What to expect from Apple's holiday quarter earnings report

Last updated

Apple will be announcing its 2023 fiscal first quarter results later today. Here's what to expect from the holiday quarter earnings — and what Wall Street is predicting.

Apple revealed on January 4 that it will be holding its investor call on Thursday, February 2, at 2:00 PM Pacific, 5:00 PM Eastern, to discuss the first fiscal quarter earnings release from earlier in the day. Based on the usual timeline for results, details should be released by Apple about half an hour before the call itself.

For the call, CEO Tim Cook and Luca Maestri will discuss the health of Apple over the last three months, including product launches and sales, negative events, and other economic headwinds that could affect the quarters to come.

As usual for Apple since the start of the pandemic, the company hasn't offered formal revenue guidance for the quarter at the time of its previous earnings report.

Earnings for the quarter are typically the highest due to Apple's highly seasonal sales, as well as a list of key product launches.

During the period, the iPhone 14 generation, second-generation Apple Watch SE, Apple Watch Series 8, Apple Watch Ultra, second-generation AirPods Pro, tenth-generation iPad, 6th-generation iPad Pro, and the third-generation Apple TV 4K were introduced by the company.

However, unusually for the quarter, Apple did issue an uncharacteristic notice about iPhone production in November. Due to COVID-19 issues at Foxconn's Zhengzhou factory, the supply of the iPhone 14 Pro and iPhone 14 Pro Max was interrupted, prompting Apple's notice.

At the time, the press release admitted the factory operated at a "significantly reduced capacity," though it has since caught up. Apple also said it continued to see "strong demand" for the Pro models, but also expected lower shipments and longer wait times for customers.

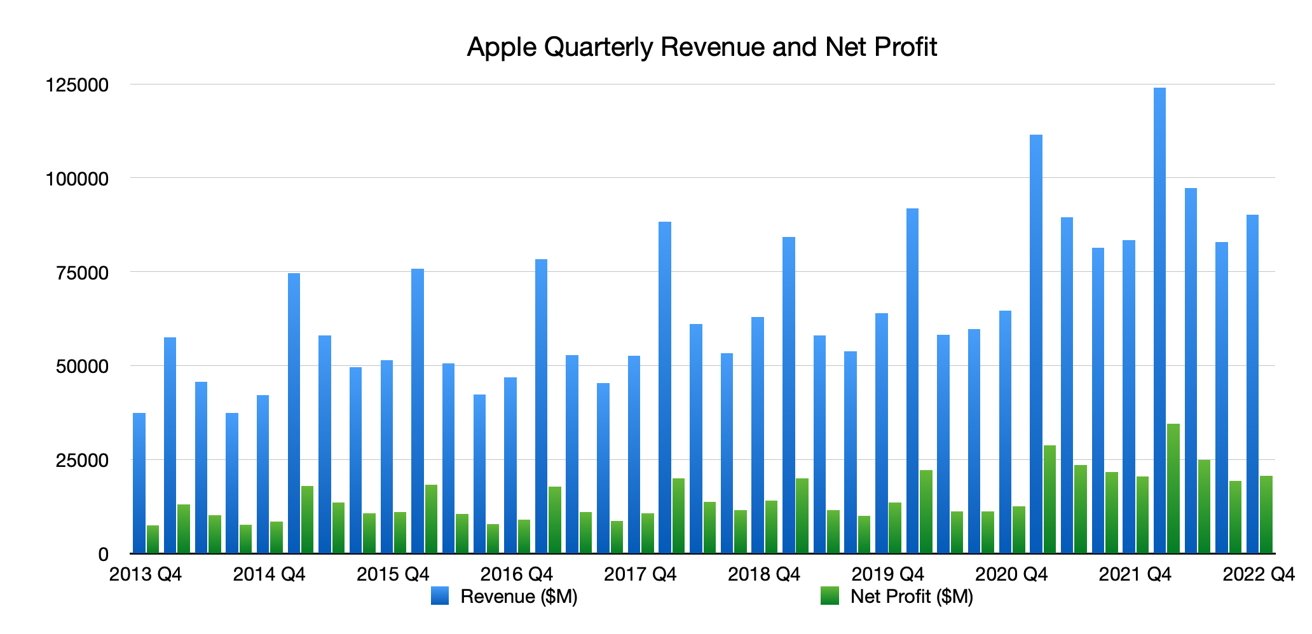

Apple's Q1 2023 figures have to beat considerably high figures reported one year ago in Q1 2022. At that time, it reported an 11.2% YoY increase in revenue to $123.9 billion, with a net profit of $34.6 billion also record-setting and an annual increase of 20.4%.

