Apple's voracious appetite for acquisitions outspent Google in 2013

Apple is quietly investing far more money to acquire talent, technology and production capacity than the market appears to realize, having liberally outspent even Google over the past year.

Apple's acquisition investments over the past quarter

While the identity of a significant number of Apple's acquisitions remains intentionally shrouded in mystery, the dollar figure of Apple's acquisition investments is publicly accounted in the company's financial statements. Both the tech and business media have sought to identify Apple's acquisition targets, but there hasn't been much attention directed to the significant and rapidly growing sums Apple is investing globally.

The rumored price Apple was believed to have paid for the three companies (Cue, PrimeSense and Topsy) it bought during the most recent Q1 winter quarter was said to be $595 million, nearly $100 million more than what Apple itself reported paying in cash payments related to business acquisitions (two other acquisitions identified during that quarter, Broadmap and Catch, are believed to have been completed before the quarter began).Over the past five quarters Apple has officially reported total acquisition investments of $11.12 billion, in addition to the $1.02 billion in cash "business acquisition" payments

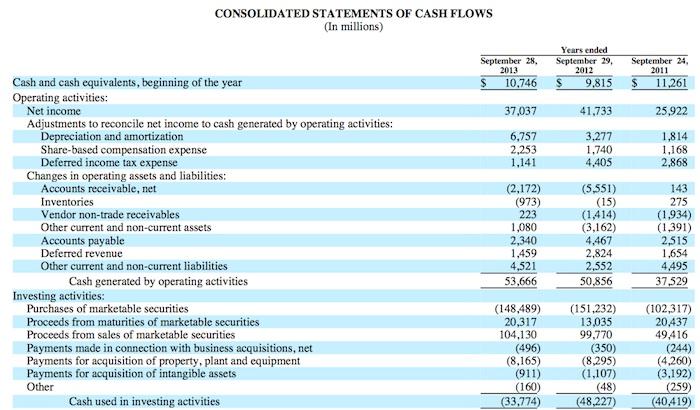

However, in addition to cash "payments made in connection with business acquisitions," Apple also reports even greater investments made in "payments for acquisition of property, plant and equipment" ($1.96 billion in the winter Q1 2014 quarter alone) and for "payments for acquisition of intangible assets," (an additional $59 million during that quarter). Also known as goodwill, "acquisition of intangible assets" refers to the premium price paid in excess of the fair market value of an acquired company's net assets.

This accounting breaks down the price paid for acquisitions into three primary buckets: payments made for a target company's non-depreciating assets (the value of its employees and technology, for example); payments made for property, buildings and equipment (that can easily be depreciated over time); and payments made for goodwill (such as the intangible value of the acquired firm's customers and reputation, which are also not depreciable).

In total, over the past five quarters Apple has officially reported total acquisition investments of $11.12 billion, in addition to the $1.02 billion in cash "business acquisition" payments. Quite clearly, Apple is secretly buying up far more assets in talent, technology and production capacity than the tech and business media are acknowledging (or are perhaps aware of), even though this data is public available.

Apple's acquisition pace rivaling Google's

Google, which has a reputation for spending record-setting amounts to acquire companies in a race against its competitors, reports spending $7.36 billion for "property and equipment" in calendar 2013 and $1.45 billion for acquisitions and "purchases of intangibles and other assets." That compares to Apple's fiscal year spending of $8.17 billion for "property, plant and equipment," $496 million and $911 million (a total of $1.41 billion) for "business acquisitions" and "acquisition of intangible assets," respectively.

Apple's annual acquisition spending pace has been neck and neck with Google, and that's even before backing out Apple's 2012 winter quarter and substituting its 2013 winter quarter instead in order to match up the period covered with Google's calendar year 2013 figures. Make that adjustment and Apple's acquisition spending for calendar 2013 grows to $7.84 billion for "property, plant and equipment," and $773 million and $832 million (a total of $1.61 billion) for "business acquisitions" and "acquisition of intangible assets," respectively.Who knew Apple had spent more on acquisition investments than Google last year?

