The quarter that saw the introduction of the iPhone XS and iPhone XS Max is the last of Apple's fiscal year. At a time when the average selling price has become more important to analysts than ever for Apple's main revenue generator, it is worth looking at several years of previous data to see how the latest one stacks up.

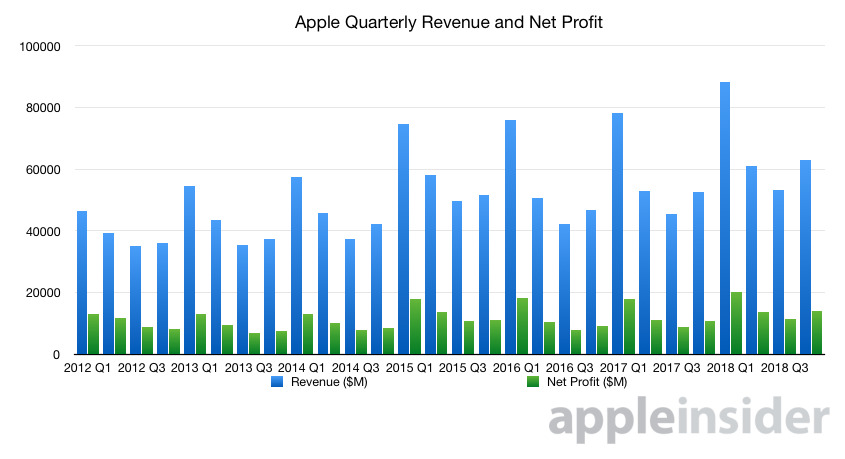

For the fourth quarter, Apple earned a total of $62.9 billion in revenue, which is over $10 billion more from the same period last year. This is above Apple's forecast for the period, which had a top end figure of $62 billion.

It is also worth noting that this quarter breaks a pattern from the previous five years, where the fourth quarter results are roughly comparable or below the second quarter's figures.

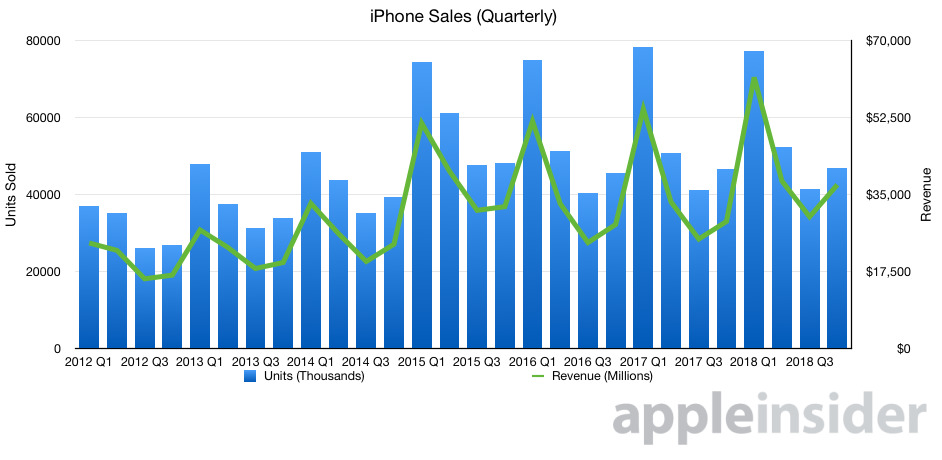

As to be expected, the iPhone makes the lion's share of revenue for the company, bringing in $37.2 billion compared to $28.8 billion from last year. The rise in revenue isn't accounted for by unit sales, as Apple sold 46.9 million iPhones in the period, barely higher than Q4 2017's 46.7 million.

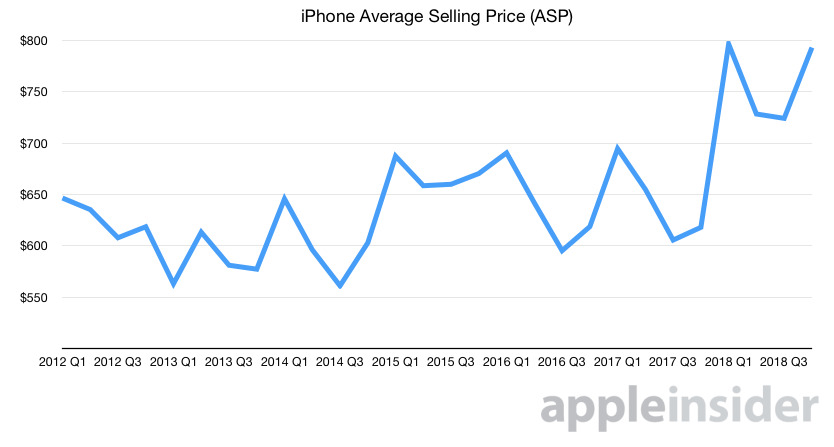

What can account for it is the average selling price (ASP), which this year was reported at $793, beating last year's figure of $617.99. This is explained by the continued sales of the high-priced iPhone X during the period, followed by the iPhone XS and the more expensive iPhone XS in the last few weeks of the quarter.

With sales growth relatively flat, this has led to analysts suggesting Apple will be relying on higher ASP levels in its products in the future, rather than purely increasing sales.

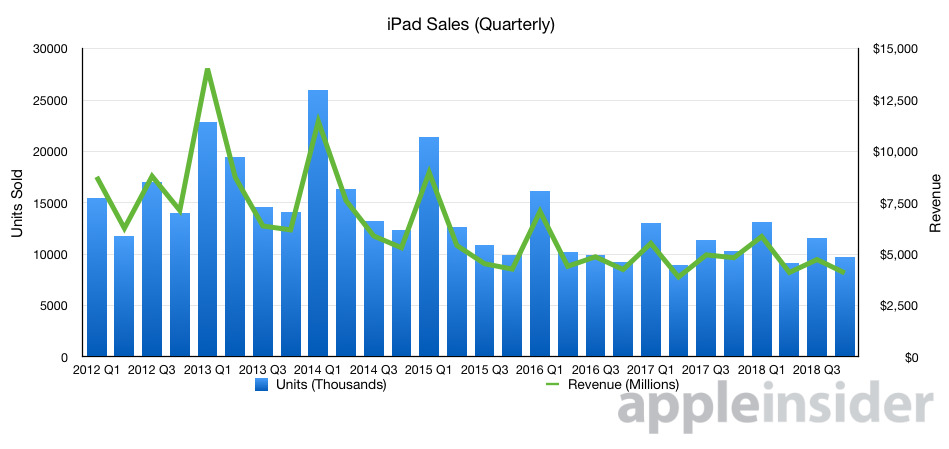

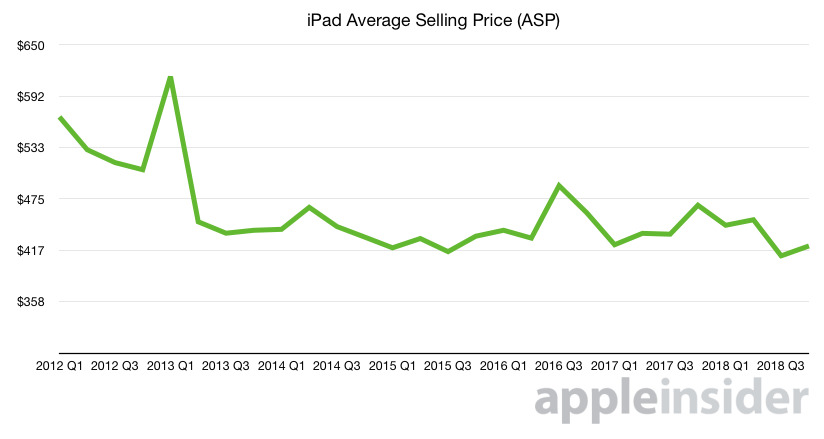

On the iPad side, there's little to be happy about. Sales are down compared to last year, and seemingly has the appearance of levelling off. It remains to be seen if the all-new iPad Pro will make a dent in the next quarter's finances, and if Apple will bring any of the new features like Face ID down to the iPad.

For ASP, the iPad Pro is likely Apple's biggest chance of increasing the figure dramatically. Of course, this does need to be match by sales for it to be of real value to the company.

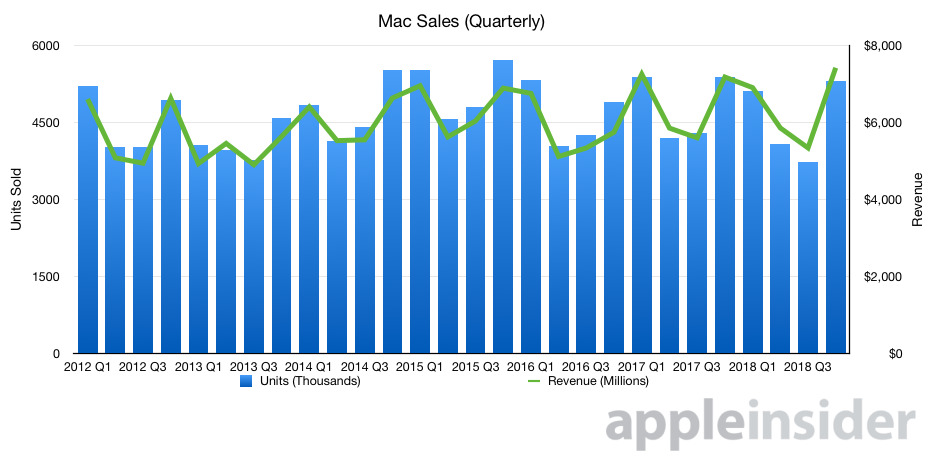

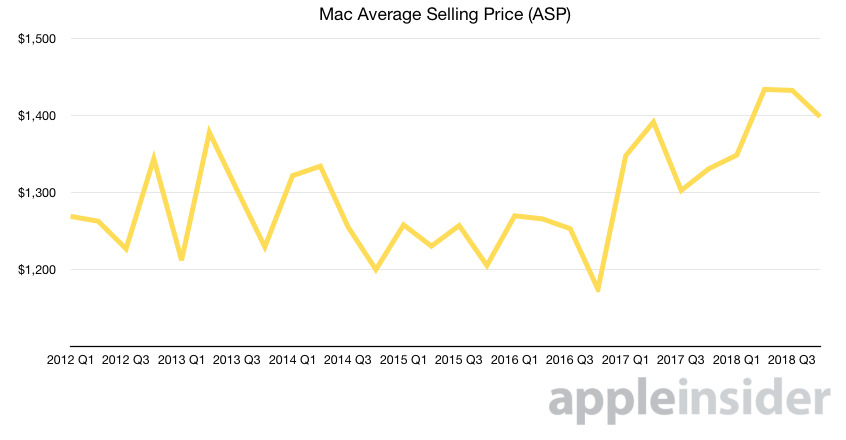

The Mac has improved its revenue from $7.2 billion last year to $7.4 billion this year. At the same time, sales of 5.3 million units is slightly down from 5.4 million. Again, the improvement is down to ASP.

While this quarter the ASP is down from earlier this year, it is still quite a high Mac ASP overall when compared to earlier years. This quarter also saw the introduction of new MacBook Pro models, complete with new processors and better GPUs, which likely helped this figure.

As a side point, it is worth noting that Apple has decided to change how it issues figures relating to iPhone, iPad, and Mac sales from the next quarter onwards, changes that will make it hard to determine the ASP of each segment. Aside from working from analyst estimations and supply chain or retail reports, it remains to be seen how accurate future ASP figures from experts will end up.

So, unless Apple specifically distributes this number, the ASP graph above is likely the last one.

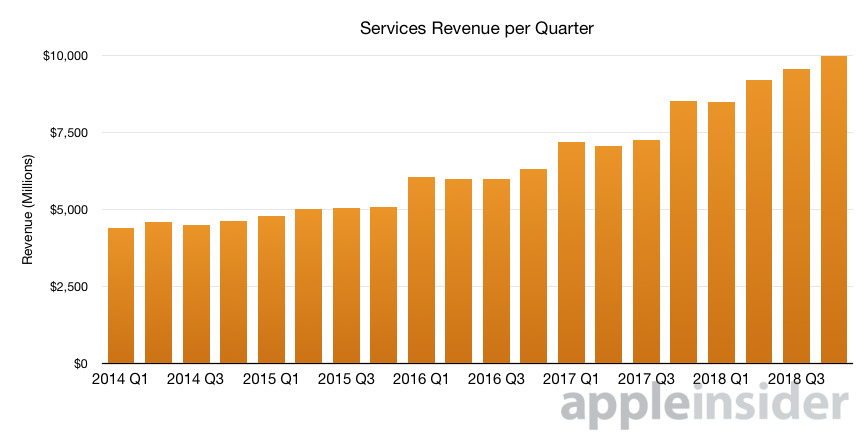

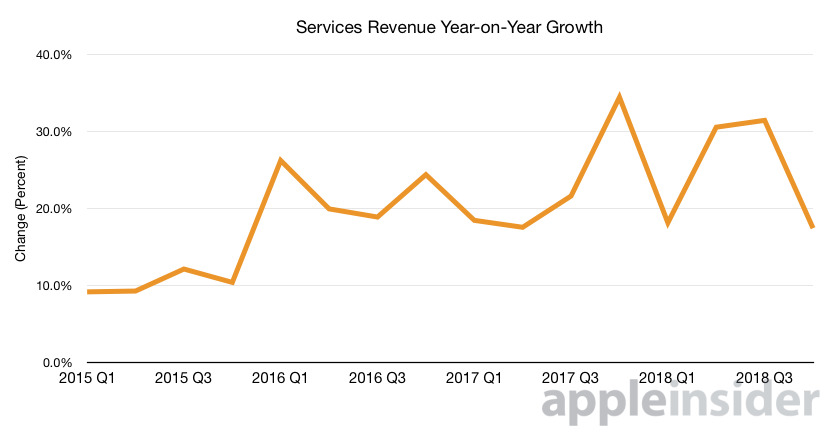

Services continues to be a trusty workhorse for revenue and growth, with the arm contributing $10 billion in revenue, $1.5 billion up from last year. During the period, Apple tripled its Apple Pay transaction volumes year-over-year, with Apple Music and the App Store also achieving quarterly records.

Yet again, Services manages double-digit growth, this time 17.4-percent year-on-year, and this is the 14th quarter in a row where the growth has been in double figures. Given the increased reliance for online services, and the rising usage of mobile payments, it's probably going to be growing like this for quite a while longer.

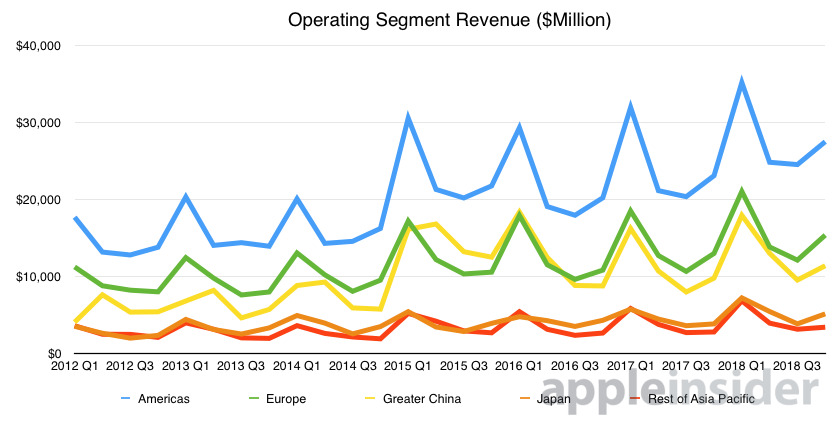

This last graph shows the vast bulk of Apple's revenue stems from the Americas, followed by Europe then Greater China. It is also worth noting that the combined revenue of the Japan and Rest of Asia Pacific operating segments is $8.6 billion, less than the company's Services arm's revenue.

Malcolm Owen

Malcolm Owen

David Schloss

David Schloss

Christine McKee

Christine McKee

Amber Neely

Amber Neely

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

Oliver Haslam

Oliver Haslam

18 Comments

(From one of my posts on ped30.com)

Okay, some numbers to play with this weekend:

• Apple appears to have bought back about 81 M shares last quarter. I’m assuming a flat 4.8 B shares outstanding.

• Net income was $14.125 B for the quarter, and $59.531 B for the fiscal year.

• EPS thus equals (59.531/4.8=) $12.40/share.

• At the present price of $205.65, that’s a “real” (backwards looking) P/E of (205.65/12.40=) 16.6.

I don’t think we need any clearer indication of how utterly stupid this selloff of AAPL is, but I couldn’t be more delighted, because Apple is in the market, buying back 20% of the stock that’s up for sale each and every day at fire sale prices, and consequently handing Wall Street it’s head on a platter.

What utter and complete vindication for Apple’s long term business plan.

say wh

at you want, stock prices will go down until a new event is scheduled, I guess March 2019