Investment analysts at Morgan Stanley have raised their target price for Apple based on the outlook for Services, iPhone 15 gross margins, and high consumer interest in Vision Pro.

Morgan Stanley's last target price change was a $5 drop from $215 to to $210 in October, where its analysts cited supply issues with the iPhone 15 Pro.

Now in a new note to investors seen by AppleInsider, the investment bank says that its latest "supply chain checks [are] showing relative stability in iPhone builds."

"We are turning more positive on AAPL shares as near-term risks are quelled & attention shifts to what could drive a recovery in fundamentals — Services, GMs and Edge AI," write the analysts. "With this backdrop, we address the top investor debates into year-end. PT moves to $220 as we M2M our valuation; Reiterate OW [overweight]."

Morgan Stanley believes that "well known near-term iPhone unit challenges in China," are being offset by "strength in Services and gross margins." Another reason for being "incrementally more positive" is the $3 trillion market cap, and how "year to date, Apple has outperformed the S&P 500 by 30 points."

Overall, the analysts say "we are turning more positive on AAPL shares as diminishing short-term risks refocus attention on what could drive a recovery in fundamentals over the next 12-18 months."

The key fundamentals are Apple's Services, its gross margins, and expectations over the company's AI or "Edge AI" position.

"We believe Apple is well-positioned to be an AI beneficiary via its ability to lead the market on Edge AI," write the analysts, "with its primary monetization mechanisms being 1) Hardware share gains/replacement cycle contraction, 2) new avenues for traffic acquisition costs (TAC), [and] 3) better Services monetization, 4) App Store purchases, and/or a 5) premium Siri subscription service."

"In short, we believe the need for more powerful hardware to run AI workloads at the edge could drive an iPhone upgrade cycle," continues the note, "with every 0.2 year contraction in replacement cycles driving 5-8% upside to our iPhone unit/revenue forecast."

Morgan Stanley says it has also found "very strong early consumer purchasing intentions" for the Apple Vision Pro.

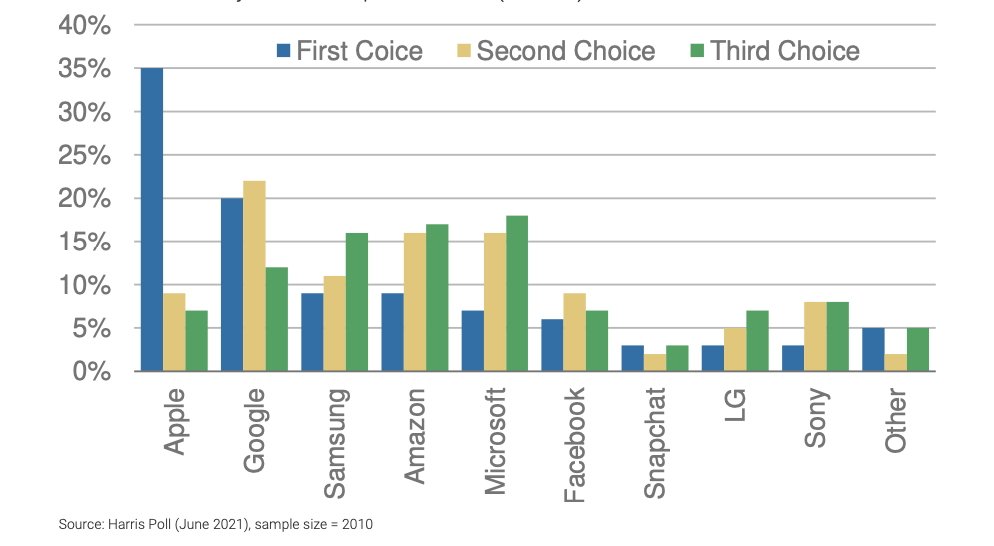

Preferred headset suppliers. Survey conducted before Vision Pro was announced. Source: Harris 2021 va Morgan Stanley

Preferred headset suppliers. Survey conducted before Vision Pro was announced. Source: Harris 2021 va Morgan Stanley"Our 2023 US China Smartphone survey showed... 33% of US iPhone owners and 74% of Chinese iPhone owners likely to purchase the Vision Pro within the first 12 months of release at the $3,500 price point," says the note.

