After an announcement months ago, Apple Savings is available for Apple Card users to transfer Daily Cash rewards into a high-yield savings account. Here's how to get started.

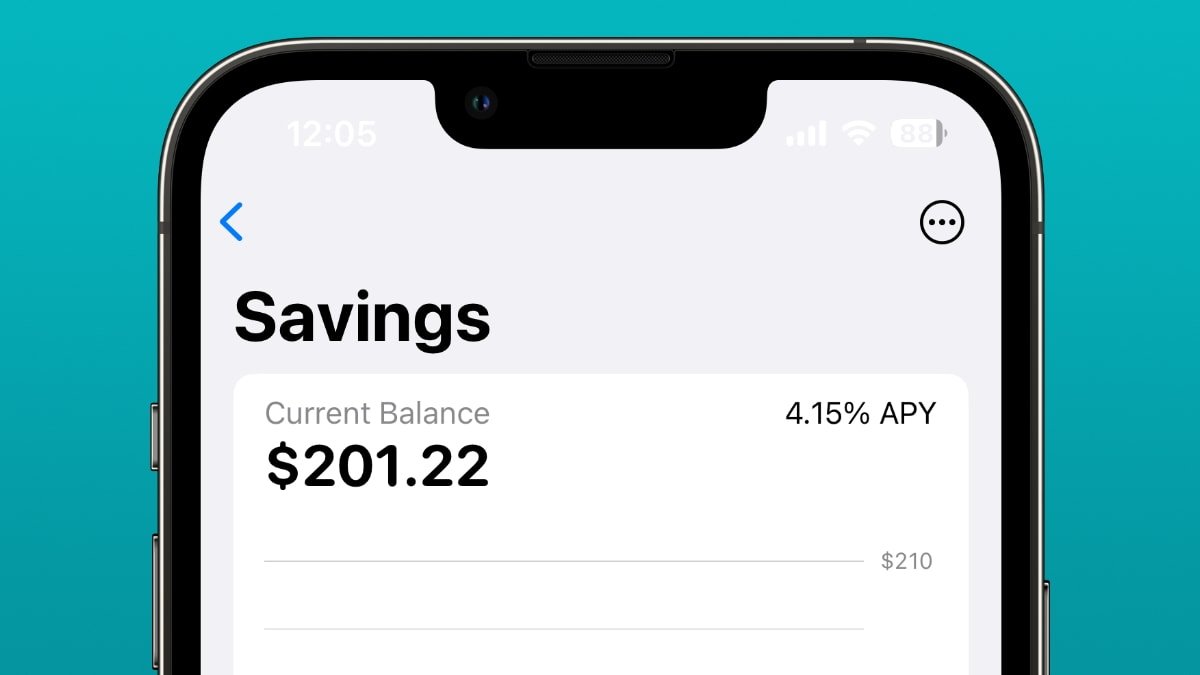

With no fees, minimum deposits, or balance requirements, Apple Savings can hold cash-back rewards or money transferred from a different bank. Like the Apple Card, Goldman Sachs manages the Savings account and offers a 4.15% APY.

Apple Savings appears after an October 2022 announcement and a silent period until March 2023 when a clause referencing Apple Savings was added to the terms and conditions of the Apple Card. The April 17 launch was discovered when someone inspected the code from Apple's servers.

Apple Savings — The beginning

When Apple first announced the savings account, it didn't give a specific timeframe for when Apple Card customers could access it. Instead, in typical Apple secrecy, it only said that it would be available in "the coming months."

After that announcement, various bits of news appeared that shed light on some of Goldman Sachs' financial activity. The bank has faced some troubles with its consumer-facing business, as it had traditionally served corporations, financial institutions, and governments as an investment bank.

It partnered with Apple to help launch the Apple Card, a consumer credit card and the bank's first credit card offering. Although Goldman CEO David Solomon called its partnership with Apple "the most successful credit launch ever," it wasn't without difficulty.

A report from January showed that Goldman Sachs posted over $1.2 billion in losses in the first nine months of 2022, driven mainly by loan-loss provisions and the Apple Card. The bank invested the money into building a system to support Apple Card transactions and has yet to have a return on its investment.

The Federal Reserve had also opened an investigation into Goldman Sachs to determine if the bank's consumer credit division had enough consumer protections. However, that is more about the Marcus savings account to see if it had appropriate oversight or management problems.

That, and another investigation from the Consumer Financial Protection Bureau (CFPB), cast doubt on whether the Apple Savings account would be launched. But launched it has, and Apple Card owners can now open a savings account with Goldman Sachs through the Wallet app.

