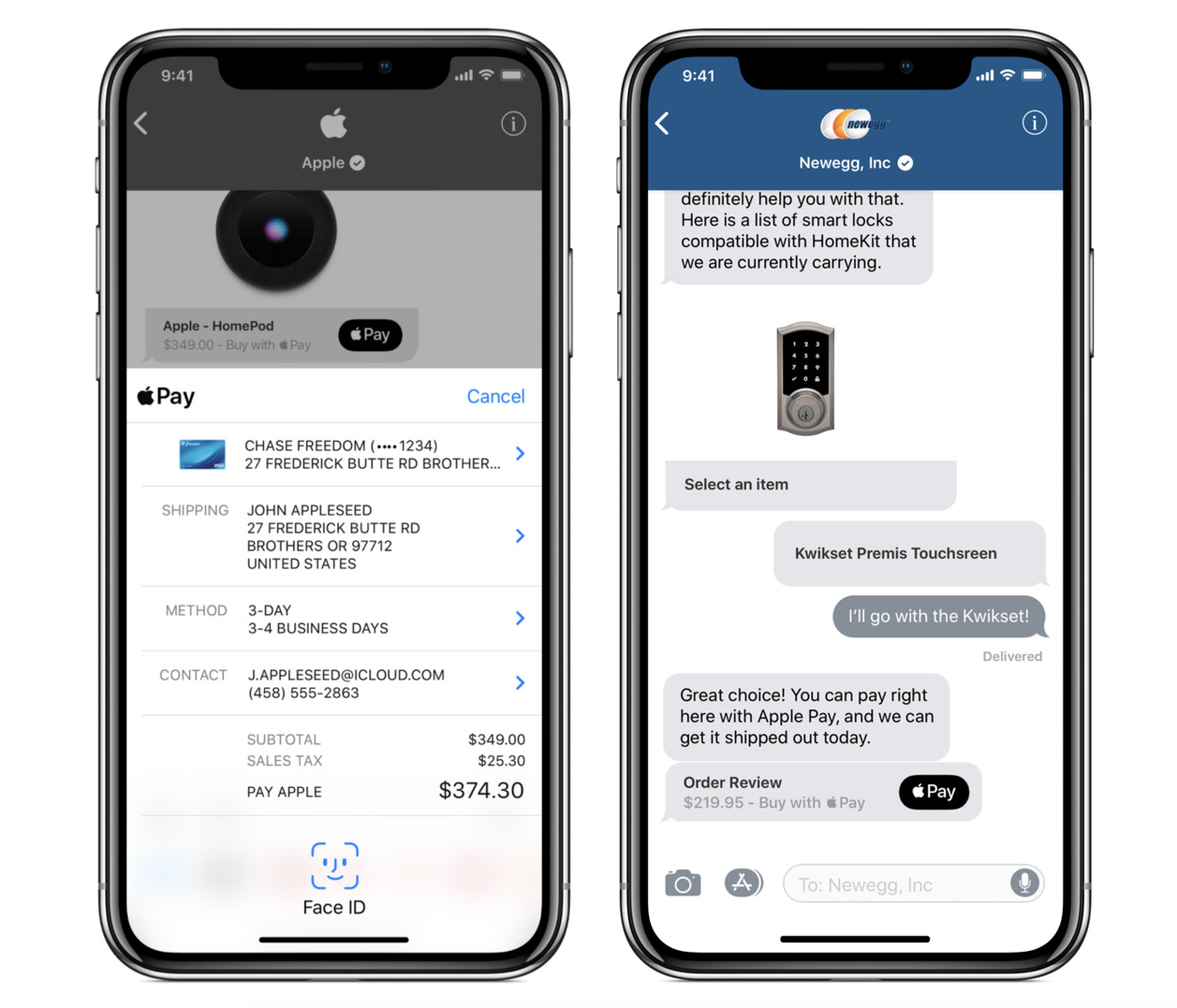

It also presents its customer support using Apple Business Chat, which takes advantage of the iMessage Apps platform to bring secure and custom interactions to familiar chat, inching away from the hassle of waiting on hold for customers and some of the expense of voice-based call centers on the other end.

These integrated Services are all a culmination of things Apple has been working on for some time. But now that the company has attracted a vast installed base of premium, affluent users in a world where there simply is no other alternative— apart from Androids that are explicitly designed to track you and sell everything they learn about you to marketers seeking to exploit you in ways that don't really align with your self-interest— Apple can now build out a new interconnected series of software services for its installed base.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Charles Martin

Charles Martin

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Sponsored Content

Sponsored Content

45 Comments

OK, but when?

Does Apple really need you marketing this thing for them?

I’m sick of companies that think they have to have a piece of every pie. Pick one or two things to do better than everyone else and focus.

Wall Street is a disease.

Can't wait for all this to take place. I also want the storage of Driver's and Insurance records on the same account with iPhone/Watch accessibility.

“Some significant percentage of Apple's vast installed base of affluent users are going to be crushing down substances and cutting lines with it.“

Would you you please translate that sentence into English, so that the rest of us can understand what you’re saying?