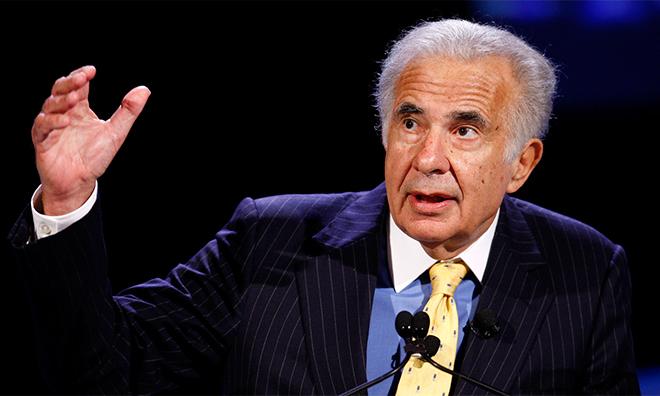

Activist investor Carl Icahn this week once again heaped praise on Apple, saying the company's stock continues to be vastly undervalued and should be trading today at a price of $216.

Icahn continues to see the company's share price as an opportunity for Apple Chief Executive Tim Cook and his board of directors to buy back more shares of its own stock. In an open letter published this week, he praised Cook for saying that he wants to give money back to shareholders.

"This position with respect to excess cash is great news for shareholders, and we look forward to the capital return program update in April, anticipating it will include a large increase to share repurchases," Icahn wrote.

As of the end of last quarter, Apple had a massive $179 billion in cash. As its money has continued to grow, Apple has increased its capital reinvestment program, authorizing share repurchases and dividend payments.

Apple has signaled that it will revisit and update its dividend and buyback plans in April, as it has done in years past.

And although shares of AAPL stock are trading at all-time highs, Icahn still believes the stock is dramatically undervalued. As such, he believes Cook and his team would be wise to spend even more money to repurchase shares at their current value.

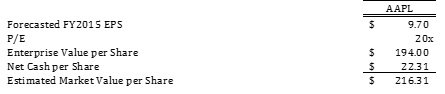

The billionaire said in his open letter that he believes the market should value Apple at a price to earnings ratio of at least 20 times. Together with net cash of $22 per share, that would value Apple at $216 per share.

"This is not a future price target," Icahn wrote. "$216 is what we think Apple is worth TODAY."

Icahn said last month that he was planning to increase his price target for Apple, which was previously set at $203. That assessment was reached last year, before the iPhone maker reported a blockbuster holiday quarter in which the company earned $18 billion in profit.

Neil Hughes

Neil Hughes

AppleInsider Staff

AppleInsider Staff

Malcolm Owen

Malcolm Owen

Oliver Haslam

Oliver Haslam

Andrew O'Hara

Andrew O'Hara

Wesley Hilliard

Wesley Hilliard

William Gallagher

William Gallagher

Christine McKee

Christine McKee

77 Comments

And just by coincidence he owns $1B+ in AAPL.

For once, I agree with Icahn. Apple is, and has always been, undervalued, especially when compared to other companies in the tech sector - even though tech is just part of what makes Apple who they are. It's great to see investors pushing Apple positive to make their money, instead of the typical "analysts" who throw out crap bad "news" about Apple in order to drive the price per share down so they make their money on shorting the stock.

Now where is Warren Buffet?

So Carl wants Apple, to use shareholders money to buy back shares from some other shareholders so hopefully spurring the share price to rise so he - who obviously wouldn't sell - and some other shareholders can potentially make a killing - or Carl, who by then will own an even larger percentage of Apple, can get himself onto the board and start running Apple the way it ought to be run. Call me a cynic but I really don't think Carl has Apple's best interests at heart.

Pump & Dump