For Q1 2022, the iPhone brought in $71.6 billion in revenue, with Mac revenue also up to $10.8 billion in the quarter. Wearables, Home, and Accessories was up to $14.7 billion in revenue, Services saw a YoY increase to $19.5 billion, but iPad revenue saw a drop down to $7.2 billion.

What is the Wall Street consensus on Apple's holiday quarter?

As of January 23, the analyst consensus for the quarter is an earnings per share of $1.95. This translates into a quarter with $122 billion in revenue. This compares to $123.9 billion in the year-ago quarter.

Consensus for the next quarter's revenue is presently sitting at $98.2 billion, but most of the analysts in question chimed in before the release of the new Mac Pro, updated Mac minis, and a second-generation large HomePod.

Individual analysts on Apple

The iPhone 14 Pro shipment problems were a point of issue for analysts examining the company's fortunes, with lower shipment forecasts of the models thought to heavily impact revenue. However, some offered the view that shipments would be pushed into Q2 2023 sales instead.

At one point in January, Apple's market capitalization dipped below $2 trillion, with investors wary of the supply chain problems and listening to analyst discussions on the company's fortunes.

Wedbush

Wedbush lowered its price target for Apple from $200 to $175 on January 4, on the basis of it being a more "uncertain environment" for trading, and over demand headwinds.

"Apple remains our favorite tech name," Daniel Ives and John Katsingris of the firm said while insisting it maintains its "Outperform" rating for the stock, but supply chain checks were "clearly mixed heading into the next few quarters," with Apple also apparently cutting back some orders for products.

On iPhone, demand for the iPhone 14 Pro is more stable than feared, and that there is a belief that the "overall demand environment is more resilient than the Street is anticipating."

JP Morgan

On January 19, Samik Chatterjee of JP Morgan warned investors it believes demand is falling slightly across the entire Apple product catalog. Viewing the earnings as a "tough setup" due to supply headwinds, the worries turned into "demand concerns for the Mar-Q and beyond," the firm believes.

Revenue and earnings for the first quarter of 2023 will "track modestly below consensus expectations," but the miss should be "more modest" than previously expected. JP Morgan also raised its December quarter estimates on supply tracking, but added that weakness in underlying demand will make the next quarter "equally tough."

After lowering the price target in December 2022 from $200 to $190, JP Morgan went further in January, pushing it to $180.

Canaccord

A January 22 note had Canaccord Genuity Capital Markets cut its price target for Apple from $200 to $170, while reaffirming the "buy" rating for stock.

Demand for the Pro model iPhones has been disappointing, but believes some lost December sales will be pushed later into March. Recent channel checks indicate that a four-week wait for the premium models has all but evaporated.

Overall demand has been slowing despite a strong sell-through for iPhones, it adds, which presents a more pessimistic view for 2023 as a whole. There's a forecast of $68.3 billion for first-quarter iPhone sales, with a full-year estimate of $199.6 billion.

Other hardware is also at risk of a meaningful decline in demand, with the higher price points of new Macs making it hard for Canaccord to see if consumers still have a "willingness to invest in more expensive products" given a tough macro backdrop.

Rosenblatt

On January 13, Rosenblatt Securities reduced its price target by $24 down to $165, with iPhone production delays and "macro services headwinds" to blame.

A December survey found fewer people willing to buy or have bought an iPhone 14 than a similar survey in September, with buying intent for the iPhone 14 Pro Max reducing from 44% in September to 34% in December for that group.

Rosenblatt also echoed reports that the App Store has slowed down, including a double-digit percent drop in the December quarter following growth earlier in the year, which is "potentially reflecting weakening game revenues."

Ultimately, the analysts expect improvements and offers that investors may view this "as a throwaway quarter" and to instead "focus on later periods."

UBS

In a Jan 23 note to investors, UBS said it expects December revenue of $120.3B and an EPS of $1.93, lower than a consensus of $122.9B and $1.96. Soft holiday sales of Pro-model iPhones caused from the Zhengzhou factory issues has led to UBS forecasting 79 million units shipped in the quarter, down from 80 million from the consensus.

Despite the lower sales, UBS thinks that the strong Euro, Pound, Yen, and Yuan against the dollar could work in Apple's favor for its financials.

Morgan Stanley

On January 24, Morgan Stanley's note offered that it was practically following the consensus. It estimated reported revenue of $122.8 billion, up from an earlier expectation of $120.3 billion, and higher than the $122.1 billion of Wall Street.

