Following a $23.5 billion buyback in the March quarter, Apple discreetly bought up another $20 billion of its own shares off the open market in the June quarter, taking advantage of the continued, vapidly ignorant noise generated by analysts and financial news sites who bizarrely wondered aloud for months when and how Apple might "kill" the most advanced, commercially successful smartphone it has ever produced.

Apple greedy for its own shares while Street Analysts were fearful

Apple's shares have appreciated nearly 11 percent over the first two calendar quarters of 2018 (Apple's fiscal Q2 and Q3), but the company is still valued like a utility, with a Price/Earnings ratio of 17.5. And Apple's shares are not near their peak. Last quarter, Apple's P/E reached 18.2 (which was slightly lower than last summer!)

In comparison to Apple's meek valuation, Google's P/E is 32.96, Facebook's is at 26.69 even after its recent correction, Netflix is at 142.05, and Amazon's is at a lofty 161.43. If investors understood the same potential in Apple as they see in FANG stocks, the market cap of the iPhone maker would be multiple trillions, rather than $956.48 billion.

Instead, we're getting regular "news" reports that Google and Amazon are "racing" Apple toward a trillion dollar valuation, as if such a benchmark would somehow make up for the fact that Apple earns far more money across a broader set of businesses, globally and has successfully branched out into new markets and segments. Both companies are nearly $100 billion behind Apple in their valuation, despite the recent dip in Apple's share price prior to earnings.

Additionally, while nobody is reporting that Google is "killing" its old software for new technology, analysts have been shouting from the rooftops that Apple is desperately trying to distance itself from iPhone X via something akin to murder, supposedly because the product was somehow bad news and barely hanging on to life support anyway because it offered buyers "nothing new" and is supposedly too expensive.

The incredible sewage pipe of analysts and supposed journalists working together to fire out a torrent of turbid slop in Apple's direction is quite incredible in the shameless nature of its purely false stink. The incredible sewage pipe of analysts and supposed journalists working together to fire out a torrent of turbid slop in Apple's direction is quite incredible in the shameless nature of its purely false stink

In May, after two quarters of Apple reporting that iPhone X had been its most popular phone it sells, the chief orifice of AAPL hogwash CNBC published "More evidence emerges that Apple is killing its iPhone X, analyst says," a piece by Arjun Kharpal that outlined with the straightest face possible that some minor analyst had figured out a way to pretend that success was failure and up was down.

Kharpal presented the logical leaps of Mirabaud Securities analyst Neil Campling in a bulleted list resembling unquestionable facts, suggesting that Apple's actual sales and ASP could be ignored in favor of examining the earnings of Cognex, a small company that "sells technologies to factories that assist with putting OLED screens on iPhone X devices."

Because "Apple accounts for 20 percent of Cognex revenues," there was some reason to believe that this could be interpreted to mean that this vendor's "slowdown can be attributed to Apple killing off the iPhone X," Campling stated.

Never mind the clearly documented performance of iPhone X in boosting Apple's sales, drawing in customers and convincing them to pay a high premium for its technological advancements. Here was a supply chain rumor fronted by a virtual nobody!

"Cognex results provide further evidence that the smartphone cycle has turned south, the OLED overcapacity bites and Apple's iPhone X is over," Campling told his clients. CNBC confirmed this logic with Campling on a phone call.

"If Apple is stepping back from the iPhone X production cycle, then Cognex is lead indicator of when that is taking place," he noted. Kharpal also pointed out that Ming-Chi Kuo of KGI Securities had "said the iPhone X could be canceled in the summer." Case closed!

Instead, Apple drew down its internal iPhone inventory by a surprising amount, and continued to sell tons of iPhones. Additionally, iPhone X continued to be Apple's most popular model, even despite CNBC trying to make a news story out of a personal theory of an analyst who claimed to know a lot about one of Apple's smaller suppliers.

Recall that Bloomberg similarly constructed an elaborate palace of flawgic that claimed in the spring that Samsung's inability to find growth in its OLED panel business was clearly evidence that Apple was finding limited demand for iPhone X, because it used Samsung's OLED panels.

Never mind that Samsung's own higher-end Galaxy S9 OLED-based phones were not selling great, or that Samsung had also reported sales troubles in its non-OLED screen business. Bloomberg specifically failed to note material facts because those would have caused its story to crumble immediately, rather than just failing to stand up to Apple's earnings a quarter ago.