Ignoring the accounting buckets that divide the investments into segments that means that during 2013 Apple invested a total of $9.45 billion into acquisitions compared to $8.81 billion by Google.

Who knew Apple had spent more on acquisition investments than Google last year? Apple doesn't publicize these figures because it's not trying to win the race on how much it can pay for acquisitions, just as Cook stated to shareholders last Friday. Cook also said Apple isn't in a race to make the greatest number of acquisitions. But clearly, Apple isn't concerned about the amount of money it is spending as much as it is the return on investment it can gain through those acquisitions.

Apple's acquisition value exceeding Google's

Now consider what value Apple has derived from its recent acquisitions. On Friday, Cook described Touch ID, the fruits of its most expensive recent purchase (the $356 million acquisition of AuthenTec), as "incredibly well received." As a driving force supporting sales of its premium iPhone 5s at the expense of iPhone 5c, Touch ID helped Apple to maintain premium iPhone Average Selling Prices by attracting upscale customers.

Touch ID materially contributed to record iPhone sales despite millions of low end Android shipments that drove the platform's ASP down to being 2.5 times less than the iPhone. The AuthenTec acquisition gave Apple exclusive access to advanced, market leading technology, and Apple delivered the feature about five quarters after acquiring AuthenTec.

A year prior to Apple's acquisition of AuthenTec, Google acquired its most expensive company in the $12.5 billion purchase Motorola Mobility. Spending 35 times as much didn't help Google build its hardware business or improve its ASPs or hardware profit margins. Instead, it simply hemorrhaged over $2.3 billion in losses across seven quarters. Google has now pawned the remains of Motorola off to other companies as scrap.

Motorola's products, even after a year and a half of Google draining its product pipeline and starting from scratch, were never "incredibly well received," despite being designed without a significant profit margin and intended to serve as simply a entrance into the hardware business. While the media focused on the ostensible value of Motorola's patents, the reality is that Google has accomplished nothing with them. Most of Motorola's products weren't even salable and its technology was neither exceptionally advanced nor market leading in any significant respect.

Now consider acquisitions targeting Google's primary business of ads rather than Apple's core competency in selling hardware. In 2010 Apple acquired Quattro Wireless for $275 million to develop iAd, after Google swooped in to pay $750 million for AdMob. Three years later, eMarketer reported that across 2013, Google's AdMob led U.S. mobile ad sales with $3.98 billion in revenues compared to Apple's iAd, which generated an estimated $258 million.

Apple's iAd acquisition has been berated as a failure over the past three years, in stark contrast to the tech media's defense of Google's Motorola purchase. However, iAd isn't bleeding money, even though it is not designed to be, nor is it run as, a profit center to monetize user behavior. Instead, Apple has used its acquisition to monetize iTunes Radio and encroach upon Google's near monopoly in mobile advertising while providing App Store developers with an alternative to Google's AdMob.

Acquisitions vs DIY

Apple's acquisition that resulted in iAd is an example of the company buying an entrance into an entirely new market. It's harder to say how much of Google's current ad empire can be attributed to the acquisition of AdMob. It's possible Google could have built a mobile strategy from scratch, the same way Apple developed hardware products like the iPad without needing to acquire an existing tablet company.

The same comparison can be made with other companies' recent big ticket acquisitions. While Microsoft paid $8.5 billion for Skype and Facebook ponied up $19 billion for WhatsApp, Apple developed its own iMessage and FaceTime services for text, photo, voice and video messaging. This not only allowed Apple to deliver its solutions first, but also resulted in highly integrated products all linked to the same user account, in stark contrast to the integration issues Microsoft and Facebook face.

