Why Apple's new GPU efforts are a major disruptive threat to Nvidia

Apple's plan to decisively migrate iOS to its own internally-developed GPU within the next two years obviously shocked Imagination Technologies, its current supplier of PowerVR graphics technology. It should also rattle Nvidia. Here's why.

Nvidia invented the GPU

Nvidia has had a spectacular run. In the last 24 years, the company has outpaced larger rivals and even completely pushed more established competitors (including VideoLogic) out of the PC business, while gobbling up others it outperformed (notably 3dfx). It has also done a good job of marginalizing ATI, forcing its primary competitor to be sold off to AMD and divest its mobile GPU architecture to Qualcomm.

Since its IPO in 1999, Nvidia's stock has appreciated by well over 6400 percent. However, most of that appreciation occurred in the last year, as the company's shares jumped from about $37 (the same place it was back in 2007) to today's price slightly above $100.

Nvidia now has a Price/Earnings ratio above 40, indicating that investors have big expectations for the firm. With annual revenues currently just below $7 billion, Nvidia would need to identify major new customers willing to pay a high premium for its technology to ever justify its nearly $60 billion valuation.

Investors seem to think Nvidia will find these customers in artificial intelligence, particularly in the automotive industry, but also in neural net processing, Machine Learning and other AI tasks by data center clients including Facebook and IBM.

It's noteworthy, however, that when presented with a massive opportunity to radically expand sales beyond its origins in the PC industry, Nvidia failed spectacularly, despite its mobile efforts being closely aligned with both Microsoft (in the Zune and Kin, then Surface RT), and then Google's Android (Motorola Xoom and Dell Streak tablets, then Google's own Nexus 9 and Pixel C).

Most alarmingly, Nvidia didn't lose out to a more sophisticated competitor with better technology. It was blocked from materially participating in the mobile phone market (which is now annually a roughly $500 billion industry— twice the value of PCs) due to a combination of low-end disruption it couldn't handle and terrible execution of its own strategies. This looks certain to repeat.