Apple Savings — Terms & Conditions

Apple specifically markets the account as a destination for Daily Cash rewards, although customers can transfer money into Apple Savings from a different savings account.

As a savings account, spending money or making purchases in Savings directly from the Apple Card or Apple Pay is impossible. Instead, users must transfer money from Savings into Apple Cash or a linked external bank account.

There are some conditions to opening and maintaining an Apple Savings account.

- Be an owner or co-owner of an active Apple Card account and add Apple Card to your iPhone.

- Be at least 18 years or older.

- Have a social security number or individual taxpayer identification number.

- Be a US resident with a valid US address.

- Set up two-factor authentication for your Apple ID and update to the latest version of iOS. Savings is available with iOS 16.4 and later.

There are further terms and conditions listed in the Deposit Account Agreement. For example, while there is no minimum balance required to open an account, it does have a maximum balance of $250,000.

That is the standard limit for consumers to have their funds insured by the Federal Deposit Insurance Corporation (FDIC). And the Apple Savings account is FDIC-insured.

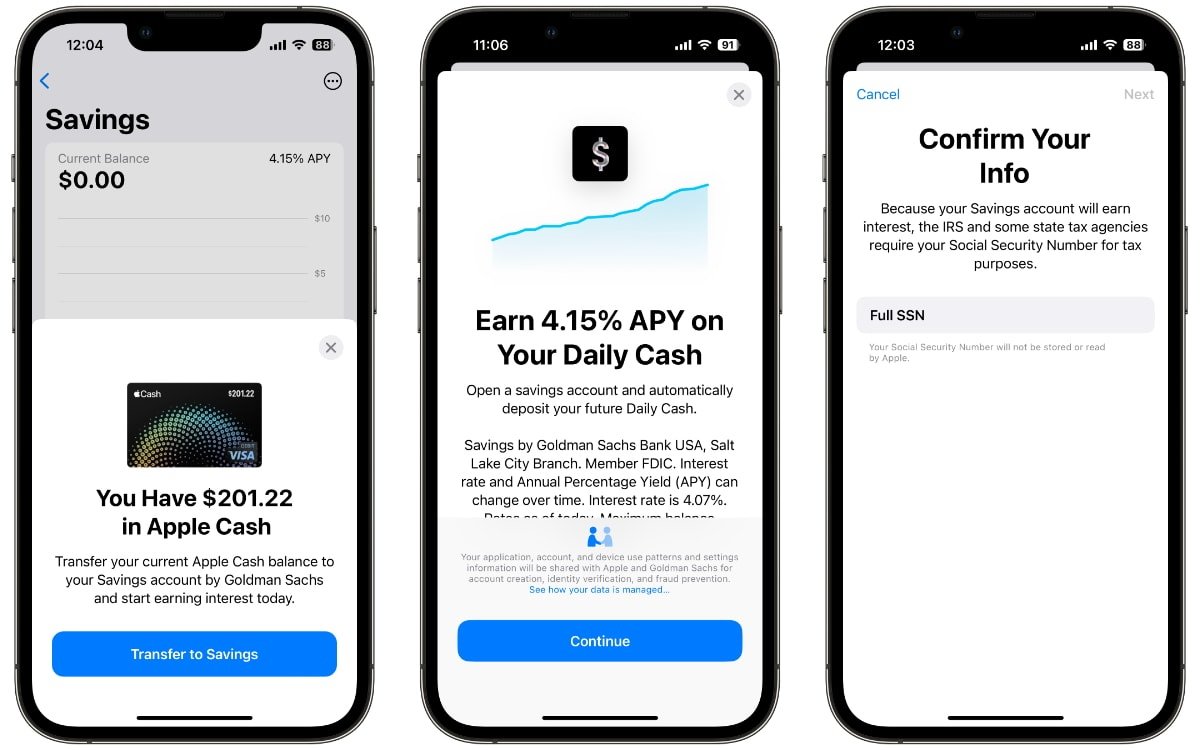

How to set up Apple Savings

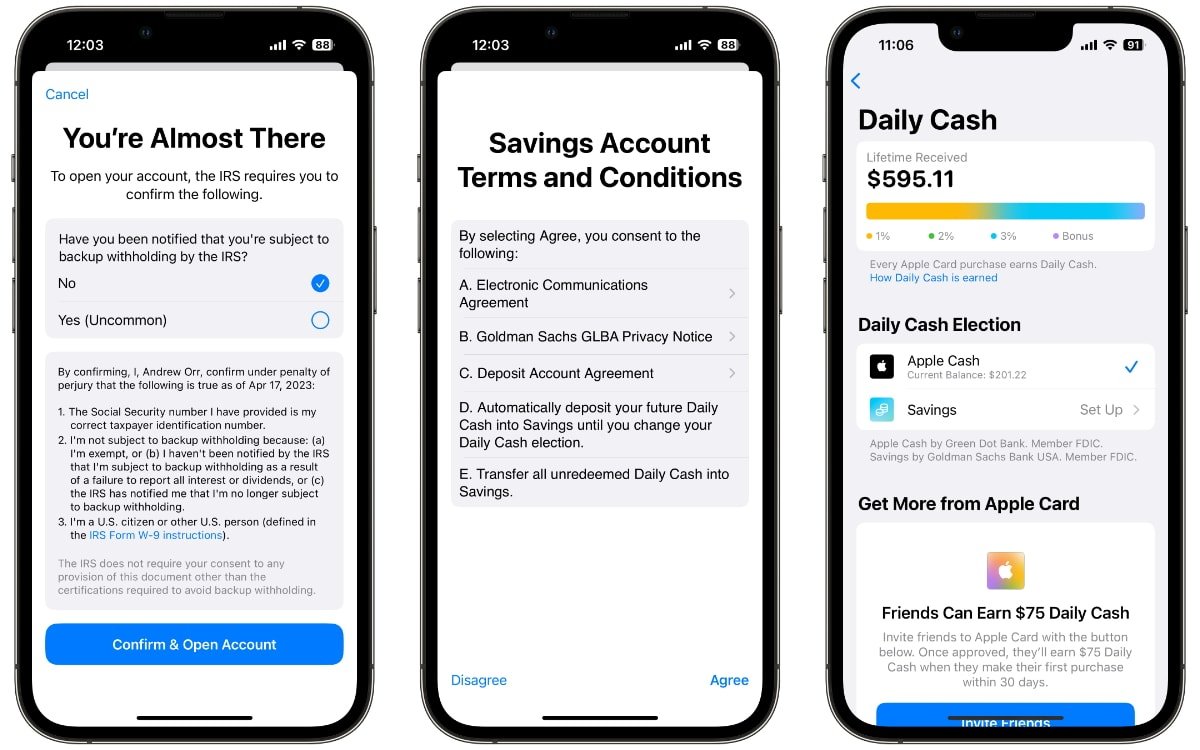

These instructions involve entering your full Social Security Number which Apple doesn't store or read, and agreeing to the terms and conditions. Finally, the IRS needs to confirm whether you're subject to backup withholding.

- Open the Wallet app on an iPhone.

- Tap the Apple Card.

- Next, tap the three-dot "More" button and select Daily Cash.

- Tap Set Up next to Savings and follow the onscreen instructions.