In the end, these panics whittled down Apple's share prices, enabling the company to dive in and buy up shares at a discount, and in incredible volumes that appear to be unprecedented even in an era of monster buybacks.

Walmart, Starbucks and Union Pacific have all recently announced buyback plans of around $20 billion, but all three planned to make that the maximum they could do across two years. Apple just did that in three months, after already having done it three months ago!

This all happened before

While essentially unprecedented in sheer scale, Apple has previously dropped massive coin on quarterly buybacks after analysts dragged the company's stock down with irrational fear mongering, often rooted in panics built on channel check mumbo-jumbo.

Back in 2015, Apple spent an opportunistic $14 billion on a share grab it initiated after its stock plunged more than 8 percent in January following the report of its highest ever quarterly revenues and operating profits— results that the tech media depicted as "disappointing."

The same thing happened again that summer after Apple announced record earnings in June but market players raised the fearsome prospect of weak sales in China. Apple's shares tanked, enabling the company to opportunistically snatch up another $14 billion of its shares at what was then the lowest point of the year.

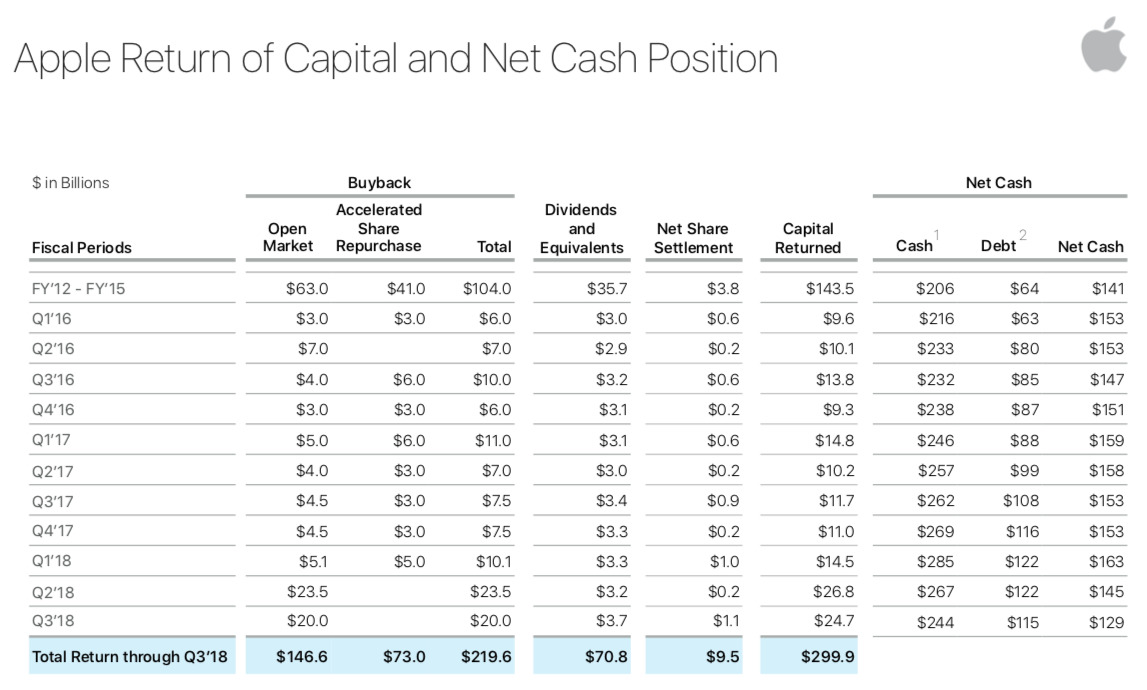

Since the start of Fiscal 2016, Apple sped up its buyback rate, spending nearly as much ($96 billion) in 2.5 years as it spent across its initial four FY ($104 billion) of stock buybacks. The company has now allocated another $100 billion in stock buybacks, on top of about $10 billion in remaining funds that have already been set aside for stock repurchase.

Apple's biggest acquisition yet

Apple began buying back shares in 2012, paying market prices for its stock and then destroying those shares. That process makes the remaining shares in the company more valuable, effectively returning the value paid to shareholders. This benefits outside investors in the company, as well as its employees who hold shares. It also enables Apple to recruit talent because it can offer valuable stock options. Buying back shares is effectively an investment in the company itself.

