Apple's first fiscal quarterly results will be released by the company on Thursday evening. Here's what happened in the holiday quarter, and what to expect the iPhone maker to reveal to investors.

Apple confirmed on January 8 that it will be holding its holiday quarter earnings call on Thursday, February 1, 2024. The call, which will occur at 5 p.m. Eastern, will involve CEO Tim Cook and CFO Luca Maestri explaining to investors and analysts some of the details from Apple's Q1 2024 results, due at around 4:30 p.m. ET.

Last Quarter: Q4 details

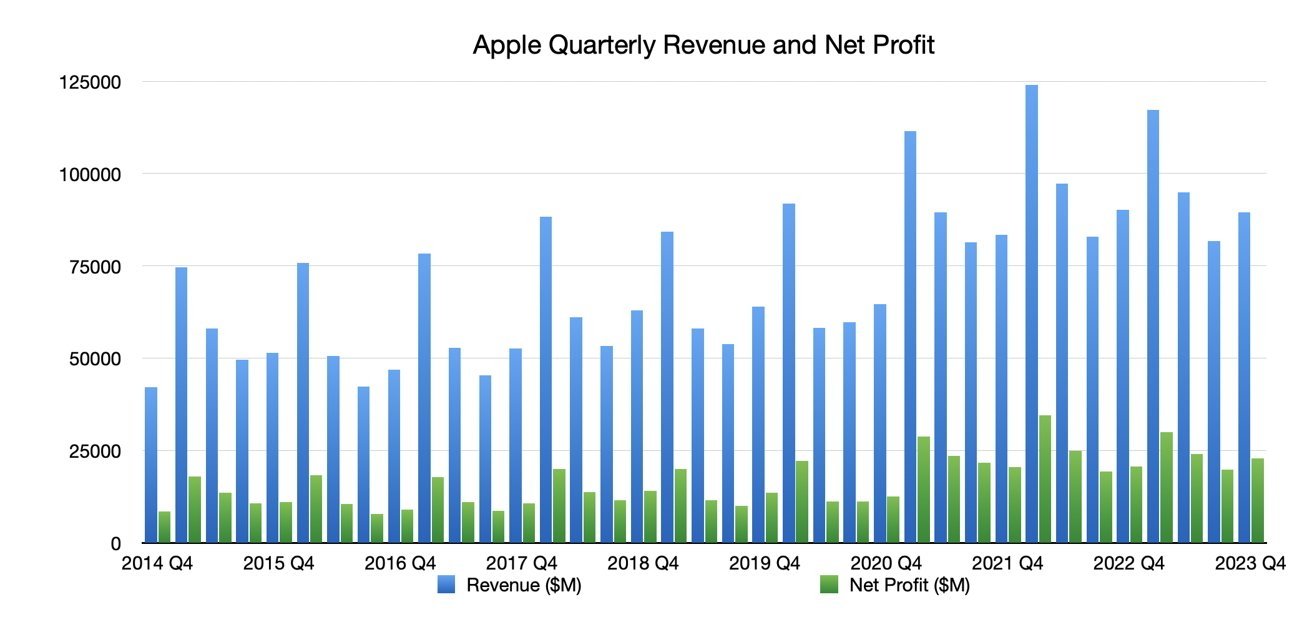

The Q4 results for the 2023 fiscal year was a mixed one for Apple, as it incurred its fourth consecutive YoY revenue drop in four consecutive quarters. However, it still beat the expectations of Wall Street.

For the quarter, Apple secured $89.5 billion of revenue, which is down from the $90.1 billion reported in Q4 2022. Apple also declared an earnings per share of $1.46.

In the period, iPhone revenue rose YoY from $42.6 billion to $43.8 billion. This offset the reduced iPad revenue from $7.17 billion in Q4 2022 to $6.43 billion in Q4 2023.

Mac revenue was down a lot from its $11.5 billion Q4 2022 figure, managing just $7.61 billion for Q4 2023. Wearables, Home, and Accessories was also down, but only just at $9.32 billion versus $9.65 billion.

Services continued to be a dependable sector, with growth from $19.19 billion one year prior to $22.31 billion.

Cook characterized the results as a September quarter record for iPhone revenue, and an all-time Services revenue record. Maestri added that Apple's active installed base of devices reached a new all-time high across all products and geographic segments.

For Q1 2024, Apple did warn of a potential deceleration of wearables sales, with the ITC sales ban causing problems for the Apple Watch in the United States. It also offered expectations that Mac sales would grow.

In post-results analysis, analysts were quick to claim Apple had mixed results that were in line with consensus, but they were also quick to move on to Q1 results speculation.

Year-Ago Quarter: Q1 2023

Four quarters before Q1 2024, Q1 2023 saw Apple haul in $117.15 billion in revenue. This was a decline from the year-previous quarter, which was Apple's record-setting $123.9 billion revenue quarter, and it also marked Apple's first year-on-year quarterly drop in revenue since 2019.

For the period, Apple's earnings per share was $1.88, down from $2.10 one year prior.

As usual, iPhone brought in the most at $65.78 billion for the quarter, though this too was a drop from $71.6 billion in the same quarter one year ago. Zhengzhou factory issues were blamed for part of the shortfall.

Revenue from iPad rose from $8.4 billion for Q1 2022 to $9.4 billion for Q1 2023, with Services also up from $19.5 billion to $20.77 billion.