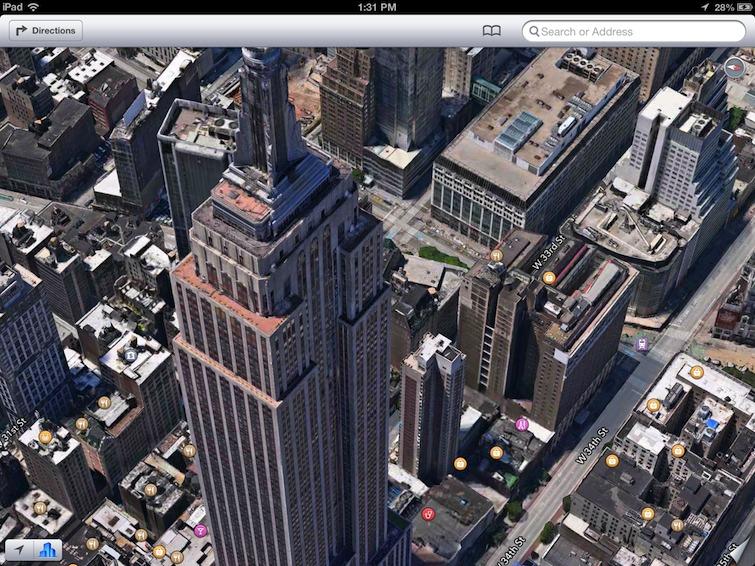

Conversely, Apple bolstered the internal development of its iOS 6 Maps project with a series of acquisitions, and continues to acquire mapping companies today. But the companies Apple acquired were all relatively small, in stark contrast to Nokia's $8.1 billion acquisition of Navteq in 2007.

Apple's unique acquisition strategy

Overall, Apple's history of business acquisitions has involved relatively small companies. More often than not, the acquired firms have directly resulted in key new apps, product features and services that have materially benefitted Apple's core business and enabled it to expand into new ones. Despite an impressive list of big ticket acquisitions, it's harder to say the same of Google, particularly in view of the litany of acquisitions that were intended to flesh out its wholly unsuccessful Google Wallet, Google Wave, Google TV and Google+ initiatives.

Google's reputation as a big spender in acquisitions also isn't allowing it to outpace Apple in terms of actual performance. Over the past two years, Google's gross profits have increased by $11.3 billion compared to Apple's profit growth of $25.5 billion, while its operating income has grown $2.3 billion versus Apple's $16.3 billion. Google's revenues grew by $21.4 billion, compared to Apple's revenue growth of $63 billion.

In part, this can be attributed to the fact that Apple has rarely sought to acquire huge companies, and instead has aimed to buy smaller firms that can deliver a technology (or be tasked to work on a new project) that has a high potential for immediate sale or strategic advancement. Included in Apple's accounting of acquisitions are investments made to obtain a portion of a company, whether a team, a facility or manufacturing equipment. This kind of selective investment avoids acquiring unwanted personnel, infrastructure and businesses that are only a distraction and drag on operations.

A recent example of a large capital investment in manufacturing capacity installed within another company's facilities is Apple's $578 million deal to build out sapphire production facilities operated independently by GT Technology. In fiscal 2013, Apple reported $8.2 billion in total capital expenditure payments, a figure that includes product tooling, manufacturing process equipment and other corporate facilities and infrastructure.

In fiscal 2013 Apple also spent just under $500 million to expand and enhance its own retail store facilities, a figure that could be compared to the value of spending the same amount to acquire an existing retail chain and then trying to convert it into something that could effectively sell the company's products.

Apple clearly isn't making acquisitions simply to make news about making acquisitions. In fact, while it quietly invests more than acquisition-happy Google, Apple has largely avoided suffering Google's buyers remorse in being saddled with superfluous employees it must lay off and undesirable infrastructure it has to auction or abandon.

Daniel Eran Dilger

Daniel Eran Dilger

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Chip Loder

Chip Loder

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Michael Stroup

Michael Stroup

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele