Ahead of its June quarter earnings report next week, a number of factors have put Apple in a position to exceed investor expectations, making it a good time to buy into the company's stock, one analyst believes.

Maynard Um of Wells Fargo Securities issued a note to investors this week, a copy of which was provided to AppleInsider, in which he said he likes the conditions ahead of next week's Apple earnings. In particular, he said that investor expectations remain "very low" before the June quarter print.

Beyond that, Um sees a number of other factors playing to Apple's advantage, including the fact that the "iPhone 7" is rumored to look largely the same as the current iPhone 6s. While many see this as a negative in terms of driving sales, Um believes that using the same essential form factor could offset the typical cyclical decline in gross margins.

In addition, after the booming iPhone 6 product cycle, many customers will have had their handset for two-plus-years and could be due for upgrades, Um said.

He also believes that consensus estimates for iPhone sales in the December quarter and beyond look very conservative, putting Apple in a position to exceed expectations. His own forecast calls for Apple to ship 77.5 million iPhones in the December quarter, above Wall Street estimates of 75 million.

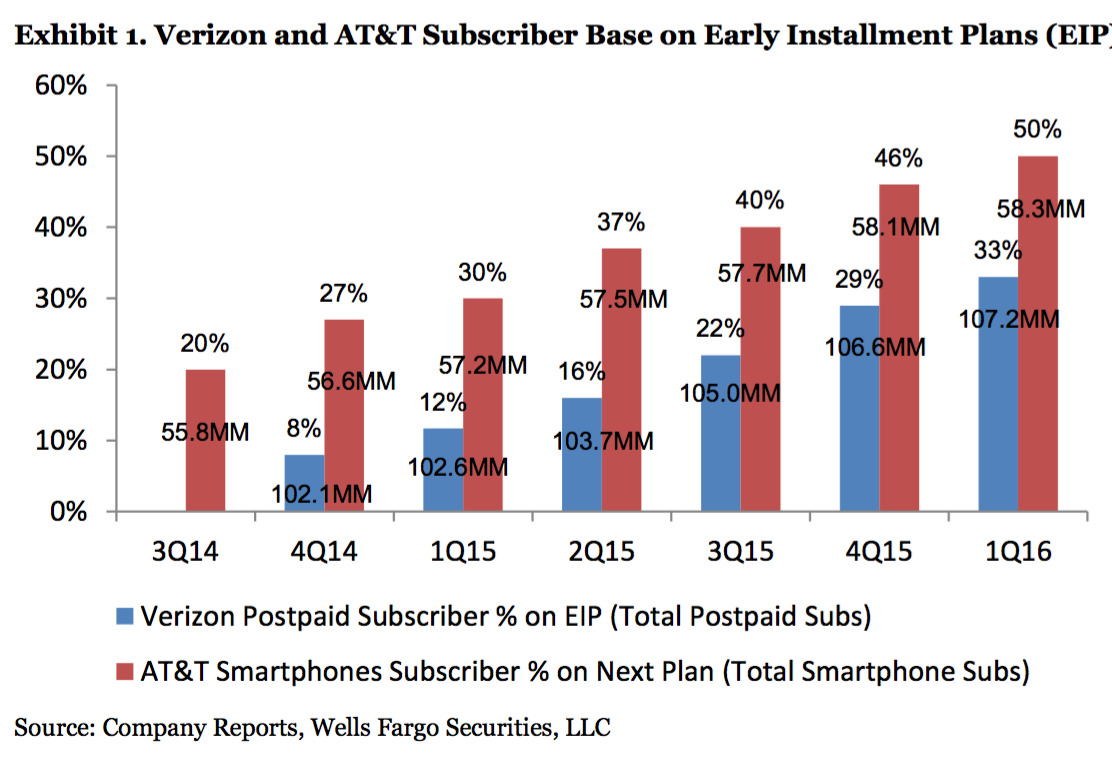

"With what we believe to be one of the lowest periods of investor sentiment, we believe any positive data points (such as supply chain) could rally AAPL shares, particularly if our analysis and premise about iPhone 7 units is correct (we believe carriers will want to limit churn of the large base of subscribers coming off contract)," the analyst wrote.

Wells Fargo has maintained its "overweight" rating for shares of AAPL, with a "valuation range" of between $115 and $125. Though Um believes investors should buy in, his price target range is slightly reduced from between $120 and $130.

Apple is set to report its June 2016 quarter results next Tuesday, July 26, after markets close. A conference call featuring company executives will follow at 5 p.m. Eastern, 2 p.m. Pacific, and AppleInsider will provide full, live coverage.

Neil Hughes

Neil Hughes

-m.jpg)

Malcolm Owen

Malcolm Owen

Andrew O'Hara

Andrew O'Hara

Andrew Orr

Andrew Orr

8 Comments

Translation? Pump and Dump. Beat down the company with an onslaught of negativity. Scare the shit out of investors by telling them Apple is a lost cause and on its last leg. Praise the competition as the future king of mobile. Drive the stock price down to the basement. Then, one week before the quarterly report, suddenly, miraculously find a pot of gold at the end of the rainbow. All is not lost after all, buy! Apple is okay again.

Nothing to see here, just like Apples product line. Good time to invest, a company can not keep this incompetence up for too long... eventually they will make something that people want to buy.

I understand the stock is down... Name one aspect where Apple is at the forefront these days. Maps? A joke, iMessage? Since it isn't compatible with other chat programs (as it used to be with iChat) I can hardly use it anymore, Siri? Well, it doesn't work that well in Dutch, Pro users? Apple lost to offerings from Adobe and HP, iPads? My company (3000 workers) are exchanging them for Windows 10 devices, so is the educational sector with chrome books. IMacs, MacBooks, Mac pro's? Way overpriced and dated hardware... I'm wondering what they're doing these days and wish they would bring as much attention to their products as to their shops and wristbands. China, India? Well, they're offering the same knitted together tech in phones or even better at half the price. Apple is getting lazy and arrogant and they're headed fore a well deserved nosedive. Don't flame me for speaking out what's happening today.