Money makes things happen

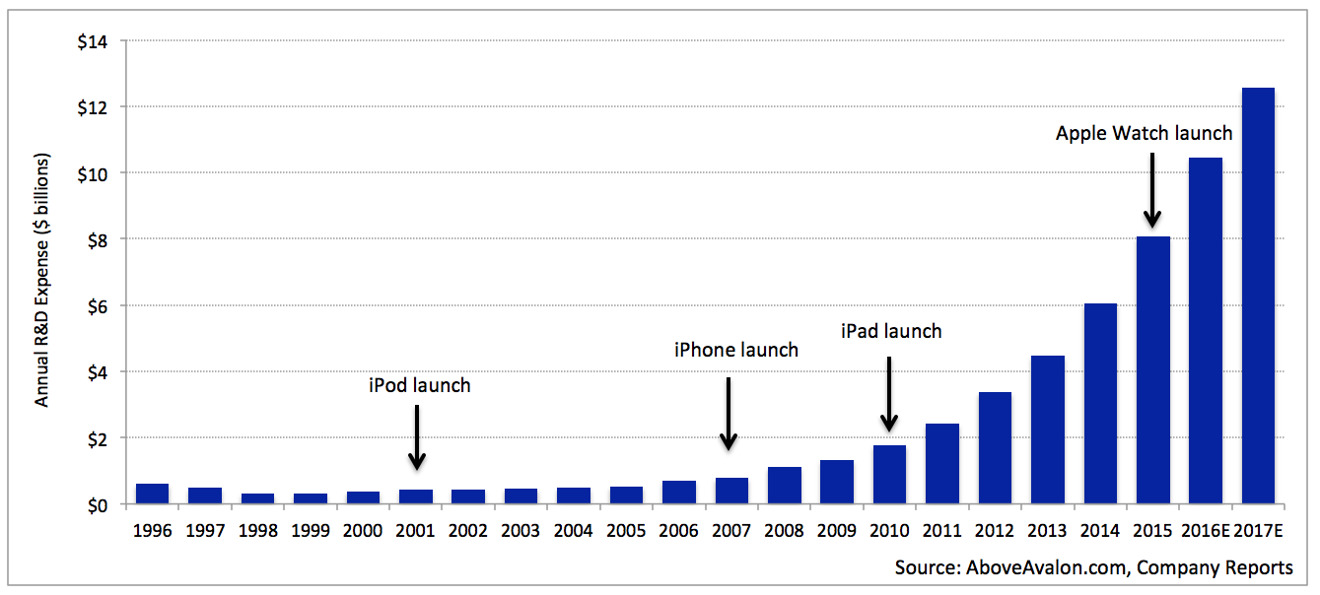

We don't yet know how Apple is planning to attack the mobile GPU market. We do know that Apple has experience in developing specialized, advanced silicon and the ability to fund very expensive advanced research and development. Apple is now spending over $10 billion annually on R&D. Nvidia spends less than $1.5 billion per year.

We have seen how Apple radically sprinted ahead of larger companies in mobile CPU design by acquiring talent and technology and building a world leading silicon design team. Apple's A10 Fusion is leaps ahead of the best chips available to Samsung and Google. Even the A9 from 2015 outperforms the top chips in new Android flagships.Apple is now spending over $10 billion annually on R&D. Nvidia spends less than $1.5 billion per year

We also know that apart from Apple, virtually all mobile competition has settled on building low-priced, "carrier friendly, good enough" devices across most of their portfolio. Apple's ultra premium iPhones sell at an Average Selling Price of nearly $700. Samsung's ASP is closer to $225 and the rest of Android generally wallows below $200.

Apple's consistent profitability over the past ten years of iOS enabled it to launch Imagination's PowerVR mobile GPU designs and fend off mobile competitive threats from PC GPU giants Nvidia and AMD, both of whom missed out on the mobile gold rush as badly as Intel and Microsoft did.

What about AI, AR, VR and GPGPU?

Nvidia hopes to capitalize on an upcoming surge in processing tasks related to emerging technologies, in particular the massive processing requirements inherent in self-driving vehicles. The company would also like to materially participate in all of the other forms of AI, as well as Augmented Reality and Virtual Reality, and of course the natural extension of GPUs working on general purpose tasks (GPGPU).

Coincidentally, there is another company that also has aspirations in self-driving vehicles, which likes to talk about the future of AR and VR, which is rapidly expanding its own Deep Learning, Machine Learning and AI initiatives and which invented and open-sourced the first mainstream cross-platform API for GPGPU (OpenCL). That's Apple.

Apple has vastly more capital than Nvidia, tremendously higher revenues and profits and— most importantly— has an effective track record of entering new markets and obliterating the competition, to the shock and awe of incumbents. It did this in MP3 players, then in phones, then in tablets and most recently in smartwatches and wireless headsets.

In fact, if you want to list examples of Apple materially failing, you have to talk about things like iPod socks, Ping social comments, iAds and Aperture photo software, all a distant stretch from Apple's core competencies in hardware design and software platforms. Nvidia repeatedly failed to sell its existing GPU technology— its core competency— to mobile makers who desperately wanted to make it work.Nvidia repeatedly failed to sell its existing GPU technology— its core competency— to mobile makers who desperately wanted to make it work

Further, Apple's success in mobile devices has had a traumatic impact on other businesses, particularly in commodity PCs— which have been brutally ransacked since iPad first appeared. That's also where Nvidia makes most of its money.

Over the past five years, Nvidia has brought in quarterly revenues of about a billion dollars— on par with Microsoft's Surface hobby. In the last year, Nvidia's stock has surged due to a quarterly revenue jump to slightly more than $2 billion— which is still less than Apple brings in from Apple Watch sales.

While Apple's critics like to berate sliding iPad sales since they peaked in 2014, the reality is that Apple created a new platform that shook the very foundations of the PC industry, then maintained its control over tablets as commodity competitors fell out of relevance. Nobody predicted that would happen. Instead, everyone expected Android (or perhaps Microsoft) to take the tablet market away from iPad. They don't even like to talk about tablets anymore.

Clearly, Apple would love to sell even more iPads. But Microsoft would also like to have its $11.6 billion annual Windows monopoly back, and alternatively would probably settle for a meaningful business selling Windows RT ARM tablets that were even half the size of Apple's current $19 billion annual iPad business.

Apple doesn't sell GPUs

Nvidia probably doesn't have to worry about Apple selling its GPU, the same way Qualcomm and Intel don't have to worry about Apple directly competing in CPUs with third party sales of its A10 Fusion Application Processors.

