Institutional investors appeared to have lost some faith in Apple's performance last quarter, as a new examination shows that their holdings in the iPhone maker dropped 4 percent over the period.

The second quarter of this year marked the third quarterly drop in institutional ownership of Apple shares, according to a FactSet report cited Monday by MarketWatch. How solid a trend last quarter's four percent drop represents, though, is uncertain due to what appears to be a steady rebound in the company's share price.

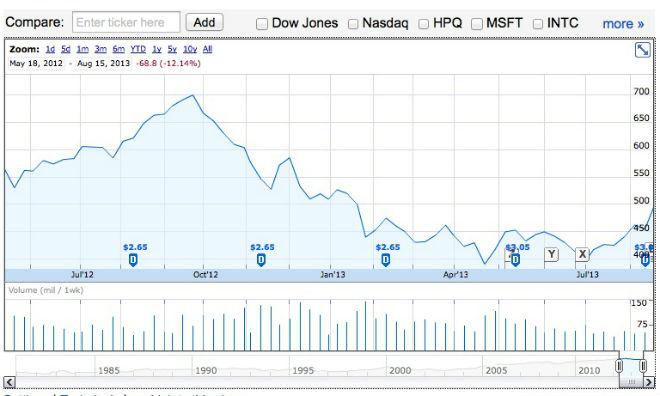

Apple shares dropped 10.4 percent over the second quarter to bottom out at $396.50, one of the company's lowest prices in years. Since then, though, shares have rebounded by 28 percent, and currently sit above $500.

AAPL saw a boost recently from the announcement by Carl Icahn that he was taking a roughly $1.5 billion stake in Apple, saying that the Cupertino company was "extremely undervalued." FactSet's figures predate Icahn's announcement, raising some questions as to the degree to which that institutional holdings trend is still applicable given the turnaround.

A number of investors have become very cautious on Apple in recent months, even given the company's strong profitability. Competition from Google's Android and other phone manufacturers, the reasoning goes, could gradually marginalize Apple at the expense of those profits. Wall Street has long called for Apple to introduce a cheaper iPhone or to bring out new, innovative products to spark growth again.

The past few weeks, though, have seen increasing evidence that Apple will at least debut a lower-cost iPhone in early September, a fact that has encouraged some investors. Additionally, Apple announced earlier this year a dividend program, a move thought by some to be aimed at putting a bottom under AAPL, which at the time was hemorrhaging value.

Still, institutional investors may hold off on repurchasing Apple stock until they see more of what the company has in store. In April, Apple's largest active shareholder cut its stake by 10 percent. At the same time, institutional investors grew their shares of Microsoft by 2.9 percent and of Google by 1.7 percent.

Kevin Bostic

Kevin Bostic

-m.jpg)

Amber Neely

Amber Neely

Oliver Haslam

Oliver Haslam

Malcolm Owen

Malcolm Owen

Christine McKee

Christine McKee

Charles Martin

Charles Martin

William Gallagher

William Gallagher

20 Comments

Finally!!! All the heavy lifting work of the nay-sayers and doom forecasters has paid off! They were working sooo hard at manipulating Apple's stock, I was afraid all their efforts were for naught!

Now, watch Apple's stock hit the stratosphere after September 10th.

Naw, they're taking their long waited profits for recording purposes, then will buy in again, starting afresh to gain the next profit share. It's a circle game.

Institutional Investors... maybe like Steve Ballmer, he made great decisions on Apple stock as well if I remember... what was the loss there according to AI... 11 billion plus??

I also read that Apple plunged to 79th in innovation somewhere...

Just keep bringing it, I have a few years to retirement and all this negativity is letting me load up on a vastly undervalued stock. Time to back up the truck!

Apple's stock is plummeting again, while most of the other mainstay tech companies are rising. I'm so fed up with this constantly recurring scenario, the hope from the last few days of major AAPL stock rises has gone...again! It'll probably be below 500 by tomorrow and back to 400 in a week...frustrating.

I wish more than 4% was the case. World will chase Apple in 2014 to new highs