On May 18th, Apple will pay its shareholders of record (as of May 15th) a quarterly dividend of $0.63 per share. Apple will pay out $3 billion in dividends on its outstanding shares for the quarter, on stock that has appreciated 34.4 percent so far in 2017.

Apple has been paying its shareholders a dividend about a month and a half after the end of each fiscal quarter ever since it declared its modern dividend plan in the summer of 2012.

The May dividend will be the twelfth to occur since the company issued a 7-for-1 stock split. That split converted the dividend from $3.29 per share to 47 cents per share, which Apple subsequently increased to 52 cents, then 57 cents and again increased this year to 63 cents.

Over the past four quarters, Apple has paid out around $12.3 billion in dividends to its shareholders, distributing close to $3 billion every quarter, although that number has decreased slightly in tandem with the company's stock buybacks.

AAPL Buybacks

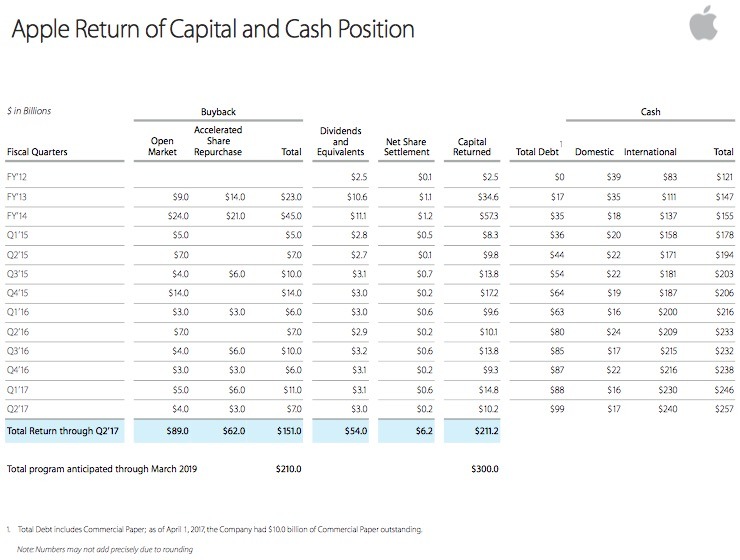

Dividends are a minority portion of Apple's shareholder capital return program, the majority of which has been earmarked for buying back outstanding shares.

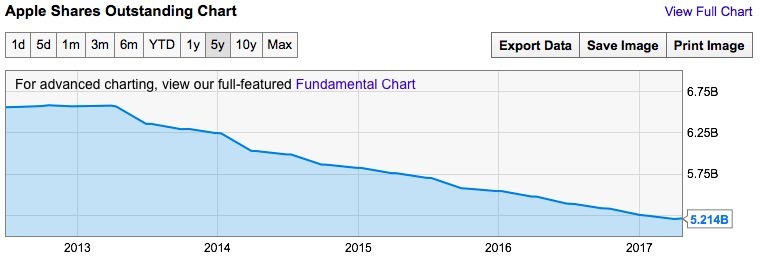

Buybacks increase the scarcity, and therefore value, of Apple's stock by taking shares off the market and retiring them. Removing shares from circulation also enhances the company's closely-watched earnings per share metrics. Over the last four quarters, Apple has repurchased $34 billion worth of its stock off the market or via accelerated repurchase programs, with $7 billion of that spent in the most recent quarter ending in December.

In total, Apple has spent $151 billion on stock buybacks since initiating its capital return program, including an opportunistic $14 billion share grab initiated after the stock plunged more than 8 percent in January 2015 following the company's holiday Q1 release which detailed its highest ever quarterly revenues and operating profits— results that the tech media depicted as "disappointing."

This happened again in the summer after Apple announced record earnings in June but market players raised the fearsome prospect of weak sales in China. Apple's shares tanked, enabling the company to opportunistically snatch up $14 billion of its own shares at what was then the lowest point in 2015.

Apple subsequently announced blockbuster earnings for the holiday Q4, particularly in China where revenue nearly doubled and iPhone sales grew by 87 percent in a market that only grew by 4 percent (meaning that outside of Apple, the market for smartphones had actually contracted). Apple also guided for growth higher than analysts were expecting. That correction in intelligence sent Apple's stock up a relatively meager few percent, followed by a massive collapse resulting from new rumors of supplier cuts that were interpreted as representing a massive decline in iPhone demand.

However, those rumors did not materialize in Q1 results. Instead, Apple provided guidance for Q2 to indicate a much smaller decline year over year than the rumors had anticipated. Even so, Apple's shares continued to fall to levels not seen since the summer of 2014, before iPhone 6— the most popular and massively successful computing device ever sold— appeared.

Against earlier predictions, iPhone 6s achieved similar sales in the winter quarter, while Apple's valuation returned to the days of iPhone 5/5s. Over the March quarter, Apple's global sales of iPhones, iPad and Macs were all lower than the year ago quarter, with the company attributed to a difficult economic climate and very unfavorable exchange rates across most of its international regions.