However, Qualcomm and Intel have been massively impacted by sales of Apple's finished products incorporating its own A-series chips. As iPhone and iPads ransacked the earnings of previously profitable consumer electronics firms, the potential premium markets for both Intel x86 and Qualcomm Snapdragon chips have slid downhill, falling into competition with cheap commodity chip makers in China.

That's certainly not where Nvidia wants to end up. However, Apple's new GPUs could be expected to launch the company's existing products— as well as potential new products ranging from AR glasses to imaging devices and self-driving vehicles— ahead of the market, leaving scraps for Nvidia's competitors.

That creates an obvious potential for Nvidia's current clients to end up as blindsided as Nokia, Palm and Motorola were in phones and tablets. The result would very likely be as disastrous for Nvidia as it was for the suppliers feeding their components to the status quo in mobile, a list that includes Texas Instrument's OMAP architecture (and Nvidia's four generations of failed Tegra mobile chips).

Investors have already called into question the prospects of Nvidia's GPU in Nintendo's new Switch gaming console, largely due to its lower margins. Nvidia itself expressed disinterest in getting its GPUs into Sony's PlayStation 4 because it said it wouldn't be worth doing. Gaming has been the bread and butter for GPUs.

Apple has been serving itself a healthy dose of video gaming revenues from the iOS App Store, where it materially participates in the market for top mobile games. Last year, that included AR hit Pokemon Go and an iOS exclusive of Nintendo's Super Mario Run. Long known as apathetic about gaming, Apple is now deeply invested in gaming development and sales.

The more of the gaming market Apple consumes with iOS (and tvOS) devices, the less money is left over for Nvidia, regardless of how much better Nvidia's GPU chips might legitimately claim to be.

Patent troll alert!

How do you know a company is in desperate trouble? Well, take a look at Nokia, AMD and Qualcomm. After they began losing business, they switched from a focus on serving customers to one oriented around "enforcing patents."

Qualcomm earns 70 percent of its revenues from patent licensing. In February, AMD sued LG, MediaTek, Sigma Designs and Vizio over GPU-related patents.

Surprise: that followed Nvidia's own 2014 lawsuits targeting Samsung for using a variety of GPUs it deemed to infringe upon its GPUs, including Qualcomm's Adreno GPU, ARM's Mali GPU and Imagination's PowerVR GPU.

While Nvidia didn't make any apparent progress, it has successfully pulled royalty revenues from other hardware makers willing to license its technology, including Intel and Lenovo. As a client of Imagination, Apple could also face patent litigation from Nvidia even before it unveils its own GPU sometime next year.

But that litigation threat may also tie into why Apple began working on its own GPU technology in the first place. If it remained dependent on the relatively small Imagination for its mobile GPUs, it could face substantial interruptions if Nvidia were to successfully sue over PowerVR technology.

Nvidia's lawsuits targeting PowerVR users likely emboldened Apple to work on developing its own, independent GPU technology, and the GPU maker's failure in those lawsuits probably further encouraged Apple to seek to own its own GPU tech.

Nvidia can't be happy about another GPU on the scene

In any case, there's no good news for Nvidia— a standout leader in GPU technology— in the public exposition of the fact that the world's largest tech company has been working for years to develop its own GPU technology, and plans to show it off next year.

This is particularly a problem if Apple continues to target new areas where Nvidia would like to be, including the data center, professional workstations used for high-end research work, the automotive industry, specialized imaging products, Machine Learning and the development of AR and VR content.

Today, Apple specifically repeated its interest in the future of the Mac Pro and new processing-intensive content creation. Apple is building billions of dollars worth of its own iCloud data centers, gathering deep insight into the needs of cloud service providers and their clients. Apple is also known to be investing major work into automotive research and development. Additionally, Apple has also advanced its capabilities in image signal processing on iOS devices.

Another threat for Nvidia is Apple's voracious appetite for talent. In 2015, for example, Apple recruited away Nvidia's director of deep learning software Jonathan Cohen, absorbing his experience in the development of autonomous ADAS (advanced driver assistance systems).

Taken together, these factors tend to make Nvidia's current valuation look particularly optimistic.

Daniel Eran Dilger

Daniel Eran Dilger

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

Christine McKee

Christine McKee

Andrew Orr

Andrew Orr

Sponsored Content

Sponsored Content