Since 2012, Apple has spent a total of $219.6 billion in share buybacks. Across 2016 and 2017, it spent between $6 and $10.1 billion per quarter on both open market and Accelerated Share Repurchase programs to buy its back stock. However, since the start of 2018, Apple has more than doubled its pace, spending an astounding $23.5 billion on stock repurchases in the first calendar quarter, followed by another $20 billion this quarter. Since the start of 2018, Apple has more than doubled its pace, spending an astounding $23.5 billion on stock repurchases in the first calendar quarter, followed by another $20 billion this quarter.

Apple's stock repurchase plans have been constrained in part because of U.S. tax laws that levied a substantial penalty tax on the repatriation of money earned overseas. Because it was not required to return these funds, Apple left its foreign earnings invested outside the U.S. and began borrowing money at very low interest rates to fund its buybacks.

Now that this tax rule has been changed (something that both U.S. presidential candidates promised to do during the 2016 election), Apple can use its foreign earnings to invest domestically while paying a reasonable tax rate (it plans to pay $38 billion in repatriation taxes), reducing its cash pile and putting its money to work.

Apple's $43.5 billion stock repurchase— in just the last two quarters— is nearly 16 times the size of its largest-ever acquisition (Beats) and more than four the size of Google's acquisition of Motorola Mobility. It's close to double the IPO valuation of Spotify or Microsoft's massive acquisition of LinkedIn— but was quietly performed without any lengthy regulatory approvals or the layoffs of redundant talent. And unlike Motorola, Spotify or LinkedIn, Apple's "self acquisition" target was actually profitable.

Betting against AAPL

Even as this pattern of fear and loading continued to repeat, pundits took potshots at the company's buyback strategy itself. In early 2016, Fortune columnist Shawn Tully declared the "wisdom" of Apple's buybacks as "looking pretty misguided" under the title "Apple Has Wasted Billions on Buybacks."

Tully was also excited to report that Google's umbrella company Alphabet "overtook Apple as the world's most valuable company," although that lasted only briefly. Apple's market cap has remained well ahead of Alphabet since.

As Apple's share appreciation has increased its pace against Google's, the "wisdom" of its buyback program has also become evident in what appears to be the most successful buyback program ever initiated.

Prior to its 2014 stock split, Apple spent about $50 billion buying back shares at prices ranging from around $50 to $90. Since the stock split, Apple has repurchased shares at prices from $100 to $130 per share, at times significantly higher than the then current stock price— indicating that Apple expected its stock to recover and appreciate to much higher levels.

Apple's shares have indeed since spiraled upward, last closing at $190.29. That means the first $151 billion in buybacks erased about 1.57 billion shares, which at today's valuation would amount to more than $298 billion, about $147 billion more than it spent— more than paying for all the dividends Apple has distributed since 2012 ($70.8 billion) and the buybacks it has spent since last summer. That fact that Apple is still buying back shares— at a pace even faster than before— indicates that it still thinks it is dramatically undervalued by investors

That fact that Apple is still buying back shares— at a pace even faster than before— indicates that it still thinks it is dramatically undervalued by investors. Incidentally, the shares Apple is buying back are open market purchases, meaning they are coming from the weak hands of shareholders willing to sell at current low P/E valuations.

Apple's buybacks are not only reducing its outstanding share count but are also erasing the doubters among its shareholders, effectively reducing the volatility in its share price.

Despite massive buybacks, Apple still has a huge pile of cash for global investment

Due to tax laws, Apple has been using much of its domestic U.S. cash flow to finance stock buybacks and dividend payments. To tap into its foreign earnings, it also began issuing bonds at extremely low interest rates around the world. It no longer needs to do this.

The company currently holds $244 billion in cash reserves overseas and $155 billion in total debt (the lowest debt it has reported across the last four quarters). Subtracted from cash holdings, this means Apple has $129 billion in liquid assets apart from the more than $10 billion in free cash flow it generates every quarter.

In addition to its vast new Apple Park campus in Cupertino and its nearby "AC3" Sunnyvale campus (above), Apple recently completed a massive 1 million square foot Americas Operation Center in Austin, Texas (below) and is operating a San Jose, California chip fab for some unknown, very secretive functions, flanked by nearby development sites capable of hosting a fourth major Apple campus in the Bay Area around 101 Tech, directly north of the San Jose airport, where Apple could build another 4 million square feet of office space.