Apple's stock has appreciated dramatically in 2017, following strong earnings in the December quarter with the launch of iPhone 7; new MacBook Pros that helped boost Mac Average Selling Prices and hit new unit peaks; new wearables including Apple Watch Series 2 and AirPods and strong growth in Services from its growing installed base of loyal customers.

Combined with dividend payments and net share settlements, Apple has spent $300 billion on capital return since mid 2012.

AAPL Buyback History and Stock Appreciation

Apple's Capital Return program has been roundly criticized by some pundits, including Fortune columnist Shawn Tully, who a year ago declared the "wisdom" of the program as "looking pretty misguided" under the title "Apple Has Wasted Billions on Buybacks."

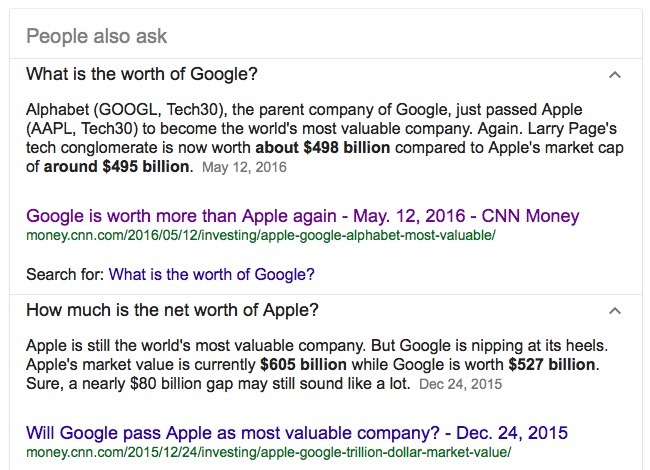

Apple's market cap is currently $813.9B while Alphabet is $651.3B, a difference of $162.6B

Tully was also excited to report that Google's umbrella company Alphabet "overtook Apple as the world's most valuable company," although that lasted only briefly (apart from Google's incorrect Snippets which continued to report false facts for nearly a year. Google still suggests that it is worth more than Apple in its search result answers, which draw upon old sources dating from 2015, below).

In reality, Apple's market cap is currently $813.9 billion while Alphabet is $651.3 billion, a difference of $162.6 billion, which is itself larger than the market cap of IBM ($141.3 billion).

However, Apple's Price/Earnings is just 18.31, compared to Google's P/E of 31.5. If investors saw the same potential in Apple as Google, the market cap of the iPhone maker would be closer to $1.4 trillion, rather than $814 billion.

As Apple's share appreciation sped past Google's, the "wisdom" of its buyback program has also resulted in what appears to be the most successful buyback programs ever initiated.

Prior to its 2014 stock split, Apple spent about $50 billion buying back shares at prices ranging from around $50 to $90. Since the stock split, Apple has repurchased shares at prices from $100 to $130 per share, at times significantly higher than the current stock price— indicating that Apple expected its stock to recover and appreciate to much higher levels. Apple expected its stock to recover and appreciate to much higher levels— and it has

Apple's shares have indeed since spiraled upward, closing today at $156.10. That means the $151 billion in buybacks has erased about 1.3 [actually 1.57] billion shares, which at today's valuation would amount to about $245 billion, about $94 billion more than it spent on buybacks, more than paying for all the dividends Apple has distributed since 2012 ($54 billion) [figures corrected for accuracy as noted by reader Carnegie]

As of April 21, 2017, the company has 5.214 billion shares outstanding. The number of outstanding shares actually increased slightly in April as Apple issued more new shares than it purchased— this appears to be the first time the share count has increased within a month since 2013.

Despite massive buybacks, Apple still has a massive pile of cash

Apple is currently using much of its domestic U.S. cash flow to finance stock buybacks and dividend payments, and is also issuing bonds at extremely low interest rates to help pay for its capital return programs.

It currently holds $240 billion of its total $257 billion in cash reserves overseas; spending those funds domestically would incur a substantial tax penalty unless the U.S. Congress approves a tax break to enable and incentivize American firms to invest their foreign earnings in America.

Investors generally view cash as bad for companies to hoard (due to low returns from conservative investments), but Apple can't currently distribute more cash to shareholders without incurring a substantial U.S. tax penalty.

That has made Apple's vast cash holdings a convenient problem to have, because it enables the company to borrow at interest rates very close to zero for domestic investment and capital returns to shareholders while still maintaining vast market power to make long term component deals and strategic investments ranging from acquisitions to expansions of its retail network and its production capabilities.

Apple currently holds $99 billion in total debt, including about $10 billion in Commercial Paper outstanding. Subtracted from cash holdings, this means Apple has $158 billion in liquid assets apart from the more than $10 billion in free cash flow it generates every quarter.