A backup withholding is an amount of tax the IRS may require a person to withhold a percentage of specific payments to report them on an information return. It's an uncommon occurrence, and most Apple Card users will be able to select "No" when asked.

After users set up an Apple Savings account, it will automatically receive further Daily Cash rewards. Apple Card owners can also go back into the Daily Cash section in the Wallet app and change the destination back to Apple Cash if they desire.

Andrew Orr

Andrew Orr

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Christine McKee

Christine McKee

Amber Neely

Amber Neely

Wesley Hilliard

Wesley Hilliard

William Gallagher

William Gallagher

34 Comments

With the continuous cloud of controversy that always floats over Goldman, you'd think Apple would have chosen someone else to build the Apple Card system with. I will probably set up the Apple Savings, but I can't decide if I want to move larger amounts of cash into it because of the Goldman factor. BTW remember derivatives? The complex and weird financial instruments that were a major cause of the 2008 financial crisis? Yeah well, they still exist and here's a fun fact: Goldman holds over $53,221,165,000,000 in derivatives as of the end of 2022. Yes, that's trillions.

I think Apple can do better and probably should be looking for a new partner for Apple Card, Pay, Cash and now Savings.

Setup was eazy peezy in a few seconds.

The option to create the savings account doesn't appear under 16.5 beta. The "3 dots" or "more" menu isn't present.

Update: I was able to create the savings account by clicking on "View Card Benefits" and following through. After the account is created, View Card Benefits must be followed to view the status of the account, add money, etc.

Will Apple Savings transactions be available to personal finance apps like Mint and Quicken?