Apple has also leased a million square feet of office space in the Broadway Trade Center in Los Angeles, California and operates a GPU Design Center in Melbourne, Florida near Orlando, as well as having built out a 1.3 million square foot iCloud data center global command facility in Mesa, Arizona that cost around $2 billion and which directs the activities of four, multi-billion dollar U.S. iCloud data centers in Maiden, North Carolina; Reno, Nevada; Prineville, Oregon and Newark, California.

The company's Advanced Manufacturing Fund, which was recently used to pump $390 million into VCSEL supplier Finisar, is growing by $1 billion to a total of $5 billion.

Apple spent almost $3.4 billion on research and development over the course of its second fiscal quarter of 2018, a $602 million year-over-year increase that bought the company's six-month spend on future operations to nearly $6.8 billion. But in the most recent fiscal third quarter ending in June, Apple spent even more: $3.7 billion.

In addition, Apple has opened new software development centers in Brazil, Italy and India, including a technology center in Hyderabad (above) and a Design and Development Accelerator in Bengaluru.

It has also built out multiple other research centers including the Zhongguancun Science Park in Beijing, China; three silicon-related research and development sites in Herzlia, Ra'anana and Hafia, Israel; a health and materials-related research facility at the Tsunashima Technical Development Center in Yokohama, Japan; a top secret production lab in Longtan, Taiwan; a Siri voice research lab in Cambridge, England; an apparent automotive research site at Kanata Research Park in Ottawa, Canada and a camera optics research facility in Grenoble, France. It also has started work on a new research and development center in Shenzhen, China.

In 2016, Apple announced a $1 billion investment in Chinese ride-hailing company Didi Chuxing, a move that resulted in rival Uber ending its efforts to compete in China.

Apple also floated $441.5 million of Green Bonds to fund new projects related to environmental sustainability, as well as a $1 billion Advanced Manufacturing Fund and a contribution of $1 billion into SoftBank's 'Vision Fund' to "speed the development of technologies which may be strategically important to Apple."

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Christine McKee

Christine McKee

Oliver Haslam

Oliver Haslam

Wesley Hilliard

Wesley Hilliard

William Gallagher

William Gallagher

Thomas Sibilly

Thomas Sibilly

46 Comments

My RRSP certainly appreciates it! (Stupid advisor said not to in 2009 - that's awfully conservative). It's only up ~6-fold since 2009

I never understood the "kill the X" chants. After my first week of use I wondered why not all devices had this user interface. Killing the home button and face recognition were simply brilliant moves. Now, if only my iPad pro worked as simply.

This--> <i>The company currently holds $244 billion in cash reserves overseas and $155 billion in total debt (the lowest debt it has reported across the last four quarters). </i>

confused me.

Does this mean that Apple has not brought any of that offshore cash back into the USA despite Trump's virtual tax holiday?

If this is true then why hasn't it?

When it comes to Apple I think the vast majority of us now agree that analysts and Wall Street are clueless about the company, its customers, its products, its business model, its appeal, its brand, its mindshare and anything other metric you can think of (except the market share boogeyman that’s trotted out at every opportunity.

Thanks for the article Mr. Dilger, nicely presented but you are preaching to the choir here. We get it. It’s the financial world that doesn’t. I was watching CNBC this morning and the talking heads were discussing Apple’s performance. The point was made that for some reason there’s always a cloud of uncertainty over Apple as if they could fail at any time for no apparent reason. Apple’s P/E is ridiculously low compared to the likes of Amazon, Facebook, Google. AAPL should be trading much higher but investors balk at buying it. Why? Is it because of all the negativity from analysts? If my financial advisor had told me to stay away from AAPL I would be thinking about suing him for malfeasance right now.

Sorry to come up with this conspiracy thing, but i think, at least today most analysts and some financial news outlets do nothing more than trying to shift the market in a desired direction to fill their pockets with piles of money. Which would be sort of ok, if they wouldn't do so by spreading lies.

The term analyst makes it sound like they're experts, trying their honestly best to predict the success of a company, similar to an earnest investigative journalist. In fact they are shady story tellers that try to spin stories to support their own agenda.

Without a blink of an eye they would sent an economy into a devastating crisis, if they would profit on it.