Last year Apple reported that it expected to invest $15 billion in infrastructure, tooling, retail and other capital expenditures in fiscal 2016. For the current year, Apple expects to spend $16 billion.

Massive Apple investments around the world

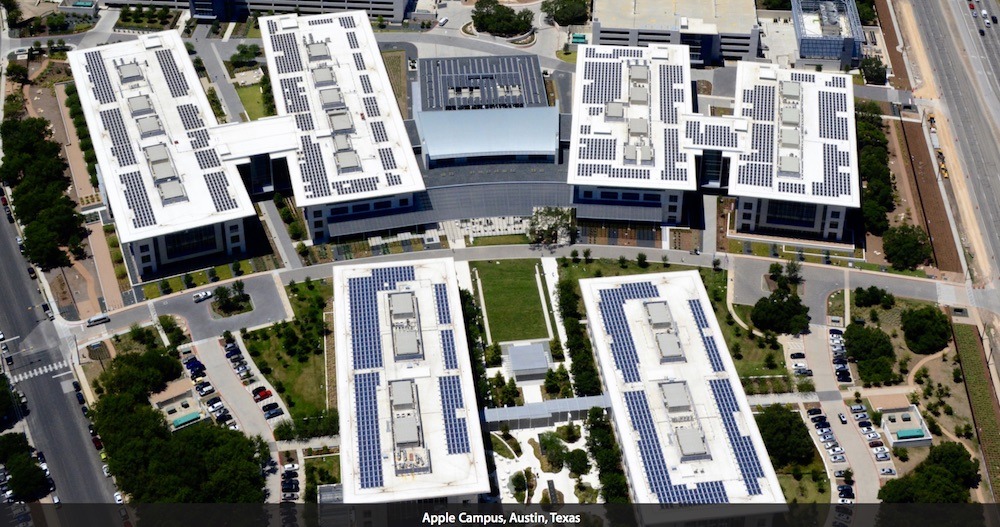

In addition to its vast new Apple Park campus in Cupertino, the company has reportedly leased a third very large "AC3" Sunnyvale campus, has nearly completed a massive 1 million square foot Americas Operation Center in Austin, Texas (below) and is operating a San Jose, California chip fab for some unknown, very secretive functions, flanked by nearby development sites capable of hosting a fourth major Apple campus in the Bay Area around 101 Tech, directly north of the San Jose airport, where Apple could build another 4 million square feet of office space.

Apple has also leased a million square feet of office space in the Broadway Trade Center in Los Angeles, California and operates what is believed to be a GPU Design Center in Melbourne, Florida near Orlando, as well as having built out a 1.3 million square foot iCloud data center global command facility in Mesa, Arizona that cost around $2 billion and which directs the activities of four, multi-billion dollar U.S. iCloud data centers in Maiden, North Carolina; Reno, Nevada; Prineville, Oregon and Newark, California.

In addition, Apple has opened new software development centers in Brazil, Italy and India, including a technology center in Hyderabad (above) and a Design and Development Accelerator in Bengaluru.

It has also built out multiple other research centers including the Zhongguancun Science Park in Beijing, China; three silicon-related research and development sites in Herzlia, Ra'anana and Hafia, Israel; a health and materials-related research facility at the Tsunashima Technical Development Center in Yokohama, Japan; a top secret production lab in Longtan, Taiwan; a Siri voice research lab in Cambridge, England; an apparent automotive research site at Kanata Research Park in Ottawa, Canada and a camera optics research facility in Grenoble, France. It also has started work on a new research and development center in Shenzhen, China.

Last May, Apple announced a $1 billion investment in Chinese ride-hailing company Didi Chuxing, a move that resulted in rival Uber ending its efforts to compete in China.

Apple also floated $441.5 million of Green Bonds over the last year to fund new projects related to environmental sustainability, as well as a $1 billion Advanced Manufacturing Fund and a contribution of $1 billion into SoftBank's 'Vision Fund' to "speed the development of technologies which may be strategically important to Apple."

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

16 Comments

Who cares how large Apple is in relation to Google? If they were smaller you'd tell us why it doesn't matter. But it doesn't matter either way. It's uninteresting to invest some much energy into talking about market valuation comparisons when it's all just based on speculation, greed and manipulation. This isn't a financial website. You'd be better off sticking to technology subject matters.

Another benefit of the buybacks is that they are now saving $819,000,000 in dividend payments per quarter at the current rate due to all of those retired shares, and this number is just going to keep getting better.

Have they really bought back 1.5 billion share? I'd love for that to continue.

"The May dividend will be the twelfth to occur since the company issued a 7-for-1 stock split. That split converted the dividend from $3.29 per share to 47 cents per share, which Apple subsequently increased last year to 52 cents and again increased this year to 63 cents."

Actually, Apple increased to 52 cents the prior year, then to 57 cents last year and from there to 63 cents this year.