While iPhone shipments are expected to be down 11% year-on-year, a "slight Services overperformance" and "better than expected Product shipments" for iPad and Mac helped improve the forecast. Despite an 11% drop in shipments, iPhone revenue will only be 4% down YoY because of a higher ASP for the iPhone, at $916.

Morgan Stanley still calls Apple a "top pick" with a $175 price target.

Deutsche Bank

Apple is expected to report "at or slightly above our estimates," according to Deutsche Bank on January 23rd. Checks by analysts "suggest that the constraints have improved, and we believe F1Q results could end up better than our estimates."

Apple should also "benefit from a more favorable foreign exchange environment, which should benefit both Products and Services businesses." These are positive factors that "should at least offset the weaker consumer spending in the quarter."

Caution on consumer spending has prompted Deutsche Bank to cut its CY23E EPS from $6.50 to $6.30, which is a little below the consensus of $6.33. It also cut the price target from $170 to $160, while maintaining a "buy" rating.

AppleInsider will be adding more analyst predictions before the earnings report.

Bank of America

The tone of the call "will be crucial to understand the underlying demand trajectory given the [quarter] was significantly supply-constrained for the higher-end Pro models of iPhones," writes BoA's Wamsi Mohan on Sunday. Checks indicate device availability has normalized and "leads us to conclude that demand could be softer than expected" for the first half of 2023.

Revenue is modeled at $120 billion, down from a consensus of $122 billion, with guidance for the March quarter also below consensus at $96 billion to $97 billion.

BoA maintains a "neutral" rating for Apple, with a lowered price target from $154 to $153.

Cowen

On January 31, Cowen's preview of Apple's financials pointed towards "softness" caused by the iPhone factory lockdowns in China. Shipments will apparently be down 8 million units to around 74 million in total.

Sales of iPads are thought to benefit from seasonality and improved component availability. Meanwhile Mac is expected to be down quarter-to-quarter due to a "lack of refreshed MacBook Pro systems with M2" in the period.

For the quarter, Apple's revenue is forecast to be down 4% year-on-year at $118.8 billion, with an earnings per share of $1.90. Cowen has a price target of $200 and rates Apple's stock as "Outperform."

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

Thomas Sibilly

Thomas Sibilly

AppleInsider Staff

AppleInsider Staff

William Gallagher

William Gallagher

Christine McKee

Christine McKee

5 Comments

Who the heck is "Rosenblatt"? The other two are well-known and well-regarded firms, but I've never even heard of the last firm. Did Apple Insider just pick this one randomly?

My feeling is that Apple will beat concensus estimates - mostly on the belief that the Apple Ultra's sales are underestimated. I think there was pent-up demand for the capabilities of this watch and, due to its price, will contribute a surprising amount to Apple's revenue. More importantly, I think iPhone 14 may have had production delays, but those didn't happen until the end of November and this year, iPhone 14 sales started in September, so production and sales were probably already in high gear by the beginning of the quarter (October) and there might have already been the ability to build up a bit of a cushion by the time the covid slow-down happened. So sales might not have ben affected as much as analysts fear. I'm just guessing too, of course :-)

Going forward, Apple may have some growth issues. While iPhone sales might still increase a few percentage points and similarly now Apple Watch sales might still incremental sales increases, I think Mac sales will be flat or down in the near future. Apple has benefited from its move away from Intel and the home-bound demand during covid, but those waves are gone. Increasingly, folks won't move from PC to Mac simply because they can't or won't because some critical or favorite software isn't available on the new Mac. One example I can think of is Turbotax for Business. Intuit never made a macOS version - but with x86-based Macs you could at least run the software in Parallels Desktop's virtual machine offering or dual-boot your Mac. Now that is gone. I got a new Mx MBP, but I am keeping my old x86-basd MBP around - just for that reason. Others simply won't/can't do that.

I was hopeful that Apple would finally make some announcements with respect to its AR plans. While I thought their rumored MR/VR headset was a side-show to help get developers writing more AR applications and prime demand for a later AR glass offering, the latest rumors have AR glasses - the one product that could easily help AAPL out of its growth doldrums - shelved for the time being. If Apple, as expected, brings out a MR/VR headset this spring, it will be a dud from a revenue-generating perspective. There are simply not enough people interested in immersing themselves in VR and, more importantly, not enough people who look forward to looking like dorks wearing ski-goggle (or bigger) sized headsets in public. Any MR/VR headset will sell as hotly as Apple's HomePod. Technically good, but not enough buyers to make it have any impact on Apple's bottom line.