Mac revenue dropped year-on-year from $10.8 billion to $7.74 billion, and Wearables, Home, and Accessories dipped from $14.7 billion to $13.48 billion.

What Happened in Q1 2024

Q1 results are, historically, the biggest money earner for Apple across the entire year, and for multiple good reasons.

The chief one is that it's the quarter when Apple's iPhones are bought by the public. Though the iPhone 15, iPhone 15 Plus, iPhone 15 Pro, and iPhone 15 Pro Max shipped on September 22, the end of Q4 2023, Q1 2024 will be the first full quarter to feature sales and shipments of the models.

Along with the iPhones, Apple also introduced the Apple Watch Series 9 and Apple Watch Ultra 2. Though the ITC ban has caused limited sales issues in the United States, the ban doesn't affect sales elsewhere in the world.

Apple also refreshed its AirPods Pro 2 at the same time, adding a USB-C case.

During the quarter, Apple introduced a new USB-C Apple Pencil, and held its "Scary Fast" event to launch new M3-equipped versions of the 24-inch iMac, the 14-inch MacBook Pro, and the 16-inch MacBook Pro.

Massive sales of Apple's product catalog are all but guaranteed as well, since they occur during the high-selling holiday sales period.

Excitement about the Apple Vision Pro may have helped sales, but since it won't be releasing until February 2, and in relatively limited numbers versus an iPhone release, it won't make that much of a splash until the Q2 results.

What Wall Street Thinks

Figures sourced from Yahoo Finance on January 27 based on 22 analyst opinions puts Apple as earning $108.37 billion as an average, with a high estimate of $113.99 billion and a low of $107.13 billion.

The earnings per share, based on 26 analyst opinions, could be at $1.93, with high and low estimates of $1.98 and $1.88.

CNN Money offered its own analyst survey figures. As of January 27, the consensus forecast sales of $126.1 billion, with a high of $131.6 billion and a low of $114.2 billion.

The EPS in this case is expected to be at $2.15, with highs and lows of $2.51 and $1.72.

On Marketwatch on January 27, its analyst forecast averages the EPS at $2.10, with a high estimate of $2.17 and a low of $2.02.

Individual analysts on Apple

Along with the overall analyst view, AppleInsider also reports on individual analyst expectations before the results.

Morgan Stanley

On January 24, Morgan Stanley characterized the results as a "clearing event" to stop short-term concerns and turns investors towards future growth.

"[Near-term] Product demand remains uneven, while Services is outperforming," says Morgan Stanley, "which we believe will result in a healthy December quarter beat, but March quarter guide down."

The forecast is for $119 billion in revenue, 1% to 2% ahead of its consensus.

Evercore

Evercore's note put forward that Apple will hit $117 billion in revenue, marginally below its $118 billion consensus figure, and practically flat from the year-ago quarter. Earnings per share is set at $2.08, up from $1.88 the year prior and below the $2.10 consensus.

Investor worries about China, as well as Services growth and Apple's dealings with the EU Digital Markets Act, will be at the forefront. Meanwhile Mac and iPad may end up turning fortunes around after a "couple years of post-COVID hangover."

It also offered a better forecast for the next quarter along, at $98 billion in revenue and an EPS of $1.65.

Wedbush

A forward look at earnings from Wedbush expects Apple will beat Wall Street expectations of $118 billion and $2.10 EPS. The hot-button issue during the earnings call is expected to be China and demand in the region.

"Our supply chain checks continue to show iPhone units that should be slightly up in FY24 which is a stark contrast to many on the Street calling for a steady unit decline over the coming year," the Wedbush note states. "ASPs continue to see an uplift in our view now trending in the $925 range with more consumers opting for the Pro/Pro Max."

Wedbush also repeated its expectations for Apple Vision Pro in 2024. It estimates 600k+ in shipments.

It rates Apple as an outperform and has a $250 target.

Gene Munster

Gene Munster is most interested in Apple updating the total device install base with the 2023 metric. The last time it was updated in 2022, it had increased by 11% to over 2 billion device.

Munster repeats previous concerns with China and rumors that government employees are being encouraged not to purchase iPhones. This could lead to headwinds for the iPhone in China and see impacts of a few percent in revenue.

The lack of an iPad update will affect iPad sales. Although, Munster believes it won't be as hard a hit as Wall Street expects.

Malcolm Owen

Malcolm Owen

-m.jpg)

Amber Neely

Amber Neely

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Chip Loder

Chip Loder

Brian Patterson

Brian Patterson

-m.jpg)

5 Comments

I predict that Apple will announce that they made several metric fucktonnes of money.

I expect their stock dropping 5% ~ 10% after their earnings presented while MSFT, NVDA, AMZN and GOOGL will smash the earning expectations with promising forecasts.

The gap of the market capitalization between MSFT and AAPL will be wider after Feb. 1.

Why?

Lack of interesting stories selling and telling. Even AI is uninteresting in the mobile world.

Literally, AAPL can´t give a magic moment with their generative AI. They can only do what Google Pixel 8 can do right now.

MSFT can sell their AI story easily as the AI market looks promising in B2B.

I don´t expect any surprising moments at AAPL.

I think AAPL will underperform in this year.

Don’t expect to much and you won’t be disappointed

In any scenario stock will fall after earnings announcement unless it’s a blow out which is doubtful