Despite this, the analysts expect that the Vision Pro is going to be more of a long term success for Apple. That's because "50%

of US iPhone owners and 90% of China iPhone owners not planning to purchase a Vision Pro [say they are] likely to consider it at a cheaper price, on average between $1-2K."

Morgan Stanley's projections see "Apple's AR/VR headset [ramping] to $8 billion of revenue by year 3," which it says "would rank the product ramp just below AirPods, but above the Apple Watch."

Risks to Apple's profitability

The analysts do see several potential issues for Apple that are of concern to investors. However, in each case, Morgan Stanley believes Apple will not be greatly affected by them.

For instance, there are the impending EU laws that will force Apple to allow third-party app stores for the first time.

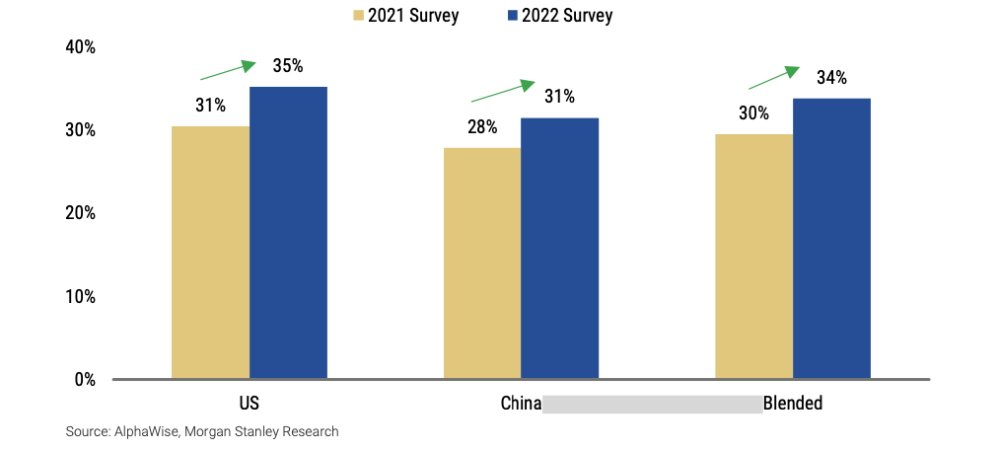

Apps would now have to be 35% cheaper before most users would consider buying outside the App Store. (Source: Morgan Stanley)

Apps would now have to be 35% cheaper before most users would consider buying outside the App Store. (Source: Morgan Stanley)Given changes to Apple's App Store risk factor language in its FY23 10K, we believe changes to comply with the EU DMA are imminent (thought still not yet finalized) and will likely come in the form of 3rd party app stores being allowed on iOS devices in the EU," say the analysts. "However, EU is just ~7% of App Store spend, and our survey work shows Apple remains well-positioned to compete, with consumers overwhelmingly preferring App Store's unmatched privacy, ease of use, and seamless OS integration."

Then there's the issue of the Department of Justice's case against Google. That did not encompass Apple, yet it's Google's deals with Apple that has come under most scrutiny and is perhaps under most threat.

"We still believe regulation/legislation [following DOJ vs Google] is a key risk for Apple, and see 5-8% downside to our FY26 EPS in the event of an adverse ruling in this case," says Morgan Stanley.

"However," it continues, "the recent pushout of the timeline for the DOJ vs. GOOGL trial, which is unlikely to reach a preliminary ruling until late 2024 (vs. prior expectations for as early as this month), followed by a lengthy appeals process and potentially further trials after that - which could put the date of conclusion into 2026 or later - means a key near-term overhang to AAPL shares is likely to be significant discounted by the market."

Declining sales

The one area where Morgan Stanley does not appear to be positive about Apple's future, is over the iPhone. There are issues both around falling demand in China, and a related chance of Apple cutting back on its orders for the iPhone 15 range.

Acknowledging this, the analysts note that "iPhone retention rates [are] at the lowest levels since 2013," but its supply chain checks "suggest limited risk of near-term iPhone production cuts."

Apple regained its $3 trillion market cap in December 2023, having first reached it in January 2022, then again in June 2023. In each case, the company shortly fell back below $3 trillion, and in each case that was believed to be because of investor uncertainty.

William Gallagher

William Gallagher

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

Wesley Hilliard

Wesley Hilliard

7 Comments

with a 3500 starting price, i dont think so, maybe in 2025 or 2026, besides they dont have an AI, comes from google and others :D